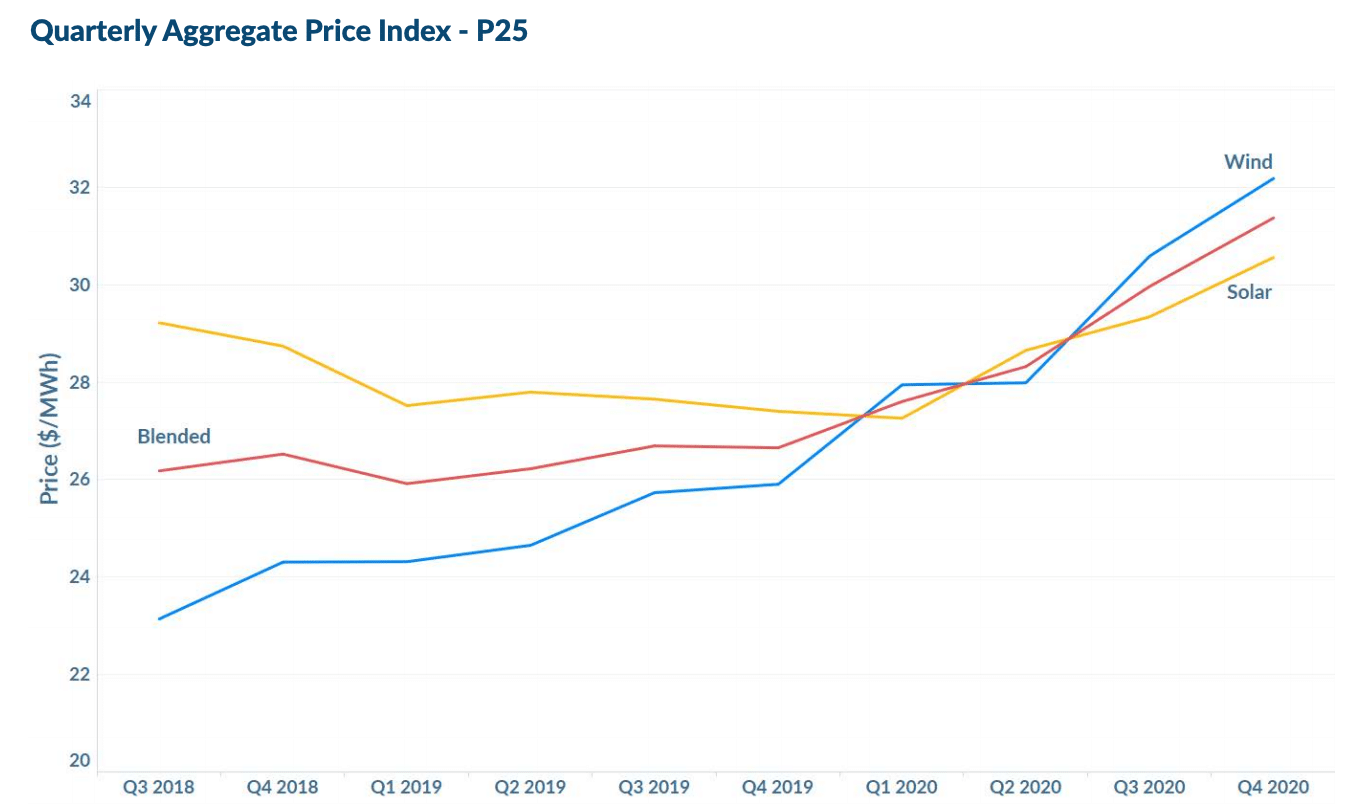

For the first time since LevelTen Energy began reporting on PPA prices in Q2 2018, solar PPA offer prices rose in 2020, with Q4 2020 prices being 11.5% higher than in Q4 2019, for an average price of $30.56 per MWh.

Broken down by Independent System Operator, PJM experienced the highest prices, averaging $37.5/MWh. That was followed by MISO at $33.7/MWh, SPP at $30.5/MWh, ERCOT at $26.7/MWh and CAISO at $25.1/MWh.

The rise began at the start of 2020, around the same time as the Covid-19 pandemic began to spread internationally. But the virus was not the only factor that drove the rise, according to LevelTen.

Image: LevelTen Energy

“In addition to disruptions caused by COVID, grid connection delays and permitting challenges have created a bottleneck for projects in areas where demand is high, creating supply constraints that have put upward pressure on prices,” said Rob Collier, vice president of Developer Relations. He said that many of the most economically competitive projects have already contracted with offtakers, leaving higher-priced projects available in the market.

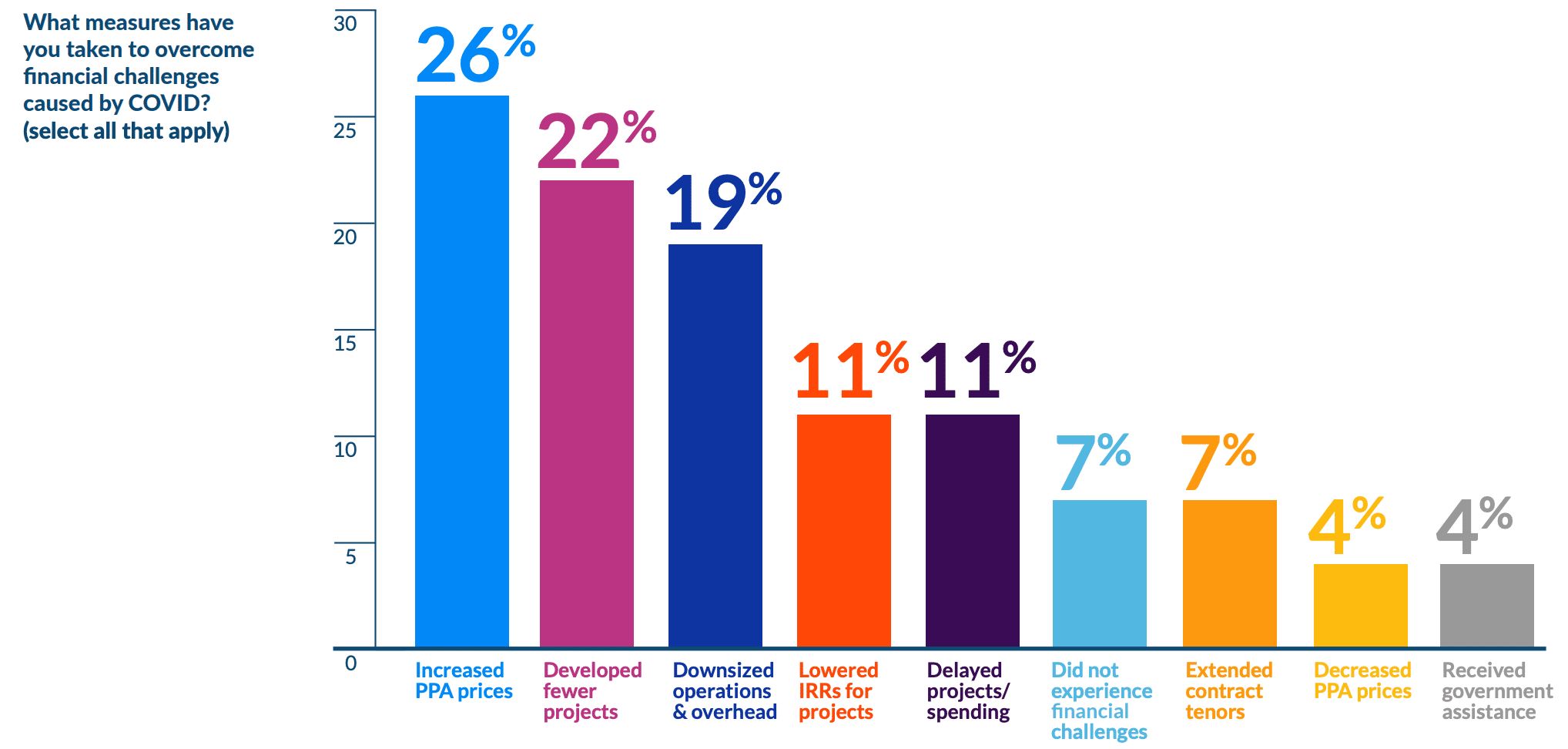

Developers with projects on the LevelTen Marketplace sang a similar tune. A survey conducted by LevelTen found that 74% didn’t choose to increase PPA prices to overcome challenges caused by COVID. Only 22% developed fewer projects, which would reduce the competition that put downward pressure on prices throughout 2019.

Image: LevelTen Energy

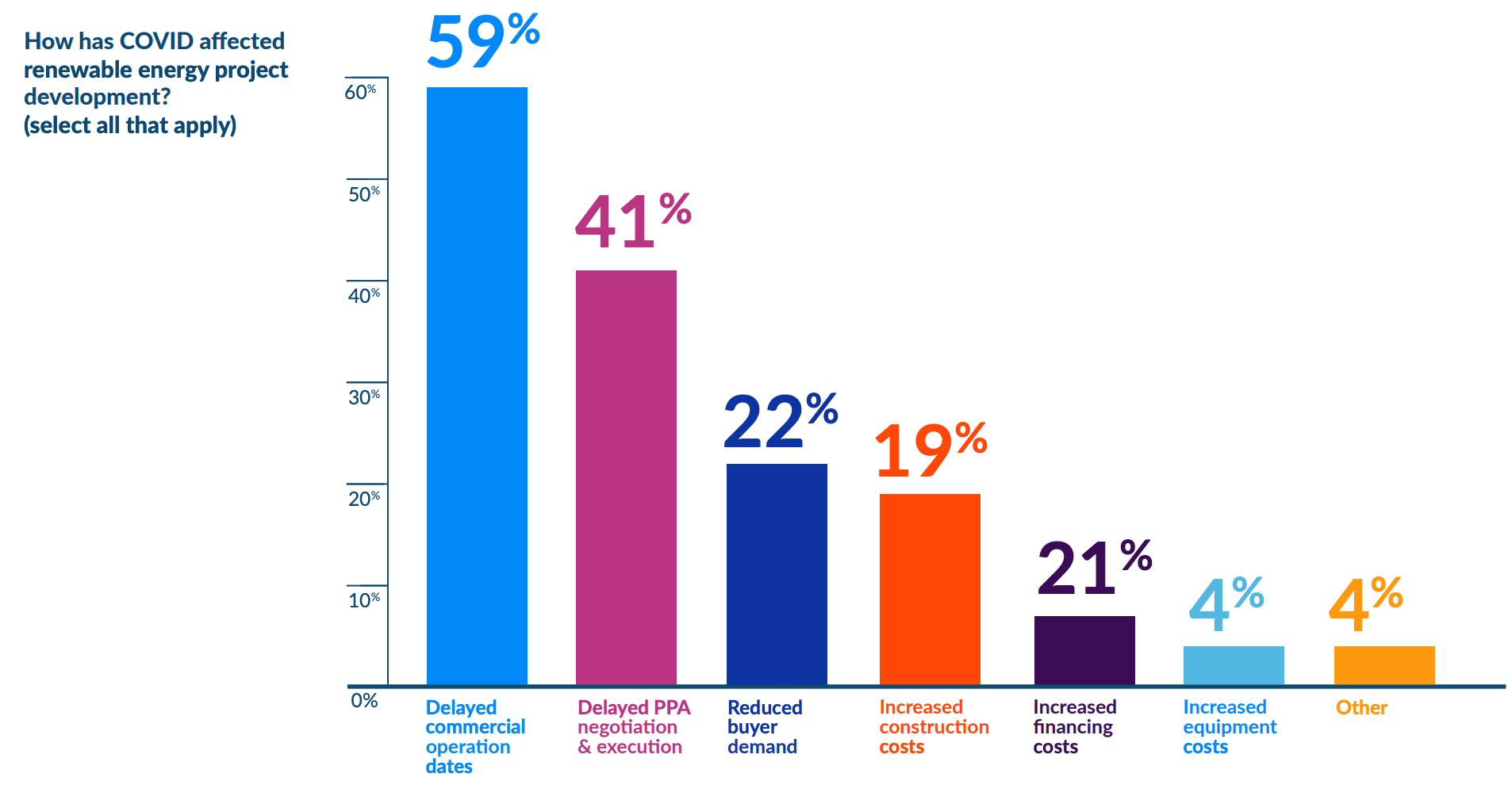

The only effect attributable directly to the pandemic was on renewable energy project timelines. In that same survey, 59% of respondents said COVID delayed commercial operations dates, and 41% said they delayed PPA negotiations and executions.

Collier commented on this as well, saying that some deals took a little longer than anticipated: procurement and finance teams were “understandably focused on other priorities when shutdowns began. But as the world adjusted to a new normal, renewable energy transactions picked back up. He said the firm does not expect the rising prices to soften demand in 2021, as boards of directors, investors, governments, employees and consumers will continue to push for sustainability commitments that will “require all large energy consumers to turn toward renewables.”

Overall, the number of PPA offers on the LevelTen Marketplace continued to grow in 2020, surpassing the number of U.S. offers available in 2019 by over 50%, showing that, in spite of rising prices, the market is still healthy and viable.

Eyes on 2021

Because of the overall health of the market and the reality that large corporations are still pushing sustainability commitments that will require all large energy consumers to turn toward renewables, LevelTen expects that there will still be heavy demand, as these customers see PPAs as an economically attractive and proven way to achieve renewable energy targets.

The report also highlights a desire to “build back better,” a term coined by BlackRock CEO Larry Fink, where companies that faced hardships in 2021 will look to rebuild their businesses for long-term sustainability and value creation.

Corporations aren’t the only buyers, however, and many municipalities, states and government agencies will look to stimulate their economy in a sustainable way, which LevelTen predicts will create more political will to spend on renewables. This will will be bolstered by the incoming pro-renewable administration and congress.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.