NextEra, the leading developer of wind, solar and energy storage, in the United States, has put forth their 2022 Investor Conference report. The report is chock-full of great knowledge, and piques our curiosity as to just how much power grid knowledge the firm has hidden away.

Of all the terminology used by NextEra, “near-firm” is this author’s favorite.

NextEra’s description of near-firm “assumes a 4-hour battery to achieve roughly equivalent reliability during peak hours for comparison with dispatchable generation sources.” The technical definition of a near firm solar power plant is one that is coupled to a battery sized at 25% its nameplate capacity, which is capable of providing four hours of energy storage, i.e. 100 MWac solar + 25 MW/100 MWh of energy storage.

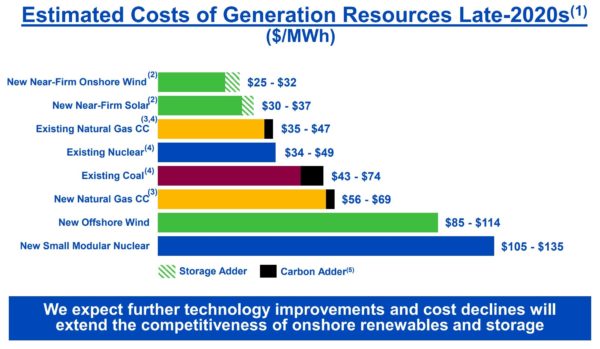

This year, the group’s estimated late-2020s cost of near-firm solar power was at $30 to $37 per megawatt hour (or 3-3.7¢/kWh). Last year’s presentation suggested these costs would be 3-4¢/kWh by the middle 2020s.

The energy storage adder for solar power is about 0.4 to 0.6 ¢/kWh, which falls within the range of the 0.4 to 0.9¢/kWh predicted for 2022 in the 2020 Investor Presentation. The half a penny adder also aligns with a market awakening series of bids the company submitted in late 2017 in Colorado.

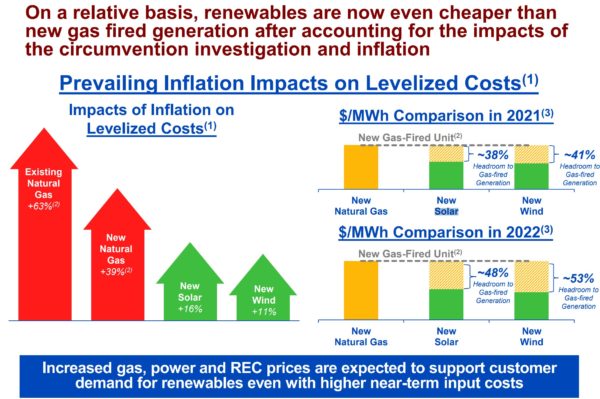

Considering inflation, it could be that a little panel pricing pressure is acceptable. At the moment, fossil fuels have been driving the majority of global price inflation. NextERA notes that levelized solar costs per kWh have increased by 16%, while fossils have more than doubled, and in some cases, more than quadrupled.

New solar power in 2021 had a 38% price advantage versus new gas fired electricity generation. Today, that price advantage has increased to 48%.

NextEra sees price inflation leading to increasingly expensive renewable energy certificates and electricity prices. The company expects this will lead to even greater demand for renewables.

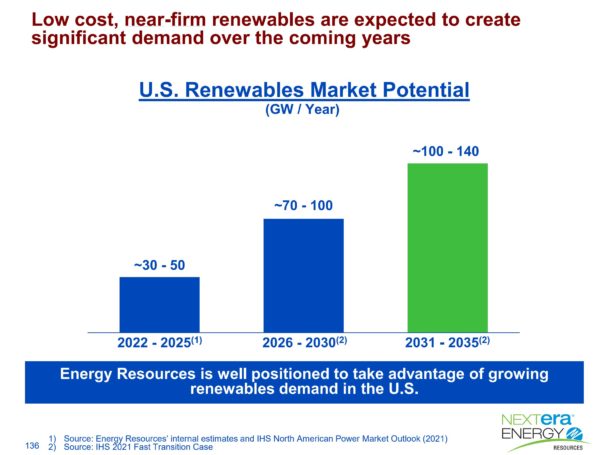

Looking at the next decade, NextEra already saw the potential for a massive growth in capacity prior to the inflation. The group’s internal analysis, coupled with third party numbers, shows a potential for 30 GW to 50 GW* of wind and solar capacity in the United States to be added from 2022 through 2025.

*All solar capacity values in NextEra presentations are measured as AC (inverter sizing) values. Add ~25-30% to account for modules deployed in DC.

The company expects this value to double through 2026 to 2030, before expanding to 100 GW to 140 GW of new capacity additions annually in the 2031 to 2035 window.

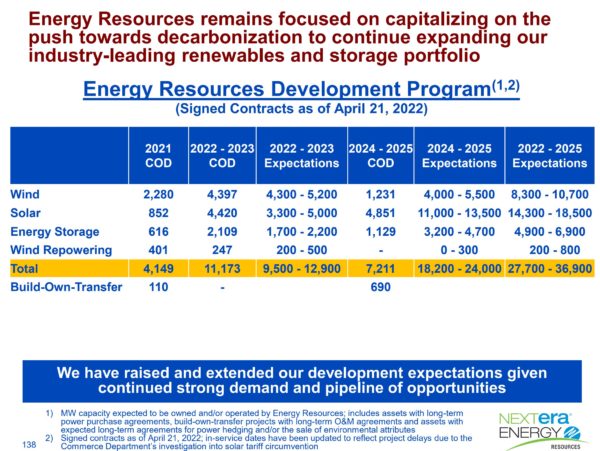

Of this capacity, the company expects that its teams will deploy roughly 22.6 GW to 29.2 GW of wind and solar through the end of 2025. Solar deployments account for 14.3 GWac to 18.5 GWac of that figure, implying that the behemoth company could deploy as much as 24 GWdc of solar module capacity by the middle of this decade.

The company also suggests that they will deploy between 4.9 GW and 6.9 GW of energy storage in that same 2022 to 2025 time period. NextEra tends to deploy four hours of capacity with their energy storage, but that number does vary, and they have not yet released a specific hourly rating.

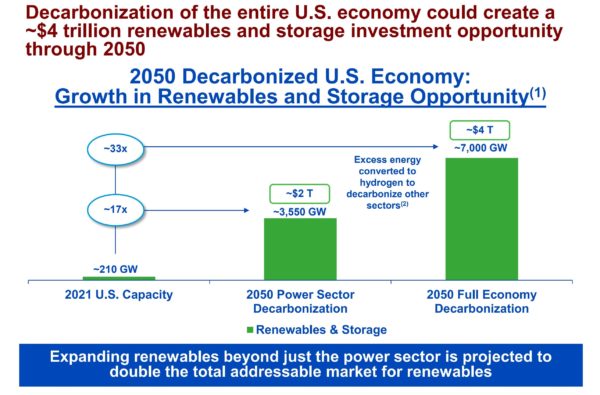

NextEra said it sees a massive opportunity in decarbonization of the full US economy – not just the power grid. In fact, they are predicting that by 2050, the decarbonization of all sectors of our economy, through the heavy use of hydrogen, will roughly double the nation’s capacity needs.

NextEra has talked about the deployment of hydrogen solutions to corporate and industrial companies in prior presentations. The company notes that their Florida utility – FPL – has an opportunity to deploy 92 GW of solar coupled with 16 GW of hydrogen electrolyzers.

Through 2050, NextEra sees the power sector’s drive towards decarbonization generating an opportunity for 3.55 TW of wind, solar, and storage capacity. In order to supply the hydrogen the company believes is required for supplying broader industries, NextEra believes that an additional 3.5 TW of wind and solar will be needed to make hydrogen green.

This increases potential financial opportunities from approximately $2 trillion to $4 trillion. Over the next 28 years, a deployed capacity of 7,000 GW implies an average of 250 GW each year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Great article! Good to hear all the good news.

I have not asked a lawyer, engineer, accountant or physicist about NextEra, and I’m sure this exciting report from NextEra, of potential perpetual motion profitability for – their model for – “Renewables”, is keeping new speculative investors interested in NextEra success.

Meanwhile, as NextEra has moved west, there is no mention of the “irreparable”, “uncompensable” damage – losses – to remaining natural environment – caused – by NextEra’s own operations in Florida, and in Nevada. Various welcome, very desirable nuisance-level layers of government “penalties” and “deterrents” against deliberate destruction of “free”, “unlimited” “wasteland” (Last Stand natural wildlands), done on a geographic ecosystem scale, (stunningly not Green), for commercial profit, have been and are the one risk-proof – foundation – “efficiency” of NextEra’s own – business model.

Investors now may not care about that, but if – any – other high speed PV tech evolution breaks out soon, removal and disposal of suddenly – or already – uncompetetive solar “large array” infrastructure, wherever installed on remaining natural wildlands for 30-40yr use by NextEra, (including “repurposeable” damage, like roads? or substation spaces?) – had better be done more than just thoroughly, (and not by governments or contracted customers), at a spectacularly inescapable, instructively high cost to the NextEra corporations, only. That seems, to me, to be one small, but good re-balance to start with.

Thank you for your report.

We don’t build near-firm grids and we shouldn’t start now.

Here is a technology capable of providing truly firm RE. The only catch is you’d have to run it on gas for 5 to 10% of the time. The wonderful thing about this technology is that you can co-locate it with process heat users and kill two birds with one stone. If NREL’s technical spec sheets are anything close to accurate this is a Holy Grail technology.

https://www.nrel.gov/news/program/2021/nrel-options-a-modular-cost-effective-build-anywhere-particle-thermal-energy-storage-technology.html#:~:text=ENDURING%20uses%20electricity%20from%20surplus,sand%20through%20a%20giant%20toaster).