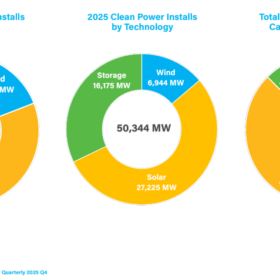

As renewables continue to grow and augment/replace fossil assets on the grid, energy storage is becoming a critical component. Today, lithium-ion batteries dominate grid-scale energy storage deployments. This will change as solar and wind penetration exceed 30%. A bevy of pilot projects using iron-flow, nickel-hydrogen, and other technologies is giving developers, IPPs and utilities a menu of storage options beyond lithium. However, driving down the costs of grid-scale storage remains a key challenge.

At a recent webinar hosted by Reuters Events, leaders from utilities, developers and technology providers came together to discuss strategies for building cost-competitive storage systems. The speakers included Dr. Sherif Abdelrazek, director of renewable engineering at Duke Energy, Daniel Dedrick, SVP of EPC and technical operations at GridStor, and Hugh McDermott, SVP of business development at ESS Inc.

The discussion emphasized several key topics regarding technology innovation, business models, policy reforms, and supply chain optimization to reduce storage system costs.

Lithium-ion batteries currently dominate the market, especially for short-duration (2-4 hr) applications. But rising lithium prices and high penetration of renewables are driving interest in alternative chemistries. Iron-flow and nickel-hydrogen batteries are gaining traction for longer-duration needs of 5-12 hours and show promise for high cycle life and low degradation.

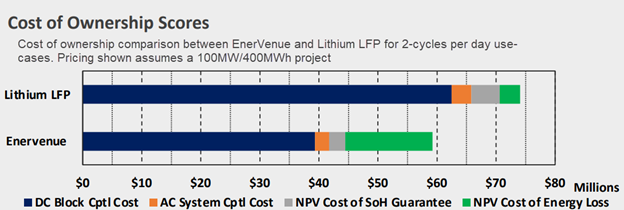

Abdelrazek at Duke Energy has piloted a nickel-hydrogen battery by EnerVenue, a metal-hydrogen solution provider who announced a 25 MWh project in Florida with EPC High Caliber Energy in June 2023. EnerVenue’s nickel-hydrogen battery technology, offers “ultra-long life, efficiency, and flexibility … feature[s] an expected lifetime of 30 years / 30,000 cycles, deliver 86% capacity after 30,000 cycles, and can cycle up to three times per day without rest.” EnerVenue’s battery technology benchmarked at 80% of the overall cost of ownership of lithium for 2-cycle a day use-cases, per Storlytics Energy Storage, an independent evaluator of new energy storage technologies. In the figure below, considerable cost of ownership savings can be realized with nickel-hydrogen batteries, on account of their high cycle life, despite their underperformance against lithium in self-discharge, RTE and energy density.

Duke is building community-scale microgrids – a trend which will be growing rapidly as an alternative to more transmission and distribution infrastructure. In the town of Hotsprings North Carolina, Duke installed a 2.7 MWdc solar and storage microgrid in 2019 that uses a 4 MW/4 MWh lithium-ion battery which gives the community several hours of off-grid operation in the event of a grid-outage.

On a larger scale, Gridstor developed a wholesale battery facility connected to the distribution system in Goleta CA, where outages are common and wholesale prices signal value for local flexibility. The Goleta project in Santa Barbara County uses a 60 MW / 160 MWh lithium-ion battery capable of powering the equivalent of 30,000 homes through the hours of greatest demand on the state’s power system.

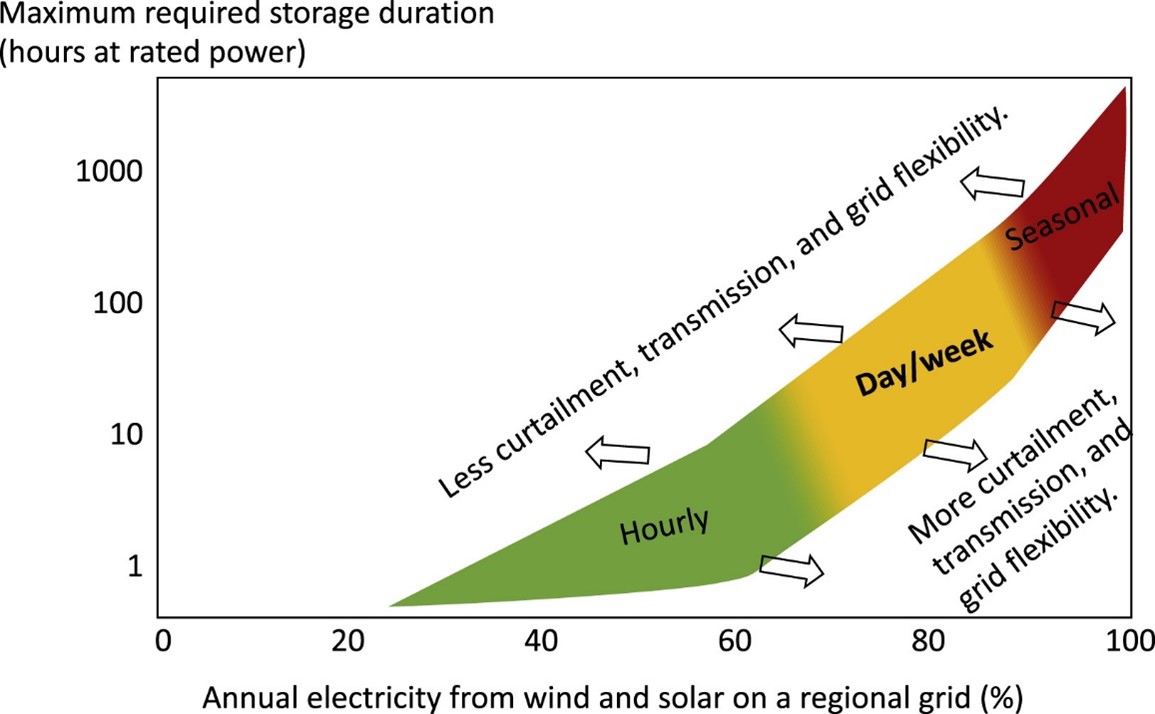

Gridstor’s Daniel Dedrick commented that deployment of stand-alone storage projects has been supported by the Inflation Reduction Act stand-alone storage ITC. “As grid penetration approaches 50 plus %, the need for longer duration storage becomes vital. Figure 2 below illustrates how wind and solar penetration drives long duration energy storage.

Figure 2. Renewables penetration drives longer duration grid storage; Source: Joule

Figure 2. Renewables penetration drives longer duration grid storage; Source: Joule

“This is why energy storage markets have heretofore focused on 2–4-hour solutions,” explained Dedrick. As the EV industry produces innovation in lithium batteries, variations on those lithium chemistries were popularized by Panasonic, LG, Samsung, and Tesla for grid applications like peak load shaving and virtual power plants. Those ‘consumer brands’ are now being augmented with more space-aged technologies like EnerVenue’s nickel-hydrogen and ESS Inc.’s iron-flow batteries. Neither company is a household name today, but energy professionals will witness these and many other medium and long duration storage products hit a grid near them soon.

ESS’ iron flow technology was recently chosen for the Stanwell Clean Energy Hub in Queensland Australia where a 1 MW/10 MWh iron-flow battery will be part of a solar, wind, battery and hydrogen storage pilot on the campus of a 1.4 GW coal plant, Stanwell Generating Station. The project is reminiscent of Vistra Energy’s Moss Landing facility, which recently achieved 3 GWh of capacity.

Achieving cost-competitive storage is not just about cheaper batteries. Developers like Gridstor are quick to point out that interconnection wait times drive up project development costs. Utilities like Duke Energy say they welcome more collaboration with both developers and manufacturers alike to reduce the hard and soft costs of energy storage.

The value stack of storage is one of the main drivers of both technology adoption and project economics. Revenue streams remain limited today, focused on capacity, resiliency, energy arbitrage and ancillary services (e.g., frequency regulation). Policy reforms to enable additional value streams will be critical, as will co-locating storage near load centers (urban centers) rather than generation assets (mostly rural). Behind-the-meter storage for C&I customers also offers a fast-growing opportunity.

Collaboration between utilities, developers and manufacturers on transparent and accurate modeling of BESSs, standardized permitting and aligned production capacity will help optimize supply chains and manufacturing. This can reduce soft costs and prevent component shortages.

Safety and degradation risks of lithium-ion remain a concern. Alternate chemistries like iron-flow and nickel-hydrogen (which despite its name has an extremely low fire-hazard rating and has been used by NASA for decades) may ease some of these growing pains.

In summary, the industry must continue working together across the value chain to maximize storage technology performance, ensure equitable policy treatment, and deliver reliable, cost-effective systems. The growth opportunities for storage are tremendous, but realizing the full potential will require persistent innovation, open collaboration and aligned incentives.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.