California-headquartered microinverter specialist Enphase Energy (Enphase) announced yesterday in a SEC filing that it is to shed 18% of its global workforce as part of a restructuring drive to increase profitability.

The firm estimates that it will incur approximately $2 million in termination costs and related benefits as it seeks to lower its global staff levels from 543 to something more manageable.

Last fall, Enphase initially warned of an 11% reduction in staffing levels in departments dealing with non-core projects. In this latest round of job cuts, the company does not specify where staffing levels will be trimmed.

A statement issued in the filing by Enphase CEO Paul Nahi speaks of how such a “challenging decision” was necessary in order to create a near-term path to sustained profitability while Enphase “delivers new and innovative products” to its customers.

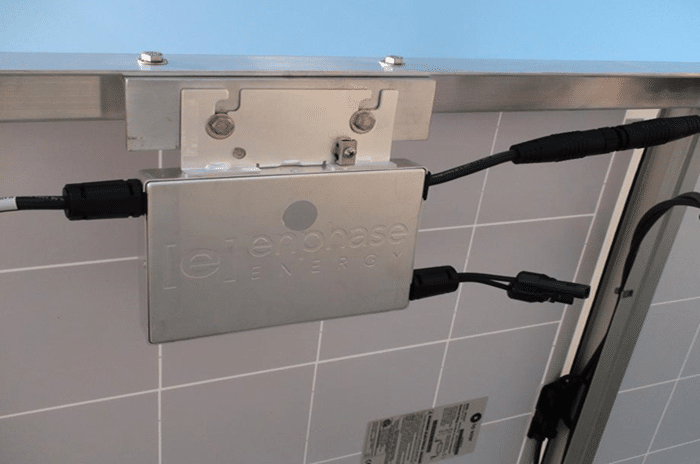

Having diversified its product offering to include its AC Home battery last year, as well as continuing to partner with module providers to deliver AC modules (which come shipped with Enphase microinverters already attached), Enphase still saw its overheads weigh heavy on its bottom line.

These financial constraints prompted the company to cut the price of its microinverter by 19% – a move that helped the firm increase its share of the U.S. residential solar market by 5.4% between Q1 and Q3 last year, according to Greentech Media research. In December, the company also sold off its residential O&M arm.

Enphase currently accounts for around 80% of the global microinverter market, according to GTM’s data.

“The gains we have seen in our inverter market share in the U.S. and global residential markets, along with the positive reception of the Enphase Storage System in Australia, the U.S. and the U.K., validate Enphase’s ability to continue to lead the industry,” added Nahi.

Earlier this month, Enphase received a $10 million injection of cash from strategic investors T.J. Rodgers and John Doerr, with the former joining the company’s Board of Directors as one of the conditions of the investment.

This cash injection comes at a vital time for the firm, which has begun to lose market share in the increasingly cost-competitive module level power electronics (MLPE) space to Israeli power optimizer provider, SolarEdge.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.