VDE Americas releases “Physical Work Test” playbook to clear OBBBA regulatory hurdles

With the July 4 “start of construction” deadline looming, a new technical memorandum provides a roadmap for developers to navigate the end of the 5% safe harbor and secure tax credit eligibility.

Navigating the OBBBA cliff for solar tax credits

The passing of the One Big Beautiful Bill Act (OBBBA) in July 2025 brought forward deadlines for PV projects to receive U.S. tax credits introduced by previous legislation, and set new requirements to demonstrate start of construction and other eligibility criteria. Project developers must move quickly to adapt to this new regulatory landscape.

Treasury, IRS release interim guidance on ‘prohibited foreign entity’ restrictions for solar tax credits

The guidance covers requirements in the One, Big, Beautiful Bill Act to establish methods to determine whether a clean energy facility or manufactured component was produced using material assistance from a prohibited foreign entity.

A “sorting year” for solar and storage

2026 is emerging as a decisive moment as capital concentrates around projects that can demonstrate early procurement and execution certainty.

Watch: Solar industry leaders discuss unlocking capital and navigating post-tax credit market

Day 1 of pv magazine USA Week 2025 focused on “Unlocking Capital,” addressing the urgent financial and regulatory challenges facing U.S. solar and energy storage. Industry leaders discussed strategies to accelerate solar growth despite tightened tax credit deadlines, increased import restrictions, and reduced federal funding.

Residential geothermal systems positioned to save energy for new construction projects

Dandelion Energy CEO says OBBBA provisions open new pathways to make geothermal more accessible and affordable.

Five trends that will shape renewable energy in 2026

Renewables dominated capacity growth through September 2025 and by balancing speed with resilience, renewables can continue to contribute to a more resilient energy system that extends well beyond 2026, according to Deloitte’s Renewable Energy Industry Outlook.

Over $24 billion in U.S. clean energy investment and 21,000 jobs lost in 2025

The latest data from the E2 Clean Economy Tracker report shows that businesses are canceling, closing or scaling back clean energy plans to the tune of billions per month during the Trump 2.0 administration.

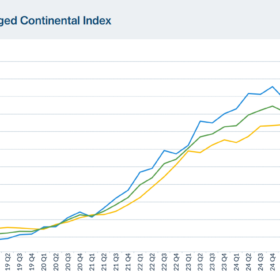

“Procure with haste” as solar power purchase agreement prices rise, says LevelTen Energy

U.S. solar power purchase agreement prices rose 4% quarter-over-quarter in Q3 2025, and prices may continue to increase for “months and years to come,” said a report from PPA marketplace operator LevelTen Energy.

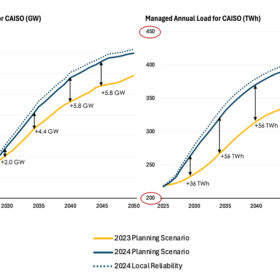

California proposes order of 6 GW by 2032 to get ahead of expiring tax credits

A California Public Utilities Commission Judge called for a “premature” order of additional electric capacity in the state to take advantage of lucrative renewable energy federal tax credits while they still exist.