Mercom Capital’s report, Q1 2020 Funding and M&A Report for Storage, Grid & Efficiency, monitors the amount of venture capital funding received by battery storage, smart grid, and energy efficiency companies to start the year.

In Q1, total corporate funding for battery storage was $244 million across nine deals, significantly lower than the $635 million across 10 deals in Q4 2019, but 88% higher than the amount of funding raised in Q1 2019.

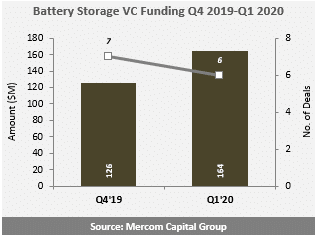

When looking strictly at VC funding, storage companies raised $164 million across six deals, which is up from Q4 2019’s $126 million across seven deals and Q1 2019’s mark of $78 million across seven deals.

Leading the industry in Q1 came Demand Power, which raised $71 million from Star America; Highview Power raised $46 million from Sumitomo Heavy Industries; Advano raised $19 million from Mitsui Kinzoku SBI Material Innovation Fund, Future Shape, PeopleFund, Thiel Capital, DCVC and Y Combinator; ZincFive raised $13 million from 40 North Ventures and TWAICE raised $12 million from Creandum.

Highview Power, you may remember, announced in December plans to develop the United States’ first long-duration, liquid-air energy storage system. Set to be located in northern Vermont, the system is sized at a minimum of 50 MW, with more than eight hours of storage for over 400 MWh.

The $164 million in VC funding raised by storage companies drove Q1’s total investment figures. Smart grid companies raised $81 million in Q1, while energy efficiency companies raised $7 million. This combined figure of $252 million in VC funding raised is up 20% from Q1 2019’s mark of $210 million.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.