The U.S. residential solar sector is in trouble, and it is not passing. After many years of steady growth, GTM Research has predicted that 2017 will represent the first year of decline in the overall market, with installations falling not only in California but also key Northeastern markets including Massachusetts and New York.

Like Tesla/SolarCity, Vivint Solar appears to be both contributing to this decline and affected by the larger policy and market forces that are driving it. The nation’s third-largest residential solar installer, Vivint nearly crashed after an attempt at acquisition by SunEdison failed, after which it underwent a major shift in strategy.

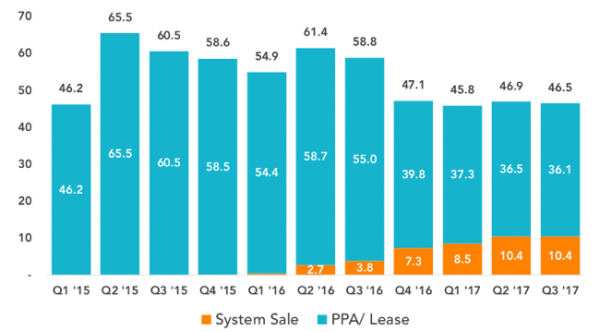

Q3 2017 sees that shift, including a less aggressive growth path and emphasis on profitability, coming to maturity. This also means that Vivint has a smaller share of the contracting residential market, and installations in Q3 fell 21% year-over-year to only 46.5 MW, slightly less than it installed during Q2.

Vivint Solar

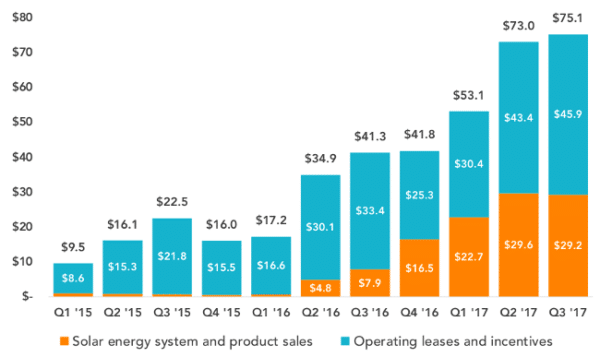

However, nearly a quarter of these sales at 10.4 MW were direct sales, and combined with the revenue coming in from the company’s fleet of third-party solar this means that revenue has nearly doubled to $75 million during the quarter, with 39% of this coming from direct sales.

Vivint Solar

And while Vivint still lost $38 million during the quarter, this is not unusual for a third-party solar company, and must be seen in light of the company’s $723 million in net retained value. Additionally, Vivint’s profitability as expressed by operating margin is greatly improving. The company reported only $12 million in operating losses during the quarter, a third of its losses a year ago.

One fact that Vivint Solar did not shy away from on its quarterly results call is that the larger residential solar market is also suffering from policy difficulties. Vivint Solar CEO David Bywater noted “headwinds in the past on the regulatory front”, but described the residential solar market as resilient, and says that prospects remain inviting.

The company is also clearly concerned about potential impacts of the Section 201 case, and like fellow residential solar installer Sunrun has come out against strong trade action.

As part of its larger strategy shift, Vivint Solar is emphasizing the California market, which it notes offers higher profitability than other markets. And while Vivint stresses that the direct-to-home model is the foundation of its customers acquisition, it is also exploring other sales channels, including its partnership with Vivint Smart Home and the training of an inside sales organization.

This does not come free, and the sales & marketing portion of Vivint’s cost per watt was the highest in at least two and a half years, offsetting falling installation costs.

These new channels represented 9% of the company’s bookings during the quarter, but Vivint says that it may be more in the future. “Additional routes to market are required to meet all potential customers,” noted Bywater.

For the meantime it will be more of the same, with Vivint expecting to install only 46-50 MW during the fourth quarter.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.