From pv magazine print edition 3/24

The world gained 110 GWh of energy storage in 2023, up 149% from 2022. The scaling of demand in China, the United States, and Europe accounted for more than 90% of the global market.

In China, several provinces are strengthening storage policies to stimulate growth in utility-based, front-of-the-meter (FTM) storage. In the world’s largest energy storage market, China, storage capacity reached 52 GWh in 2023, up 229% year over year.

The United States experienced a bumpier ride. A shortage of transformers disrupted the energy storage industrial chain, while project approval procedures remained complicated, resulting in severe project and grid-connection delays. Policy made an impact, with a US Inflation Reduction Act (IRA) tax credit significantly increasing the economic efficiency of storage projects. The United States gained 25.8 GWh of storage in 2023, up 112% year on year.

Europe gained 21.8 GWh of storage in 2023, up 117%, driven by residential and FTM projects. Residential batteries are still consuming surplus inventory. In Italy, the extension to the end of March 2023 for the 110% tax-deduction “superbonus” for renovations, saw home storage installations peak in the first quarter before falling markedly. Italy installed 2.7 GWh of storage in 2023, up 35% year on year.

Germany added 4.6 GWh of storage in 2023, for an annual rise of 142%. Batteries peaked in June before falling every month thereafter due to a sluggish economy, falling electricity prices, and a related fall in the home storage business case.

Policy reforms regarding the European Union power market are expected to push other European Union member states to include energy storage as part of their energy planning, which will further drive demand.

Big shipments

Some 196.7 GWh of battery cells were shipped in 2023, up 61% year on year. Utility-scale and commercial and industrial shipments were 168.5 GWh, up 67%. Small-scale-related shipments transported 28.14 GWh, up 27.9%. The market fell short of expectations for the high-season fourth quarter, with shipments up only 1.3% from July 2023 to September 2023.

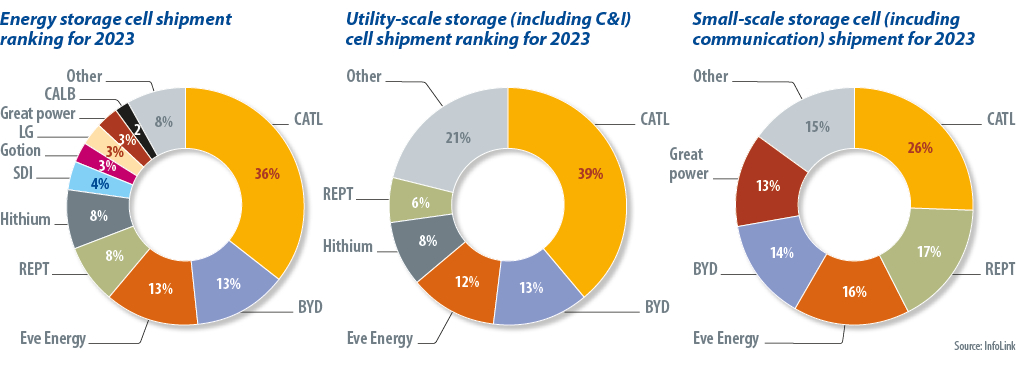

Of the battery manufacturers, CATL remained dominant, with more than 70 GWh of cells shipped. BYD and Eve Energy both topped 25 GWh and REPT and Hithium both shipped more than 15 GWh. Those big five players cornered 76.7% of the market in 2023, up from 68.7% in 2022, thanks to successful cost controls. The battery companies ranked sixth to tenth shipped less than 10 GWh each in 2023, ensuring the top 10 accounted for 92% of the market, up from 86.7% in 2022. South Korean manufacturers Samsung SDI and LG shipped a total of almost 14 GWh in 2023, down 7% year on year.

Breaking down total battery cell shipments, CATL, BYD, Eve Energy, Hithium, and REPT were the top five for utility scale energy storage shipments in 2023, with CATL topping 65 GWh of shipments and its biggest rival less than 22 GWh. With utility-scale storage cell costs falling below CNY 0.40 ($0.06)/Wh, manufacturers with better cost control and financing can still invest in cell technology R&D. Amid increasing competition, big cell makers are introducing large capacity cells utilizing stacking technology and moving toward systems integrated with direct-current side energy storage, in order to differentiate their products.

Severe competition

CATL, REPT, Eve Energy, BYD, and Great Power shipped the most small-scale storage cells in 2023 and cornered 85.1% of the market, up from 84.7% year on year. Competition was severe. CATL, including ATL joint venture Ampace, held more than 25% of the market. Their chief competitors had 12% to 17% each. The market grew only 27.7% between 2022 and 2023, thanks to small-scale storage inventory pile-up. That slowdown is expected to last until late March 2024 or early April 2024, based on current inventory depletion, with shipments to pick up from June 2024.

Chinese companies made up the world’s top five battery cell makers in 2023, with LG and Samsung emerging as the only non-Chinese operators in the top 10. Shipment numbers for 2023 underscored the confidence of big manufacturers in overseas expansion. Chinese cell makers plan to develop about 579 GWh of annual production capacity overseas, according to InfoLink’s global lithium ion battery supply chain database. That includes 353.4 GWh from production lines in Europe and 144 GWh in the United States, as well as electric vehicles. InfoLink expects more than 250 GWh of cell capacity overseas from Chinese companies by 2026. The resulting market share grab will help Chinese companies to circumvent domestic manufacturing policies, which could put rivals from South Korea and other nations under pressure.

Looking ahead, as inventory levels gradually decrease, prices across the industrial energy storage supply chain will stabilize. That development, coupled with supportive policies, means InfoLink expects the global energy storage market to sustain growth at a medium to high pace. The global expansion of energy storage installations is projected to grow at a rate of 50% to 165 GWh per year, while energy storage cell shipments will expand by 35% to 266 GWh.

About the author: Robin Song is an energy storage analyst at InfoLink Consulting, focusing on lithium ion battery supply and demand analysis. He also provides insights on energy storage market trends. He previously worked for a leading lithium ion battery manufacturer, where he provided market and investment analysis.

About the author: Robin Song is an energy storage analyst at InfoLink Consulting, focusing on lithium ion battery supply and demand analysis. He also provides insights on energy storage market trends. He previously worked for a leading lithium ion battery manufacturer, where he provided market and investment analysis.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.