SunPower reported first quarter revenues of $306.4 million, 5.5% higher than the company’s Q1-2020 level, but $35 million below Q4-2020.

On the back of strong demand and positive industry tailwinds, SunPower’s Q1 residential bookings climbed 30% year over year.

“Overall, we executed well in the first quarter as we met our key financial metrics, increased our gross margin by 660 basis points year-over-year and improved linearity compared to prior years,” said Manavendra Sial, SunPower’s CFO. The company also generated positive cash flow at the business unit level, and repaid its $30 million, 8.5% fixed-interest loan with the California Enterprise Development Authority.

The company reported that its first quarter non-GAAP results excluded net adjustments that, in the aggregate, decreased GAAP loss by $57.6 million, including $44.7 million related to a mark-to-market loss on equity investments, $7.1 million related to results of operations of legacy business to be exited, $5.0 million related to stock-based compensation expense, $5.2 million related to litigation costs, $3.8 million related to restructuring charges, and $1.0 million related to business reorganization costs.

This was partially offset by $5.4 million gain on sale and impairment of residential lease assets and $3.8 million for income taxes and other non-recurring items.

This was partially offset by $5.4 million gain on sale and impairment of residential lease assets and $3.8 million for income taxes and other non-recurring items.

In January, Sunpower said it would close its module plant in Hillsboro, Oregon, which it had acquired from Solarworld Americas in October 2018. Sunpower started production of its P-series modules at the facility in February 2019 but at the end of that year decided to transform itself from a PV manufacturer into a provider of rooftop arrays and storage systems. As part of the plan, it outsourced its production to Maxeon Solar Technologies, which now operates as an independent company.

The company said its first quarter gross margin for the quarter was 22%, up more than 700 basis points from a year earlier. The company said it benefited from stable pricing, efforts to lower its cost of capital, and an ongoing shift to higher-margin loan and lease sales and full system sales. Those sales made up around 55% of residential installations for the quarter.

It said that as more than 70% of consumers are opting for system ownership, loan options that lower the monthly cost of solar will “continue to be an important differentiator.”

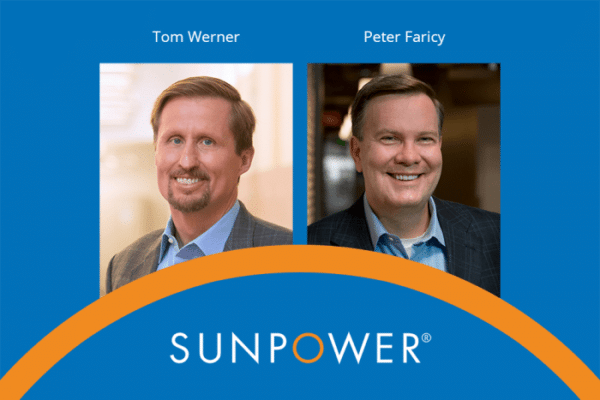

For Q2, SunPower said it expects residential and light commercial volume growth of 20% sequentially and over 50% higher versus the prior year, said Peter Faricy, SunPower’s newly installed CEO.

Solar-plus-storage

Faricy, who formerly served as CEO of global direct-to-customer for Discovery, Inc and as a vice president leading Amazon Marketplace, joined SunPower in late March. He replaced Tom Werner, who announced his retirement after 18 years with the company.

During the earning call Werner, who will serve as chair of SunPower’s board of directors for the next six months, also flagged solar-plus-storage and standalone storage as strong growth areas.

Over the last two years, SunPower has changed from a vertically integrated global solar provider to a distributed generation solutions company. Against that backdrop, Werner said that SunPower is exploring how to expand its current distributed generation market through storage and services while also addressing market segments like multifamily and affordable housing.

SunPower is also exploring partnerships to expand its reach to a wider dealer network. The hope is that this will enable the company to lower its customer acquisition costs while offering the potential to expand into adjacent markets. One thing that the company is trying to do is “blend together” its dealer network and, where it makes sense, its direct to customer activities, Faricy said.

At the end of the day, the overarching aim is to make solar, storage and EV charging easier for customers, to improve reliability, and to help people save money, Werner said.

Pivotal time on the policy front

SunPower sees an opportunity in the Biden administrations plan to buy clean energy for federal buildings as well as solar adoption in school districts. The company said it has installed more than 150 MW of capacity at almost 40 school districts in the U.S.

SunPower also considers itself well positioned for a standalone storage investment tax credit, given its roughly 3 GW installed base in the residential and commercial space, Faricy said. “Potential refundability will help our light commercial business,” he said.

According to SunPower, demand for its SunVault residential and light commercial storage solution remained high in the first quarter. SunVault experienced strong bookings momentum, but its pace of install fell behind the company’s plans.

“Our storage plan always included a strong second half ramp,” said Norm Taffe, executive vice president. He said the company remains hopeful that it can attain its 2021 goals. SunPower said that it expects lead times to come in closer to expected levels by the end of the second quarter.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.