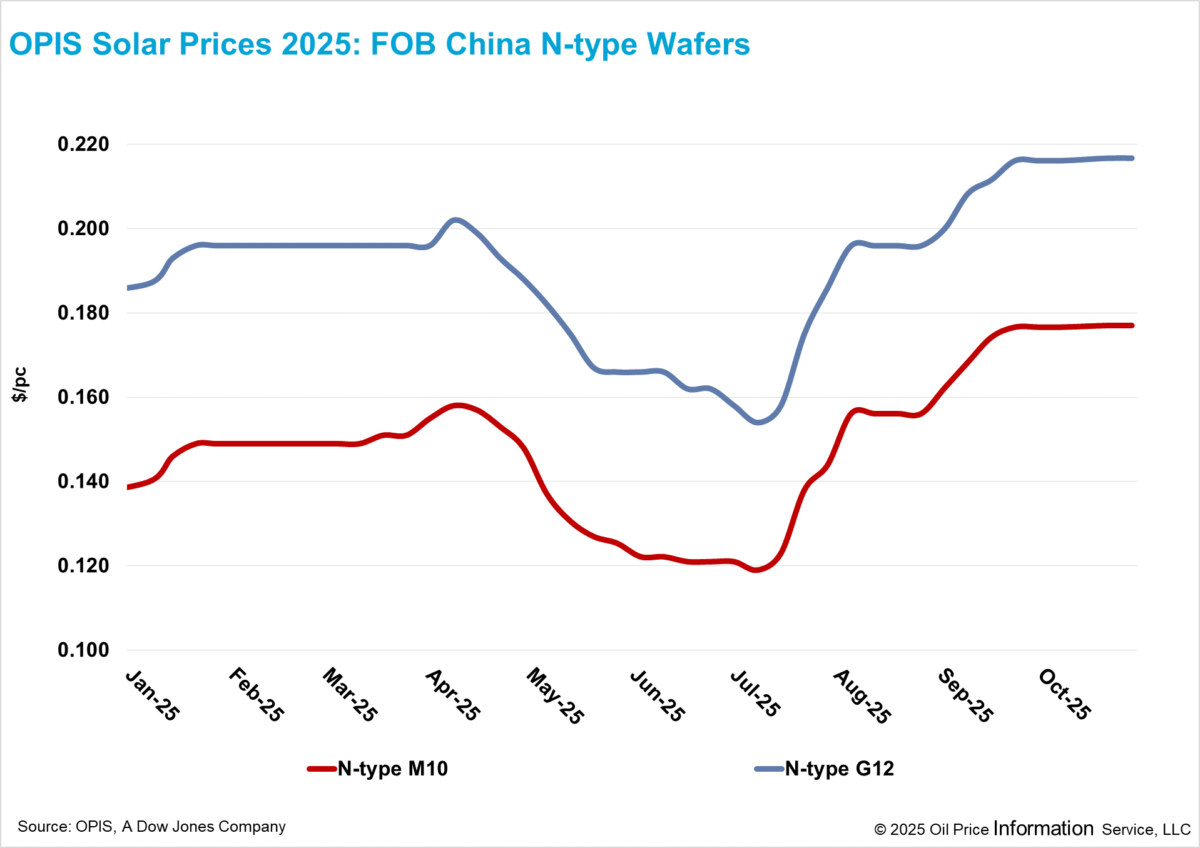

FOB China prices for n-type wafers remained broadly stable this week. According to OPIS Solar Weekly Report released on October 31, FOB China prices for M10 and G12 wafers were unchanged week on week, holding steady at $0.177 per piece (pc) and $0.217/pc, respectively.

In China’s domestic market, industry participants reported that over half of the nearly 20 GW wafer inventory comprises n-type 210R (182mm × 210 mm) wafers, underscoring a concentration in this specification. Market insiders noted that some producers have slightly reduced selling prices for these wafers from around CNY 1.40 ($0.20)/pc to CNY 1.35/pc to ease inventory pressure and improve cash flow, while emphasizing that favourable policy guidance alone is insufficient to stabilize prices amid weak demand.

Adding to the cost burden, another market participant noted that rising silver prices have pushed up solar cell manufacturing costs, further limiting producers’ ability to absorb any wafer price increases.

Despite these headwinds, wafer production remains at elevated levels. Sources indicated that average utilization rates have exceeded 60%, and October wafer output is expected to surpass 60 GW. However, under current policy directives on production control, market participants expect output to decline in November and December as inventory accumulation intensifies.

On the export front, both market sources and customs data show that Chinese wafer exports increased from January to September 2025 compared with the same period in 2024. This growth was primarily driven by rising solar cell manufacturing capacity in India, now the second-largest wafer consumption market after China. Other major export destinations include Vietnam, Thailand, Laos, and Indonesia, where Chinese wafers are processed into solar cells for markets such as India and Turkey, or further assembled into modules in Africa before being shipped to the U.S.

However, trade participants cautioned that these export flows could be affected by the ongoing U.S. Section 232 national security investigation into polysilicon and its derivatives. “If the investigation results in restrictive measures—particularly targeting Chinese-origin products—the use of Chinese wafers in U.S.-bound modules could decline,” one source warned.

Separately, reports indicate that a major Chinese wafer manufacturer is in discussions to acquire a downstream integrated producer. While the deal remains unconfirmed, insiders indicate that the target company is facing challenging business conditions.

A market insider observed that while industry consolidation could be beneficial for the sector’s long-term development, the feasibility of this acquisition remains uncertain. The wafer manufacturer itself is also under financial strain, having previously postponed an overseas expansion project that it is now reconsidering. “Whether the company can secure sufficient capital to finalize the acquisition remains unclear,” the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.