pv magazine: In the last few weeks, Sungevity, HelioPower, Suniva and now SolarWorld have all filed for bankruptcy. What does this say about the U.S. industry?

Prabhu: I wouldn’t put Sungevity along with Suniva and SolarWorld – you have to separate installers and manufacturers. I think SolarWorld’s bankruptcy has been in the making for 3-4 years now. They went and filed the anti-dumping petition several years ago. They were successful to some extent, but they could never match the pricing and scale of the Chinese. No matter what anti-dumping tariffs were imposed.

Prabhu: I wouldn’t put Sungevity along with Suniva and SolarWorld – you have to separate installers and manufacturers. I think SolarWorld’s bankruptcy has been in the making for 3-4 years now. They went and filed the anti-dumping petition several years ago. They were successful to some extent, but they could never match the pricing and scale of the Chinese. No matter what anti-dumping tariffs were imposed.

Over the last 15 months, ever since the overcapacity problem became pronounced again in China, manufacturers like Suniva and SolarWorld just couldn’t make it anymore. They’re out, but it is just not a surprise.

The tide is down for the U.S. and European manufacturers.

pv magazine: What, if any impacts do you expect for the U.S. market?

Prabhu: Essentially it doesn’t change anything, especially on the downstream project development side. The market is now wide open for Chinese panels, or whoever can compete.

This shows that if you cannot compete in the market, these anti-dumping and domestic content rules, as you are seeing in several nations, they are just stop-gap measures. They are not eventually going to work.

China has such an advantage in scale and pricing. They are now by default the solar manufacturers for the world. If you go to Japan, India or the U.S., they not only dominate but the market depends on those low prices to make a decent return.

pv magazine: How much of this do you think is due to the Hemlock lawsuit?

Prabhu: There might have been some effect on it, but SolarWorld bankruptcy is not something that just popped up. This has been in the making for years. The pricing pressure is such that most of them are not going to make it at these current prices.

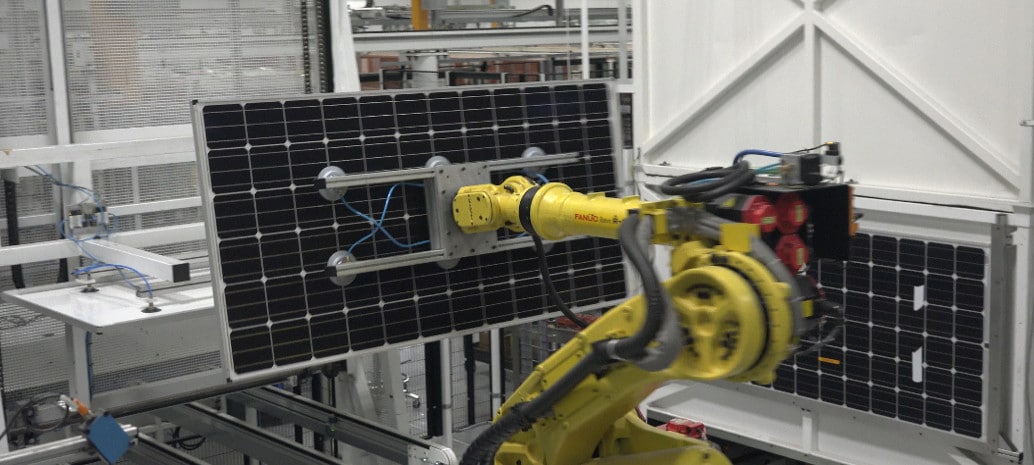

pv magazine: What does bankruptcies at SolarWorld and Suniva bode for the Tesla/Panasonic solar cell and module gigafactory in New York?

Prabhu: It’s going to be challenging. If you are based in U.S., unless you have a technological advantage and your efficiency is so good and you can beat the Chinese on price, it’s always going to be a challenge.

These guys had their own vertical integration plans with SolarCity, but it is going to be challenging. The market changes in solar happen at lightning speed.

Panasonic is not exactly known as a low-cost manufacturer of panels. They are going to have their work cut out and I would like to see how they execute.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.