Intersect Power says that it has reached late-stage development for five utility-scale solar projects across Texas and California, with a combined capacity of 1.7 GWdc. Additionally, all of the projects are considered “shovel ready” and will look to begin construction within the next year, give or take a couple weeks.

That means contracts have been signed – and indeed they have, with customers ranging from local utilities and other wholesale energy buyers under power purchase agreements (PPAs) ranging from 10 to 15 years. In addition to the PPAs, one holds a contract for renewable energy certificates but a hedge with a bank for the power sold instead of a PPA for energy.

This is at least third project with a hedge instead of a PPA that pv magazine has seen in the Texas market. And given that shorter PPAs mean a longer “merchant tail”, this further supports a move towards merchant power. While it really doesn’t happen in the rest of the country, we saw Duke Energy Renewables acquire the 200 MW Holstein project which holds a 12-year hedge agreement with a subsidiary of Goldman Sachs, with the Misae 1 solar project in Childress County, Texas also holding a hedge but no PPA.

So what doe we know about the projects so far? Well we can start with location. All of the projects are located in either Texas or California and are at least 250 MWdc in capacity:

- Juno, Borden County, TX: 425 MWdc; scheduled to begin construction February 2020.

- Titan, Culberson County, TX: 375 MWdc; scheduled to begin construction March 2020.

- Aragorn, Culberson Country, TX: 250 MWdc; scheduled to begin construction June 2020.

- Athos I, Riverside County, CA: 350 MWdc; scheduled to begin construction June 2020.

- Athos II, Riverside County, CA: 300 MWdc; scheduled to begin construction October 2020.

We also know the components that will be used in the project and who is providing the engineering, procurement and construction (EPC) services. First Solar will supply the modules, more than 3.7 million Series 6 thin-film modules over the course of a multi-year deal, to be specific, while NEXTracker will provide its NX HorizonTM solar trackers equipped with TrueCaptureTM intelligent control software. In terms of the EPC, that job goes to Signal Energy. There is no indication yet that any of the projects will be paired with any sort of energy storage.

According to Georges Antoun, chief commercial officer of First Solar, the 3.7 million panels headed to these projects represent the largest order to date for the Series 6 modules.

This big, happy, family of projects are estimated to power the equivalent of nearly 357,000 homes and result in some 2.75 million tons of avoided CO2 emissions per year. The projects are all located on former agricultural and grazing lands, which leads to the question of if the projects will partner with any sheep grazing services to keep local vegetation under control.

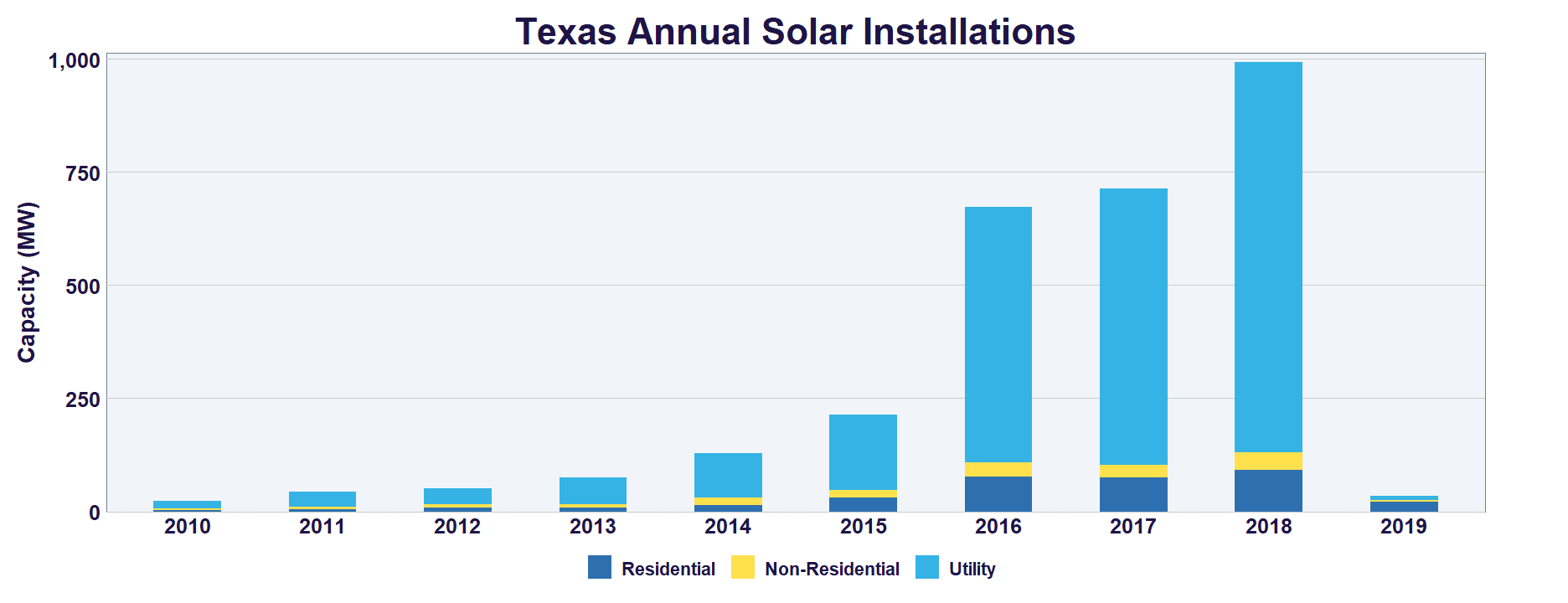

While 650 MWdc in California is still a wildly impressive level of development, this announcement of 1.05 GWdc headed to Texas is one of the more impressive developments in the explosion that is the Texas utility-scale solar market. This notion is supported by the fact that the three projects themselves are equivalent to roughly a third of all the solar installed in Texas to date. That number is going to keep multiplying rapidly, as the vast majority of Texas’ solar installations have come in the last three years.

Image: Seia

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Way too much, 20% too much generation to make Merchant spot work again.

It killed 3 nukes, much coal already and still way too much generation that some NG is closing and peakers are no longer viable.

With NGCCGTs that can vary output, cuts peak demand.

So just when are they going to sell Merchant power? The few peak hours in Texas is just too few and 95% of the time there is too much generation.

Solar will be running the peak out of the afternoon for a duck curve into late evening again cutting peak rates, time needed, just like in

California.

So a spot solar merchant just doesn’t seem to have much of a future.

Did you not see the system will have trackers? Your argument may hold for fixed array systems but tracking changes the equation from “few peak hours” to reliable 8 – 10 hour windows, particularly if the systems are spread geographically to avoid localized weather events.

Nice. I am hoping that 2019 solar install shoots up past 1GW by the end of the year.