The U.S. Department of Commerce has launched a new investigation into polysilicon imports, seeking to determine whether Chinese trade practices could allow the material to be “weaponized” or used in a predatory manner against U.S. companies.

The filing, dated July 1, 2025, outlines questions aimed at assessing risks to the domestic supply chain.

As part of the investigation, the Department is soliciting public comments on factors that could affect the security and resilience of the U.S. polysilicon supply chain, including:

- Current & projected demand for polysilicon and its derivatives in the United States;

- Extent to which domestic production of polysilicon and its derivatives can meet domestic demand;

- The role of foreign supply chains, particularly of major exporters, in meeting United States demand for polysilicon and its derivatives;

- The concentration of U.S. imports of polysilicon and its derivatives from a small number of suppliers and the associated risks;

- The impact of foreign government subsidies and predatory trade practices on the competitiveness of the polysilicon and its derivatives, in the United States;

- The economic impact of artificially suppressed prices of polysilicon and its derivatives due to foreign unfair trade practices and state-sponsored overproduction;

- The potential for export restrictions by foreign nations, including the ability of foreign nations to weaponize their control over supplies of polysilicon and its derivatives;

- The feasibility of increasing domestic capacity for polysilicon and its derivatives to reduce import reliance.

Polysilicon imports have already faced tighter oversight under the Uyghur Forced Labor Prevention Act, which prohibits goods suspected of links to forced labor in China’s Xinjiang region. Current polysilicon prices reflect China’s dominant position in the market, with rates there around $4.77 per kilogram, compared to more than $20 per kilogram from global sources.

The investigation falls under Section 232 of the Trade Expansion Act of 1962, which allows the president to impose tariffs or restrict imports if the Department determines that the quantity or price of foreign goods threatens U.S. national security. Previous Section 232 actions have resulted in tariffs on aluminum and steel and investigations into battery-related technologies. Following recent steel tariffs, Nucor, the largest U.S. steel producer, raised its prices roughly 35% since the beginning of the year.

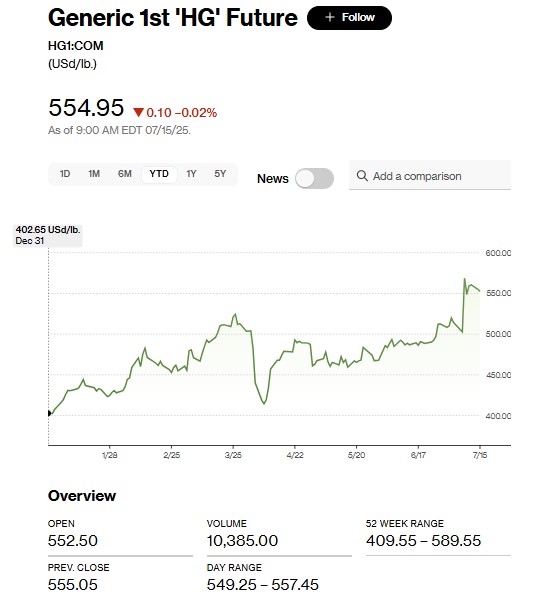

Source: Bloomberg, copper futures

In February, the White House initiated a Section 232 investigation into copper. On July 9, a 50% copper tariff was announced, expected to take effect August 1, 2025. Copper prices jumped 13% immediately after the announcement, on top of a 27% increase earlier this year in anticipation of Section 232 action.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.