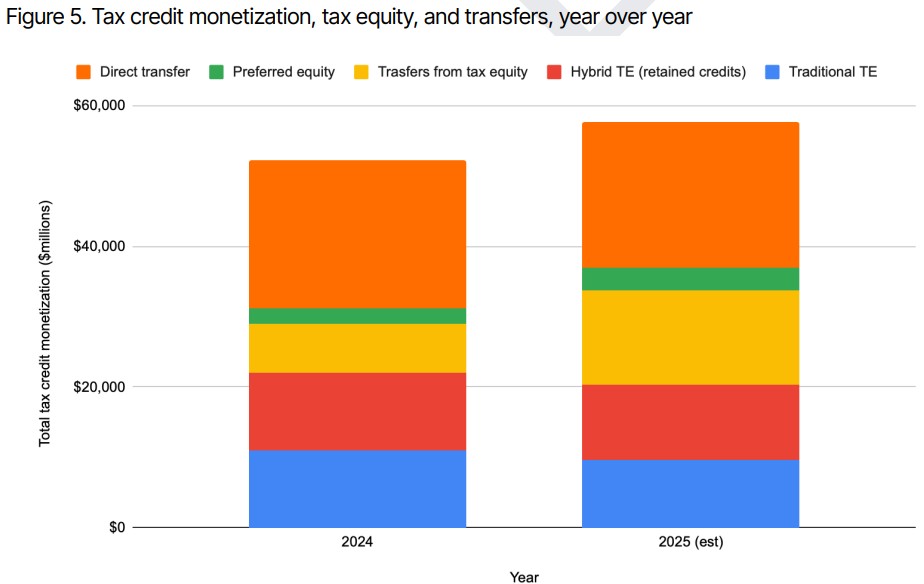

Crux analyzed debt, tax equity, and transferable tax credit transactions, and surveyed lenders, tax equity investors, and other tax credit market participants to create its highly detailed State of Clean Energy Finance: 2025 Mid-Year Market Intelligence Report. Crux finds that the market is projected to expand to nearly $60 billion, even with broad challenges.

Crux’s views on the One Big Bill (OBBB) echo those of tax attorneys who recently told pv magazine USA that FEOC rules are adding complexity. Even so, while solar and wind credits are being phased out sooner, opportunities remain for other sectors, including storage, hydrogen, nuclear, carbon sequestration, advanced manufacturing, and clean fuels.

In the near term, the OBBB restored research and experimentation expensing, 100% bonus depreciation, and looser interest deductibility. Those changes are expected to cut corporate tax liabilities by 20% to 30% in 2025. Analyses from the Joint Committee on Taxation and Zion Research Group project $100 billion to $148 billion in savings for corporations this year.

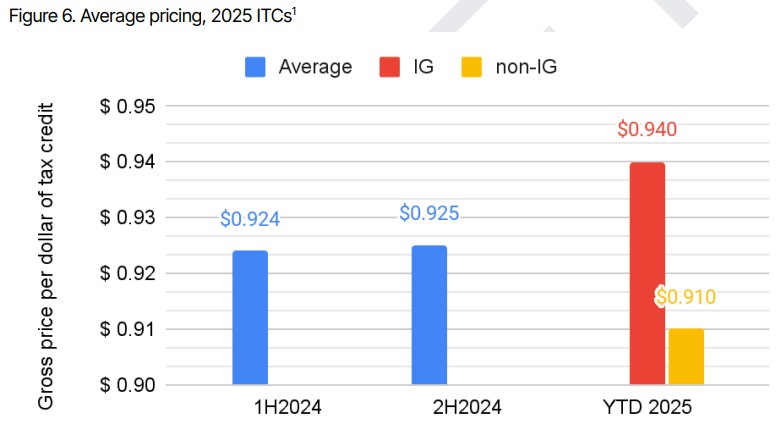

Crux’s survey found that 73% of buyers said these OBBB changes had reduced their tax capacity, and 60% said the changes influenced their tax appetite. The firm forecasts a lull in the second half of 2025 as companies digest the new rules. Crux noted that “some tax credits have dropped pricing $0.03 to $0.05 [on the dollar] below earlier transaction points, creating drag on broader market pricing.”

Source: Crux

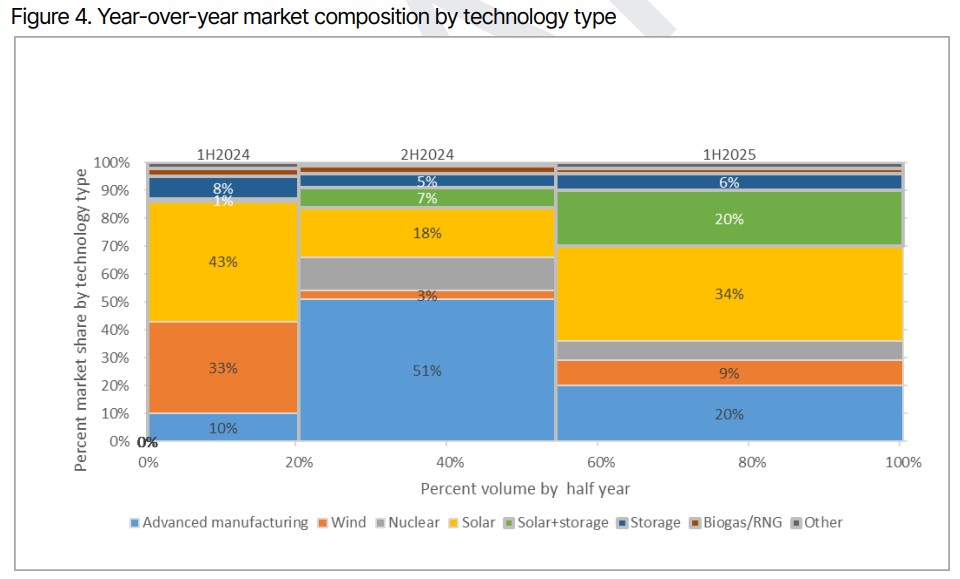

Even so, the market nearly doubled in the first half of 2025 compared with the same period in 2024, driven largely by solar and storage. Crux estimates the transferable tax credit market topped $20 billion in the first six months and projects total monetization of $55 billion to $60 billion for the full year. While standalone solar fell from 43% in the first half of 2024, solar (34%), solar+storage (20%), and standalone storage (6%) together accounted for 60% of transactions in the first half of 2025.

Wind’s share fell precipitously, from 33% in the first half of 2024 to 9% in the same period of 2025.

Tax transfers remain the dominant structure in this market. Even among traditional tax equity deals, more than 60% now use hybrid models, where developers retain part of the tax benefits while selling others. Crux says this shift has opened the door to new participants and helped accelerate the move toward storage and other emerging technologies.

After several years of steady gains, pricing has flattened, with a widening gap between investment-grade and non-investment-grade sellers. Transactions by manufacturers such as First Solar, Heliene, and SEG have cleared at higher values, with First Solar exceeding $0.97 on the dollar, while smaller solar projects have been priced closer to $0.87 on the dollar after fees. These manufacturers also dominated the second half of 2024.

Source – Crux

Crux projects that between $5 billion and $7 billion of manufacturer tax credits will come to market in the second half of 2025. Analysts see pricing ranging from about $0.94 on the dollar for transactions under $20 million to nearly $0.96 on the dollar for those above $300 million.

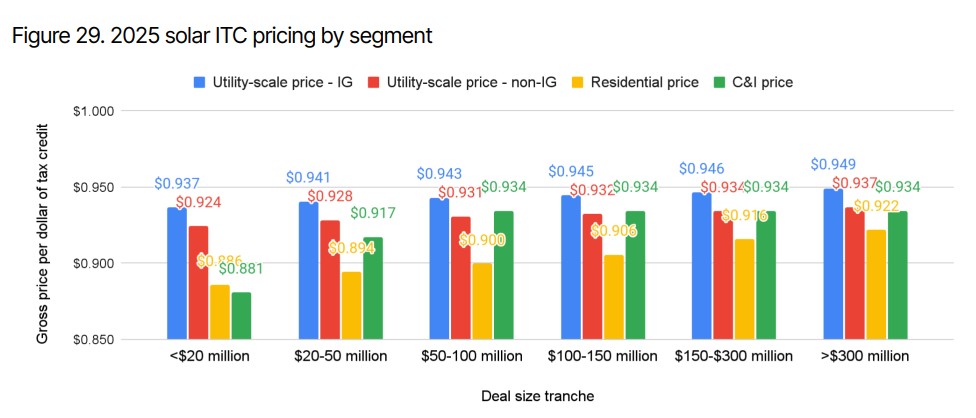

Of the more than $7 billion in solar projects marketed, utility-scale accounted for nearly 76% of tax credits sold in the first half of 2025 by volume. Residential solar made up just over 16%, while commercial-industrial and community solar combined for just under 8%.

Across all project types, from utility-scale to residential, the price per dollar of tax credit generally increased with transaction size. Utility-scale projects showed the least variation, starting at about $0.937 on the dollar. Commercial portfolios had the widest range, from about $0.88 to above $0.93 on the dollar

Energy storage pricing showed a similar spread based on transaction value.

Crux notes that some residential portfolio pricing in 2024 and 2025 may have been suppressed as multiple residential solar companies were forced to sell their holdings. Even so, Crux and solar bond analyst KBBA report that the underlying assets continue to perform.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.