You’ve got a contractor, you found your solar panels and inverter, you understand the taxes, you’ve got the project priced, and you’re ready to take care of your solar power plant for the long haul. How’s that for a Solar 101?

The next question is, where’s the money going to come from to pay for all this?

For most things we buy, this is an easy answer: Cold, hard cash. However, the out-of-pocket cost for a solar power system is pretty high, so the purchase is a lot like buying a car. And because solar panels pay dividends, a better analogy might be investing in a financial product.

The key is, your solar power plant is going to generate a commodity — electricity — which has a value that can be readily determined. And because of electricity’s highly quantifiable nature, many banks and other financial parties have an interest in being part of your solar power project. Even so, cash is king.

Long live cash

Everyone likes a cash payment, and if you’re ready to pay your contractor the day you call them, that will likely help you get the best price on your solar power project.

A small down payment to start the process (and that covers engineering, application, and permit fees) is fair. Next up is a big payment which includes a deposit, or even full payment, for hardware and at least some of the labor. The final payment – on the order of 10% – often is made after the project connects to the grid and starts generating electricity.

Paying no interest and getting a great price often means that using cash provides the fastest payback on your solar power project.

Home Equity Line of Credit (HELOC)

A HELOC with a respectable interest rate might make an attractive financial option. Naturally, this depends on the opportunity cost of spending your own cash on the solar power asset, versus investing it elsewhere.

For instance, if you prefer to put cash into your 401K or your children’s education fund, it might make sense to get a low-interest-rate HELOC from your bank.

In general, banks positively view solar power projects that are put on homes on which they hold the mortgage. This is because solar installations generally lower a homeowner’s monthly expenses, while also making the home more valuable.

Conventional bank loan

As residential solar moves past 400,000 installations a year, banks have increasingly sought to earn the fees associated with underwriting the — on average — $21,000 loans. As homeowners add accessories to their projects, the bank loan agents may even become a bit more charming.

Image: Sullivan Solar

You can visit banks in your area to see if any of them want to own your project, or search nationally for banks that have a department set up specifically for solar. Your state may already have one or more programs to drive solar power financing. Massachusetts is a good example, with its Mass Solar Loan program.

There is at least one nuance to understand when considering a bank loan. Currently, homeowners get a 26% tax credit when they buy a solar power project. If you happen to pay the average price of $21,000, that means you are entitled to a tax credit of $5,460.

Banks will generally request that borrowers put down a deposit on this type of loan. So let that 26%/$5,460 be your anchor number, and if you can find a better offer, go for it.

Keep in mind that the type of loan you choose may affect your tax burden for years to come. A home equity line of credit is similar to a mortgage, as is usually tax deductible. General bank loans are not typically tax deductible.

And we are by no means tax experts, so consult with your tax professional before making a decision, and remember to account for any additional incentives when you have those conversations.

Quick finance

Many residential solar buyers choose instant loans from companies that specialize in solar finance. These groups will include energy storage and car chargers with no paperwork and on-the-spot approvals. They offer a combination of 20-year and longer terms, no down payment, low interest rates, plus a guaranteed discount on your electricity bill.

In general, these finance companies will save the 4-8 weeks that bank financing might take.

The biggest downside to these fast-credit products is the “dealer fee.” This fee is a percentage added to your project’s price by the finance company. Make sure you compare your full project return on investment, and factor in all fees and interest rates from all product types.

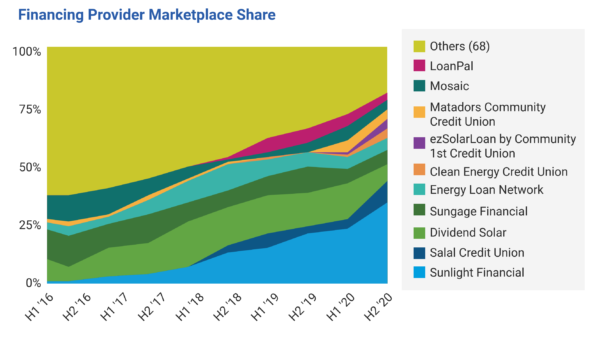

EnergySage’s semi-annual Solar Marketplace Intel Report gives a breakdown of what finance companies contractors suggest to potential solar buyers.

Many contractors offer different financial products depending on your needs and what the various companies offer.

Third-party ownership

Who would want to own my tiny little rooftop? Well, Sunrun might. Sunrun’s “tiny little rooftop” installations add up to a greater-than-utility-scale solar power plant every few months.

Sunnova also figured out that tiny rooftops add up, and they’re currently the nation’s second-largest rooftop lease company, behind Sunrun. To sweeten the deal, Sunnova offers backup batteries, 25-year warranties, no cash down, guaranteed savings, and other benefits depending on where you live.

In this author’s opinion, the greatest benefit in going with a third-party-owned system or a quick-finance company is simple: It gets the solar on your roof right away so you can be part of the movement.

And while a solar lease doesn’t offer a compelling ROI like a system you’ve bought yourself, there’s no down payment. You, the homeowner, get 10-30% off your electricity bill, and the lease company assumes all risks and responsibilities. If there’s weather damage, faulty components, and O&M, that’s not your problem to fix (even though it is your problem to deal with, and that sometimes can be unpleasant).

In our next article of our Solar 101 series, we’ll talk about what California thinks homeowners should pay attention to – and protect themselves from – when buying solar power.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.