The second quarter of 2021 was a record Q2 for U.S. solar development with 5.7 GW installed. This marks the 4th largest quarter ever for solar development in the United States.

Sector-by-sector growth was strong. It was a near-record quarter for residential (974 MW), commercial solar was up 31% year over year (354 MW), and there was 177 MW of community solar developed. Perhaps most impressive, 4.2 GW of utility-scale solar was developed, and 9 GW of utility-scale solar was procured.

Despite these growth figures, presenters from the Solar Energy Industries Association (SEIA) and Wood Mackenzie who spoke at this year’s Solar Power International warned of bottlenecks and cost increases ahead. While the market is set to grow, it is “not all unicorns and rainbows,” said Xiaojing Sun, head of solar research at WoodMac.

Supply chain woes

Supply chain bottlenecks, raw material price increases, delays due to congestion at ports, and limited availability of shipping containers are all increasing costs, particularly at the utility-scale. Uncertainty and sanctions due to reports of forced labor in the Xinjiang region of China dampen the growth outlook, as well.

Increases in costs for polysilicon, glass, steel, aluminum, and copper affect the cost of nearly every component in solar, including modules, racking, inverters, and the full suite of balance-of-system components. WoodMac analyst Molly Cox said that it can take 3-9 months for end-users to see the impact of raw material cost increases in their price.

Cox said some manufacturers will opt to absorb the increased cost of raw materials, but others may pass it on to the end user. This has caused some power purchase agreement contracts having to be renegotiated, or price increases passed on to customers, said Cox.

Different sectors have been affected by raw material costs at different rates. While residential and commercial scale solar have seen about 1% project price increases year over year in-quarter, utility-scale has seen a 6% project price increase in the same span.

Cox said that about 60% of the cost stack of a utility-scale solar project is impacted by raw material cost increases. The figure is 40% for residential, and 45% of commercial. Freight costs have had a larger impact on utility-scale solar prices than other sectors, as well, said Cox.

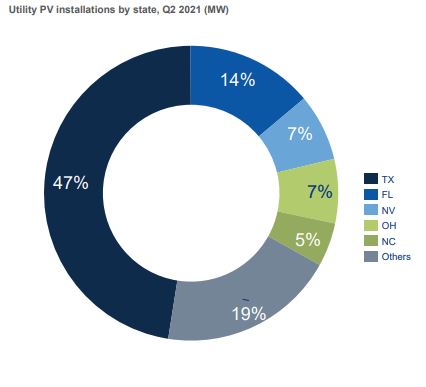

Despite these challenges, utility scale solar increased 29% year over year in Q2. Texas led the way with over 17,490 MW installed, and Florida took second place at 515 MW.

Conspicuously, California was not among the top installers of utility-scale solar. Sun said the state is expected to have a strong total in 2021, and that the high rate of complex hybrid facilities with co-located energy storage may be a reason for delays. Roughly 39% of the upcoming 106 GW pipeline capacity is in Texas, Florida, and California.

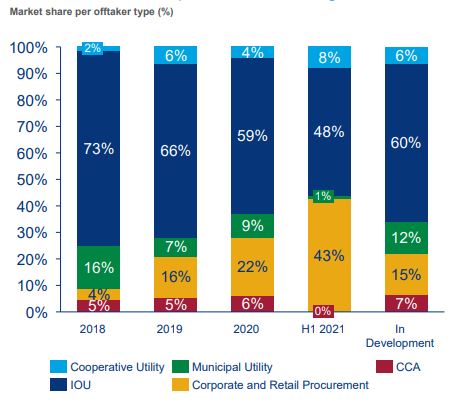

Investor-owned utilities are a top procurer of utility-scale solar, and accounted for 48% capacity procured first half 2021. About 60% of utility-scale projects in development are procured by investor-owned utilities.

Corporate and retail procurement of these projects is on a sharp rise, and now 43% of first half 2021 projects were procured by corporate customers.

Commercial solar bogs down

While raw materials affect utility-scale projects, Cox said soft costs have been the largest barrier for commercial projects. Varied labor requirements, and complex permitting and interconnection requirements are bogging down this sector.

There is strong customer interest on the commercial-scale, but interconnection issues have caused 3.5 GW of projects to get jammed in queues in Massachusetts, Maine, and New York. Often in these states, utilities conduct long studies to determine whether transmission infrastructure upgrades are needed. If upgrades are deemed necessary, the cost can be pushed to the solar developer, which often leads to project cancellations and even market exits, said WoodMac analyst Rachel Goldstein.

(Read: “Interconnection issues jeopardize New England’s clean energy goals“)

Community solar is faced by similar issues to commercial scale, and also faces challenges in siting, zoning, and changing incentive schemes. Overall, community solar is having a flagship year, and is expected to peak in 2022. Largely, community solar is driven by incentive program, like those seen in New York and Massachusetts, said Goldstein.

Residential solar permitting, labor among chief issues

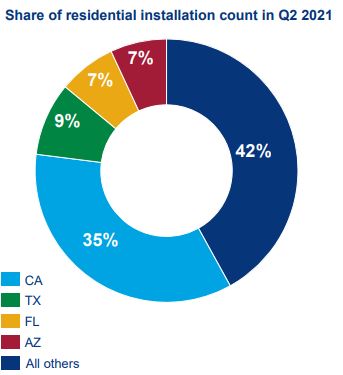

Residential solar is on pace for a record year. Installations are up 46% year over year from the pandemic-impacted Q2 2020. Still, Goldstein said that the growth is an indication of the sector’s ability to adapt, as many installers moved to online and remote customer-interface strategies.

The main bottlenecks facing this sector are labor supply issues and slow and costly permitting times. One tool that may help alleviate the latter is the SolarAPP+, a Department of Energy and National Renewable Energy Laboratory collaboration that delivers instant, automated residential solar permit approvals. In a push by Secretary of Energy Granholm, the SolarAPP+ has been implemented in over 120 jurisdictions, and it continues its reach.

Some states are growing in residential solar rapidly, and some are experiencing problems. Goldstein said that Georgia, for example, implemented a limited net metering program that hit its capacity cap sooner than expected. Now, the market has become uncertain, leading several installers to withdraw.

Conversely, Florida has moved from an emerging market to a major residential solar market. A 2018 regulatory decision to allow solar leasing caused national installers to enter the market, driving competition and lowering prices.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.