If solar and wind are going to scale to supply most of the power on the U.S. power grid, they are going to need massive sums of capital. And we are starting to see evidence of that scaling.

One piece of evidence is a high rate of increase in the amount of electricity coming from solar power. In 2017 we saw total electricity delivered by solar photovoltaics increase by 43% year-over-year. Another piece of evidence is the sheer volume of investment. Globally, we saw 7.7 GW of assets change hands in Q1’2018.

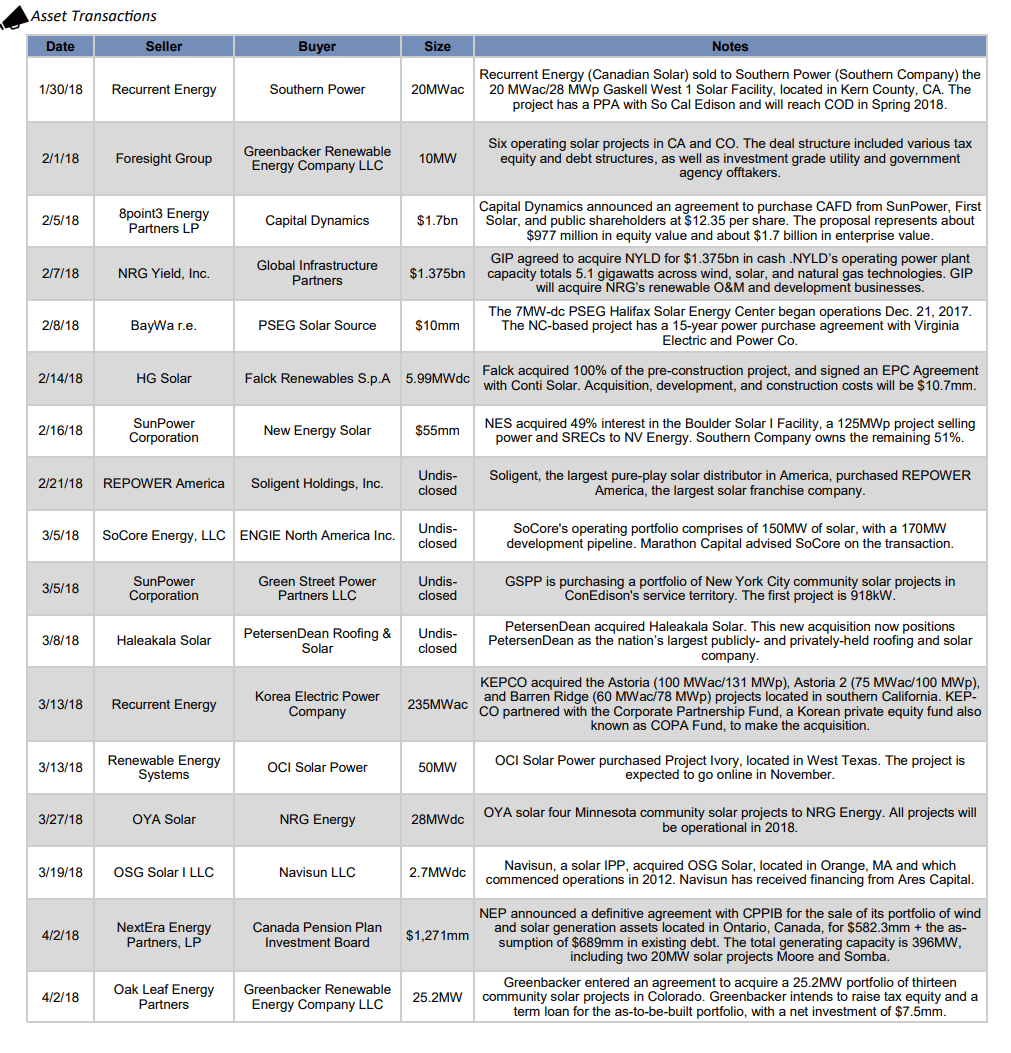

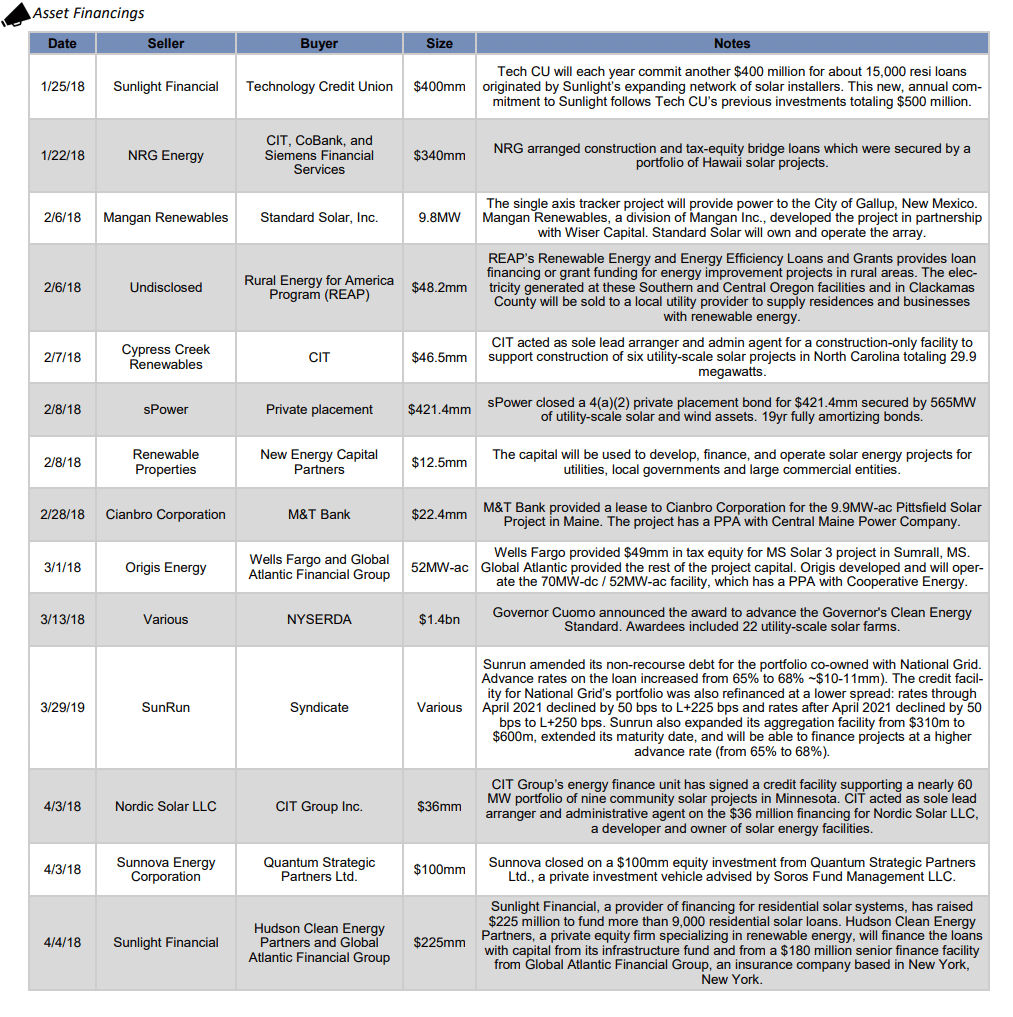

Focused on the United States, the kWh Analytics’ Spring DealFlow Report gives high-level details on 36 projects that have closed since the start of 2018. 17 of the projects are characterized as asset transactions and 19 projects as asset financings. The 21 projects that disclosed financials represented more than $8 billion in deals.

A majority of the asset transactions did not disclose financials, and truly, browsing the list is really a who’s-who of solar developing. NextEra and NRG topped the list with big deals selling off large asset portfolios. SunPower managed to squeak a 918 kW onto the list as well.

While some might consider New York State’s projected $1.4 billion from a future 22 projects to be delivered by 2022 a bit far out to be considered on this list, it may be appropriate as the bids are due by October of this year and companies have already spent money on developing at least some of the sites that will land contracts.

Along with Governor Cuomo’s contributions are 18 other projects, some of which are shown above, with close to $4 billion in funding. Some of these investments were covered by pv magazine, such as Dividend, Ares and Sunlight.

Some estimates suggest the world needs to see $1 trillion per year in clean energy investment to stave off a 2°C increase in global temperatures. We have a long way to go, and it is the rate of scaling that will be critical.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.