For some years it has been obvious that increasing deployment of solar and wind is cutting into the market share of coal and nuclear power plants in the United States and Europe. These plants are being increasingly retired, and a negligible number of new plants of either technology are being built in either region.

But this is only part of the story. For the past 15 years the United States in particular has put online a massive capacity of new gas plants, many of which are combined-cycle designs. These plants use fuel more efficiently than “peaker” plants, but also ramp more slowly, and as such are often meant for “mid-merit” applications.

However, according to a panel at Bloomberg New Energy Finance’s (BNEF) Future of Energy Summit in New York City, the market for new combined cycle gas plants may be coming to a close in favor of solar and wind paired with energy storage. And this may foreshadow a larger move away from gas.

“Renewables + storage is already much smarter than combined cycle,” stated Javier Cavada, the president of energy solutions at Wärtsilä. “Combined cycles have gone to half in 16, half in 17, and this year we will see if there is any crazy person going for combined cycle.”

And this is coming from a company that makes gas turbines.

California leads the way

Cavada’s statement may represent more of a European perspective. The capacity of new gas plants put online in the United States increased from 2016 to 2017, and while pv magazine was not able to find a breakdown by type of plant for the past two years, the majority of deployments have traditionally been combined cycle.

However, in California regulators are repeatedly choosing renewable energy plus storage over not only new gas plants but even continued operation of gas- and oil-fired power plants, including not only combined cycle but also single-cycle “peaker” plants. Additionally, the bids for clean energy are often coming in at lower prices than other options.

California is also helping to embolden environmentalists in other states, who are increasingly calling for utilities to deploy clean energy options instead of building new gas plants.

In an example from Michigan, the Union of Concerned Scientists has estimated that DTE Energy could save its customers $340 million by deploying clean energy instead of the new gas plant the utility is trying to build.

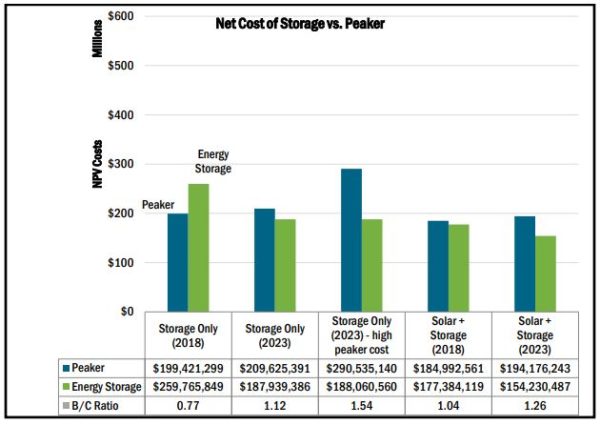

Financial analysis of new gas plants is required by law in Minnesota. When the net cost of a new peaker versus solar plus storage was modeled, it was found that right now solar+storage was competitive – despite limited solar radiation in the Midwestern state. These models take into account federal tax legislation, and Minnesota’s required Value of Solar Tariff (VOST). This includes a calculation for the social cost of carbon when building new fossil infrastructure.

But it is not only new gas plants that are in trouble. California has reduced the volume of natural gas that it burns as a fuel for electricity each year since 2014. Nationally 2017 saw less gas used to generate power than 2016, and while milder winter weather and more hydro generation were both significant factors, the share of wind and solar in the national generation mix also rose.

Low prices, technical advantages

This also comes amid record low bids for solar and wind plus energy storage, which are falling every year as the technology scales. However, price is not the only factor at play. While single-cycle gas plants can rapidly “ramp”, or increase and decrease their output as needed, battery storage has the ability to do this even more quickly – as the response by a Tesla battery to a generator going offline in Australia showed.

This is of critical importance as more and more wind and solar are added to the grid, as integrating high penetrations of wind and solar requires a much greater degree of flexibility from the rest of the fleet.

Additionally, batteries can not only allow renewable energy generation to become “dispatchable” – providing power on demand – but can also provide other grid support services including frequency regulation and reactive power for voltage stabilization. With the recent passage of a rule at the U.S. Federal Energy Regulatory Commission requiring grid operators to value the contributions of batteries and allow such resources to participate in wholesale markets, additional new revenue streams are opening up for batteries.

Replacing what?

There are still many questions about exactly what role renewable energy plus storage is going to play in the larger power system, including what exactly these resources are going to replace.

“I disagree that storage is going to be disruptive for generation… it is going to be disruptive for transmission and distribution,” argued Invnergy Executive VP and Chief Development Officer Kris Zadlo on the panel.

If California is any example, it will be disruptive to both. California recently approved a clean energy project by utility Pacific Gas & Electric Company (PG&E) to replace a 40 year-old oil-fired plant in Oakland. However, PG&E’s project was competing with alternatives based on building out physical infrastructure including transmission, not other proposals for fossil fuel-fired plants. And just last month in California, we saw 20 cancellations and 23 revisions of transmissions projects – savings electricity customers $2.6 billion – due to distributed generation and efficiency.

The ability to replace not only new gas plants but also make transmission infrastructure unnecessary changes the economic threat that renewable energy represents. Lower capacity factors and/or fewer plants hits the bottom line of electricity generators and the companies that own them, but less need for transmission and distribution affects many investor-owned utilities, particularly those whose revenues have not be “decoupled” from physical investments.

Limits

However, even as renewables plus storage projects are coming in at lower prices and being chosen over new gas plants, this does not mean that wind, solar and storage will simply eliminate the need for gas, or some other form of flexible generation.

The technical issues of integrating very high levels of renewable energy are beyond the scope of this article, many studies have concluded that in grids in northern climates without enough flexible hydroelectric capacity, it will be increasingly difficult and expensive to integrate more than 80% wind and solar, even with widespread deployment of batteries.

One means to address these problems is to make electricity demand more flexible. “The levels of demand flexibility that we will need to integrate high levels of renewables will take more time than throwing some energy storage on,” argued Smart Electric Power Alliance Chief Strategy Officer Tanuj Deora.

But this alone may not solve seasonal issues in northern climates. Without technology to store electricity on the order of weeks, in many places gas, hydro or some other form of flexible generation may be needed to fill in gaps.

“We will need long-term storage, to give it a much longer life,” stated Javier Cavada of Wärtsilä. “The lithium ion that is being deployed now, there is a limit.”

Cavada also sees a need for the faster ramping gas turbines that his company makes, at least until long-term storage technologies are commercially feasible. “The gas is going to be making that transition happen in the coming decades, but 100% renewables is the place that we need to run to.”

Lithium and cobalt

But before we even get to the issues could be reached at 80%+ wind and solar, there is the issue of materials for the lithium-ion batteries that have dominated deployment of energy storage to accompany renewables.

While there is no near-term lithium shortage on the horizon, many lithium-ion batteries use cobalt, and here supply may be an issue. In 2016 at least half of the world’s cobalt was mined in the Democratic Republic of Congo, an extremely poor an unstable nation. Cobalt prices also spiked in 2017, and have risen further in 2018.

While analysts at Massachusetts Institute of Technology have predicted that there will be no real mid-term supply constraints for cobalt, they do warn of bottlenecks in the supply, largely related to the need to open more mines to deal with ever-increasing demand from electric vehicles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.