The Solar Energy Industries Association (SEIA) has released an updated version of its, Installation Best Practices – Residential Portfolios (PDF download). The purpose of the document is to show the broader public – potential solar customers, regulators, investors, rating agencies, and other stakeholders – that the solar industry has a consistent, quality product that is worth a predictable amount.

Residential solar systems are a valuable home improvement, a consistent and long-term electric generating resource, and credit-worthy investment asset class.

The document was developed by the Solar Quality Assurance Working Group (QAWG), and is a follow up to the National Renewable Energy Laboratory’s Best Practices for a PV System Installation.

If you have those customers who really want to learn what goes into a solar power installation, then this document is a strong handout. And while this might not have the same level of detail as an installation company like SunRun – who makes consistent, high performing residential portfolios for a living – it might be enough for that homeowner to read and trust with their largest personal investment.

It’s probably also a good for new employees to read, and old employees to browse to remind them what others are looking at in their work.

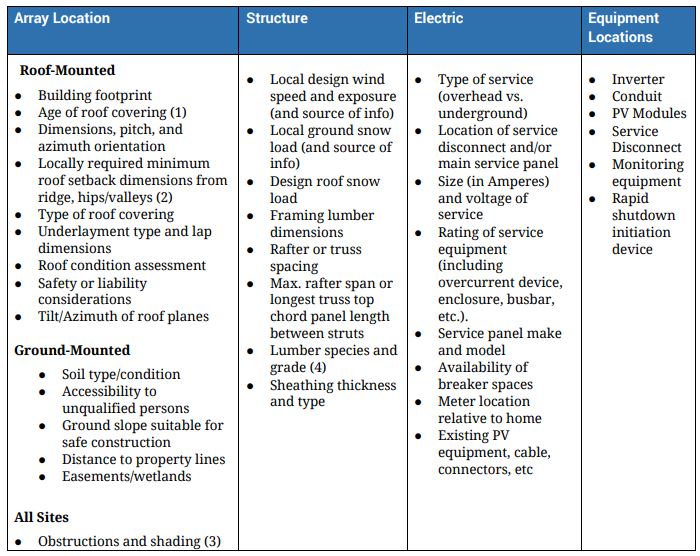

The document has suggestions on Contractor Qualifications, hardware suggestions, insurance, finance, third-party inspections and verifications, fleet practices and a lot of other topics.

The standardization of solar power is part of the broader goal to allow broad securitization, facilitating investment at scales many times greater than today’s market. For instance, the Sunspec Alliance looks to create a consistent database of information inputs for large projects being sold to investors. If all the inputs on the projects are consistent and clearly communicated then analysts who want to be able to buy and sell billions of dollars worth of solar at a time, many times a year, can do so fluidly.

This specific document might not be driving global markets, as residential customers aren’t looking to Wall Street to sell their homes. It is part of the movement towards standardization that should increase our close rates by building trust in the end product.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.