As renewable energy sources like solar and wind are increasingly relied upon for supplying electricity, a buildout of energy storage capacity is needed to address the intermittent cycles of generation of these technologies.

Today, much of the energy storage added to the grid is short duration, replacing the role of reserve natural gas peaker plant capacity that are fired up as electricity demand reaches its high points. Energy storage across the U.S. added 14.1 GWh, 4.8 GW of capacity in 2022, leading to an average duration of about 3 hours, said the National Renewable Energy Laboratory.

As more renewables are integrated with the grid, longer-duration storage methods are in-demand for their ability to supply reliable baseload power. Long duration energy storage typically can dispatch power for 10 to 12 hours, making it well-suited to complement the day-to-night intermittency of solar generation.

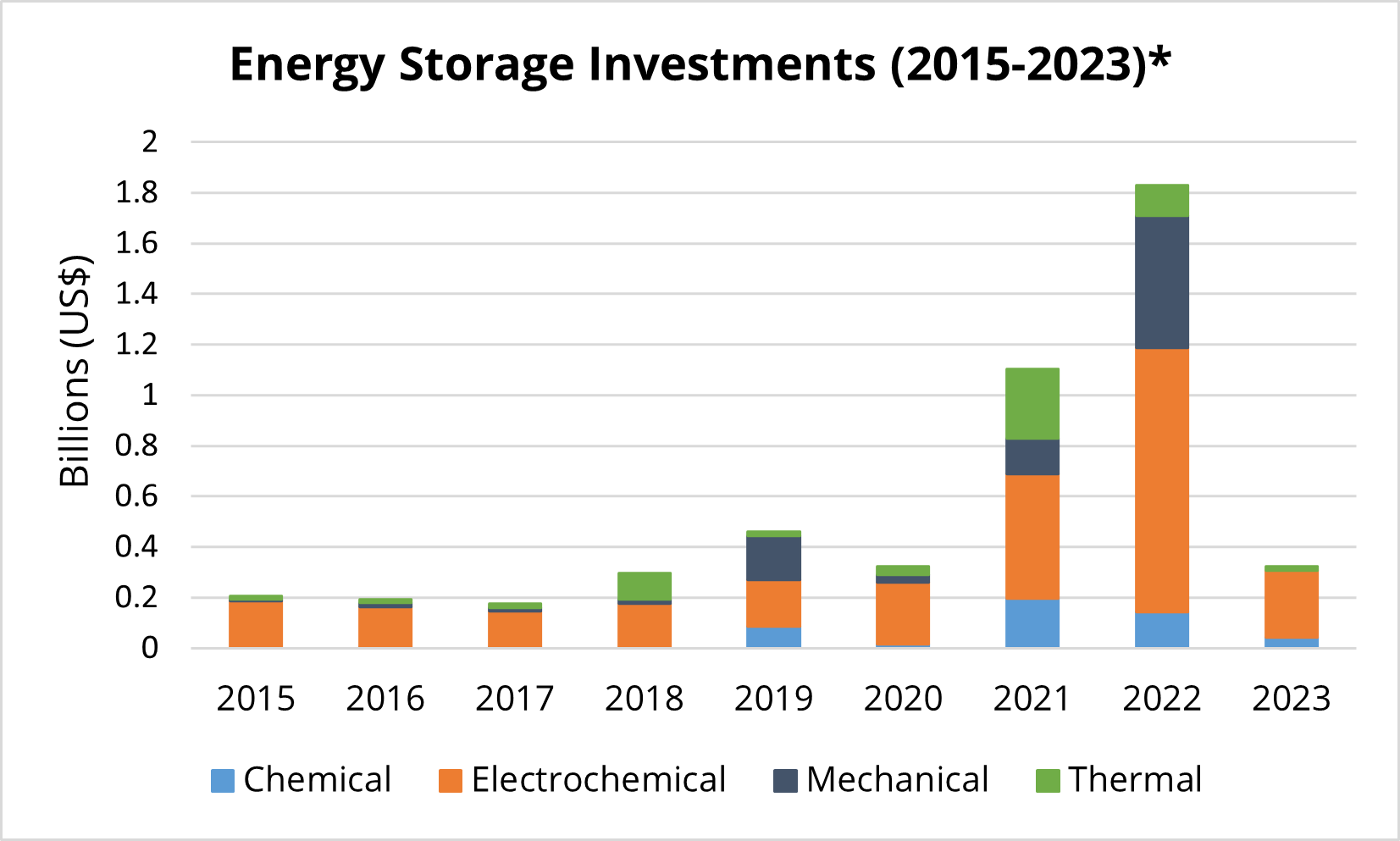

A study by the Cleantech Group showed that investments in long-duration energy storage (LDES) has grown sharply to $1.8 billion last year, as seen below.

Investment has largely been directed towards electrochemical (i.e., battery) solutions, with thermal storage, chemical storage, and mechanical storage all holding a considerable share. The report said that the variations in technology used are shaped by the environment the projects are installed in. For example, mechanical storage would be suitable for countries with abundant land and high solar penetration, whereas hydrogen would be appropriate for areas focused on wind energy with salt caverns available, said the report.

“It will not be a one-size-fits-all situation; different LDES solutions will be required for different geographies and technologies,” said Selene Law, senior associate, energy & power, Cleantech Group. “For example, Form Energy’s iron-air technology will not be suitable for balancing solar power. Conversely, vanadium flow will not be the best solution for seasonal storage.”

(Read: “Innovations in long-duration energy storage”)

The U.S. Department of Energy released a report outlining a pathway for LDES to attract up to $530 billion in cumulative investment by 2050.

DOE said maintaining this trajectory will require the deployment of six to 10 GW of LDES projects and the allocation of $6 billion to $9 billion in capital investment by 2030. To align with the 2050 goals, it will need to establish a manufacturing capacity of 10 GW to 15 GW and roll out further deployments by 2035.

The DOE objectives for 2050 include the deployment of 225 GW to 460 GW of LDES capacity, which is projected to save $10 billion to $20 billion of system costs annually, compared to scenarios without such deployment. By 2030, inter-day LDES project costs must decrease from $1,100 to $1,400 per kW to $650 per kW and improve round-trip efficiency from the 69% seen in best-in-class technologies in 2022, to about 75%, said the DOE report.

The Cleantech Group shared that Spain, Canada and Australia are among leaders outside the U.S. Spain has set a target of 20 GW in grid-scale storage by 2030, while Canada aims for 12 GW.

“The emergence of support schemes like the Inflation Reduction Act (IRA) in the U.S., carbon prices of $100 per ton of carbon dioxide in the European market and increasing penetration of renewables have created a fertile ground for developing new LDES solutions,” said Law.

The Cleantech Group will hold a webinar, “Long-Duration Energy Storage: The Next Frontier or The Next Hype?” on June 28th at 10:00 a.m. EDT / 3:00 BST.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 details.

In 3 yrs EVs with V2G will kill the grid storage market with about 100GWh with each averaging 3 days of storage and still have EV range left.

With mostly solar, EVs and a small home pack plus CHP and hopefully small wind, so many homes, buildings, businesses won’t need the grid except to sell it on demand power.

It’ll cost them about $.05/kwh to make, store so both a huge savings vs utility power 2-10x more and very profitable to sell on demand utilities can’t compete with, so likely 50% of loads will do it, killing utility generation demand.

So we only need a moderate grid RE build out and a really smart grid as homes, buildings and businesses are going to make their own as so much lower cost, even profitable.