From pv magazine 06/23

Two of the biggest solar markets, the United States and China, expanded their distributed-generation capacity by more than 65% in 2021 and 2022, against a 4% fall and an 18% rebound in utility scale PV. That means a qualitative shift in financing, in particular to back the integration of mass, networked, distributed-energy resources (DER) under virtual power plants (VPPs) and traditional utilities. Rethink Technology Research believes that utilities, especially in the U.S., plan to participate in mass distributed-solar rollout. We think they will offer to partner with residential and commercial and industrial (C&I) property owners and act as a bridge to finance.

While net metering payments and reduced electricity sales might spook utilities, electric companies have tremendous balance sheets to borrow against and can recruit “full scale” distributed-generation (DG) customers, equipped to their maximum solar roof and energy storage potential.

First mover

The first power company to embrace this change will be imitated by others because the alternative is to be abandoned by customers wealthy enough to go full scale distributed alone, free from grid reliance. Utilities that rent roofs back to customers unable to purchase PV arrays outright will open the market to more solar customers and safeguard themselves from falling energy prices while retaining control of power generation.

With half of the world’s electricity to come from solar in future – and half of that DG arrays – utilities will have to embrace the VPPs expected to become widespread in the US in the next two years, and later in Australia, parts of Europe, and, potentially strong DER markets such as Japan.

VPP outlook

The Rocky Mountain Institute, a sustainability thinktank, announced a virtual power plant partnership in January with General Motors. It also announced agreements with Ford, Sunpower, Sunrun, home-automation specialist Google Nest, and the OhmConnect energy-efficiency program. In addition, it started working with Olivine, an energy demand-response specialist, and SPAN, which provides home energy-consumption panels. It also collaborates with VPP developer SwitchDin and Virtual Peaker, a residential electric demand software platform.

Utilities in the United States and elsewhere are already obliged to enable VPPs on their grids, meaning they must track and model VPP grid participation. More than two-thirds of U.S. electricity meters at the end of 2021 were smart devices, with 120 million now installed.

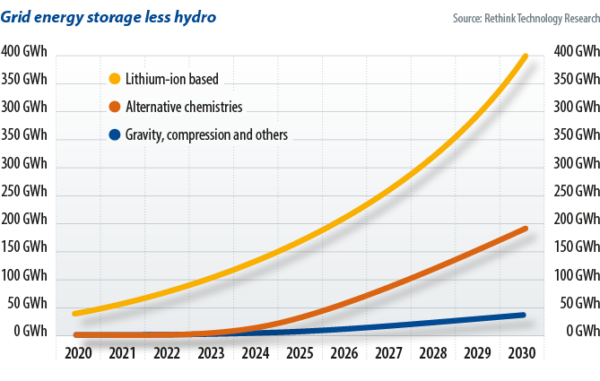

Independent aggregators are now pushing VPPs, meaning more generation and storage is taken out of the hands of utilities until they join the market. If more than 60% of solar capacity is small scale, a similar volume of storage capacity can be expected, paid for by homeowners or whoever paid for the systems, and will be attached to a revenue-generating VPP.

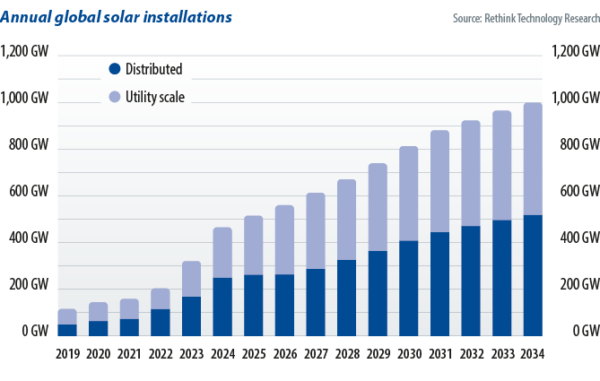

Despite rising solar prices, Rethink Energy estimates the global PV industry grew 30% last year, with 221 GW added, and will rise 50% this year and in 2024, based on 330 GW of annual solar manufacturing capacity last year, plus 45 GW per month more this year.

Distributed outlook

We estimate rooftop panels accounted for 57% of the solar added last year and will stay above 50% through mid-2025, with DG numbers rising in the U.S., China, and most other big markets. While high module prices and other supply chain issues affected utility scale plants, war in Ukraine prompted people and businesses to go solar to safeguard energy security.

Rethink Energy expects the pendulum to swing back to utility from 2025 to 2030, as manufacturing bottlenecks ease and module prices – which make up around 40% of project costs – return to the price decline curve which prevailed until mid-2020. Prices topped $300 per kilowatt of generation capacity in late 2021 but have now subsided below $240/kW, before shipping, and will reach $200/kW in 2025.

DG systems will retake the crown from 2031, to hit 63% of all new installations in 2050. Both will boom and while hundreds of gigawatts of capacity in Australian and Chilean deserts alone will power green hydrogen, DG’s potential will be even greater, driven by energy prices.

Distributed solar has so many cost factors that the price spike in polysilicon – which still accounts for more than 25% of module costs – barely changed the financial formula, enabling small-scale PV to dominate. Many countries have boosted rooftop solar with new policies but these are simply riding the wave, not causing it.

In 2027, utility-scale solar will, for a brief moment, once again enjoy the 57% share of new installs it held before the pandemic. From that point on, multiple long-term trends will work in favor of distributed PV – with one of them being the “next big limiting factor” of the solar industry – transmission. In 2031, the two sectors will return to parity, as distributed prepares to take over for the second time.

Peter White founded Computerwire in 1984, launching tech publications such as “Computer Business Review” before evolving into a market research and consulting firm. White founded Rethink Technology Research in 2002 to publish strategy bulletins and market forecasts. The company has a focus on the technology inside video, cable, satellite, and digital homes, along with solar, energy storage, hydrogen, and wind power.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.