On July 4, this pv magazine USA author gave you their philosophies on why distributed solar power, in the hands of individual, parallels the political ideology of the United States – and the structure of the way the universe runs. As such, you ought term me generally bullish and optimistic on this topic.

Analyst Philip Shen, of Roth Capital Partners, has noted in his most recent Solar Snapshot newsletter, that the Roth expects to see residential solar power demand growing 25% in both 2019 and 2020. Shen says that interviews with significant suppliers suggests growth greater than 25%, while interviews with executives while at Solar Power International had him hearing that their estimations are conservative and that 30-50% growth is not out of question.

The group says third party ownership companies are beginning to “panic” at keeping up with the customer demand. Keeping up with demand becomes a challenge due to ongoing labor shortages for installation crews – which Roth says will continue, module constraints, the ongoing California wildfires which have shut off electricity to hundreds of thousands, as well the looming California home solar power mandate.

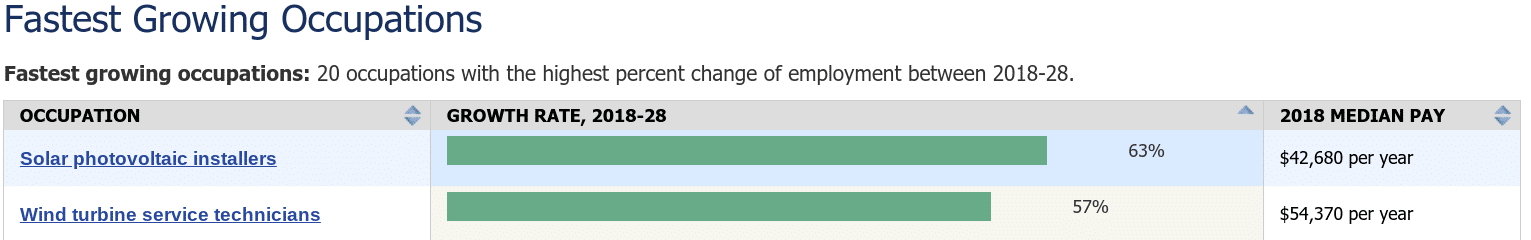

As has been the case many of the past years, the U.S. Department of Labor published that solar power installers is projected to be the fastest growing occupation from 2018-2028 (above image).

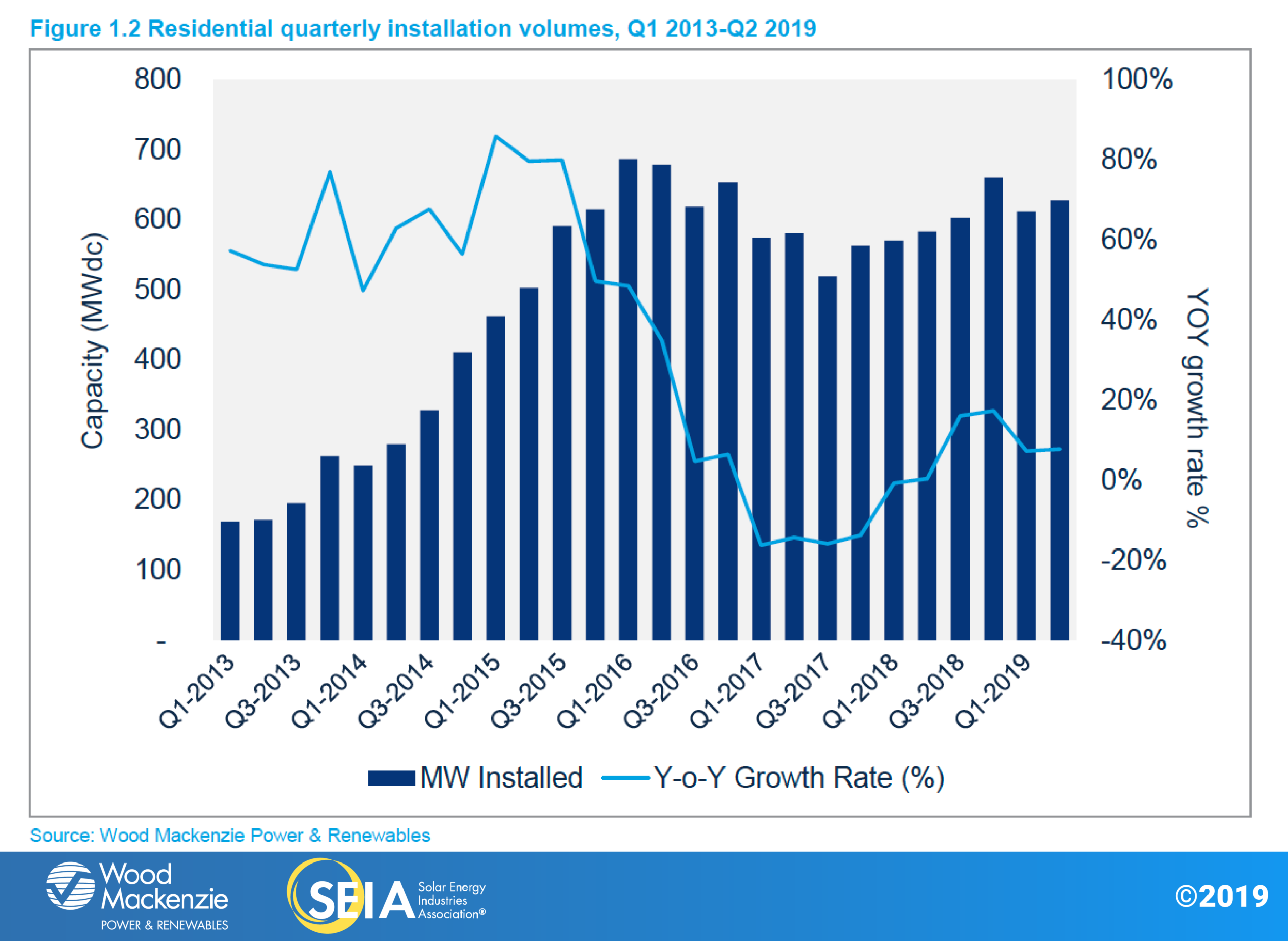

Per the Solar Market Insight Report 2019 Q3 (image below), residential solar power has grown 7% so far this year versus 2018, having installed 628 MWdc as of the end of Q2’19.

However, forward looking projections from two of the inverter and power electronics makers with the largest share of this market suggest much more growth is coming. SolarEdge’s CEO Guy Sella, on the company’s Q3 earning call in September, stated high confidence in the company’s very strong Q3 guidance of 67% to 74% growth year over year. When an analyst asked where they expected that growth to come from, it was said the US’s 3rd/4th quarter growth was a driver of that number – and that their backlog, in September, was well into the 4th quarter already. Enphase also projects growth in the U.S. market in Q3/Q4, however they’ve been supply constrained for over a year already and the company has been sold out for months ahead starting in Q2/Q3 of 2018.

Roth also sees California having a big effect – via both the wildfires shutting down up to 800,000 households and greater than 2.5 million people, as well the residential solar rooftop mandate that starts in less than three months. Specifically, they suggest that third party ownership companies like Sunrun, Sunnova, and Vivint that have energy storage solution that can offer protection from these shutdowns will benefit in an outsized manner.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Not surprising since the federal tax credit start going down in 2021 and subsequent years, sans future extension.