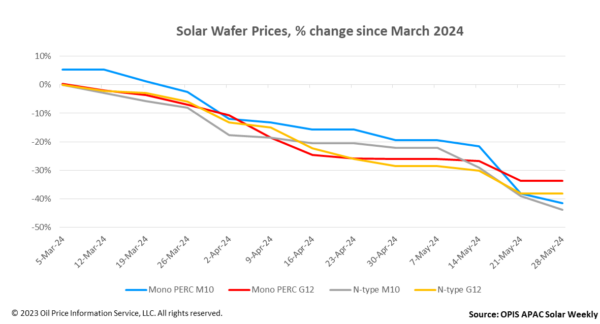

FOB China prices for M10 wafers continued their downward trend this week. Prices for Mono PERC M10 and n-type M10 wafers declined by 5.37% and 7.95% week-to-week, reaching $0.141 per piece (pc) and $0.139/pc, respectively.

FOB China prices for G12 wafers stayed relatively steady this week, with both Mono PERC G12 and N-type G12 wafer prices remaining flat at $0.236/pc and $0.238/pc, respectively.

According to OPIS’ market survey, the average transaction prices of Mono PERC M10 and N-type M10 wafers in the Chinese domestic market have descended to around CNY1.13 ($0.16)/pc and CNY1.12/pc, respectively. Even at this price point, the volume of transactions remains minimal, according to an upstream source. Another industry insider even cited an offer of CNY1.05/pc for n-type M10 wafers, suggesting the potential direction of n-type wafer prices in the immediate future.

The current wafer selling price has notably diverged from production cost considerations, with the main emphasis being on securing sales, according to a market participant.

The wafer inventory remains high at more than 5 billion pieces, equivalent to about 40 GW and twenty days’ production, according to multiple market sources. Against the backdrop of high wafer inventories, reports emerged this week of certain manufacturers reducing their operating rates. Consequently, the overall operating rates of wafer producers have decreased to between 50% and 60%, with a monthly output expected to range between 55 GW and 62 GW.

Recent discussions have emerged about cell manufacturers stockpiling wafers, suggesting that a bottom price for wafers may have been reached. However, a source from the cell market suspects this could be a deliberate attempt by wafer manufacturers to spread misinformation. The source considers this move “unnecessary”, noting that “even if they do hit rock bottom, there’s no basis for a price rebound.”

As a result of shifts in international trade policies, there’s an expectation that orders for cells and modules exported from Southeast Asia to the U.S. will face obstacles in the near future. This development has prompted discussions within the industry regarding the digestion of Southeast Asian wafers and the potential source of wafers for the U.S.’ future cell production.

“It is anticipated that until local cell production capacity is established in the U.S., policies will not completely block the import of Southeast Asian cells. Consequently, the impact on Southeast Asian wafers is not expected to be too significant in the near future,” a source from the global polysilicon market disclosed to OPIS during the China Polysilicon Development Forum (CPDF) held in Leshan, Sichuan, China on May 23 and 24.

In the global market, market insiders have disclosed that a vertically integrated manufacturer’s initial phase 3.3 GW wafer project in the U.S. is slated for completion this year. The factory has already secured the necessary amount of polysilicon for its annual production capacity. Additionally, other wafer manufacturers are exploring the viability of establishing factories outside Southeast Asia, such as in the United Arab Emirates, to navigate the complexities of the international trade environment, sources disclosed to OPIS during the CPDF.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.