When certain commodities hit their apex in popularity, it’s often harder to find a consumer that doesn’t own the product than one who does. Adidas Ultraboosts, Apple Airpods, Kombucha, to the average consumer, these products are mandatory for social relevance.

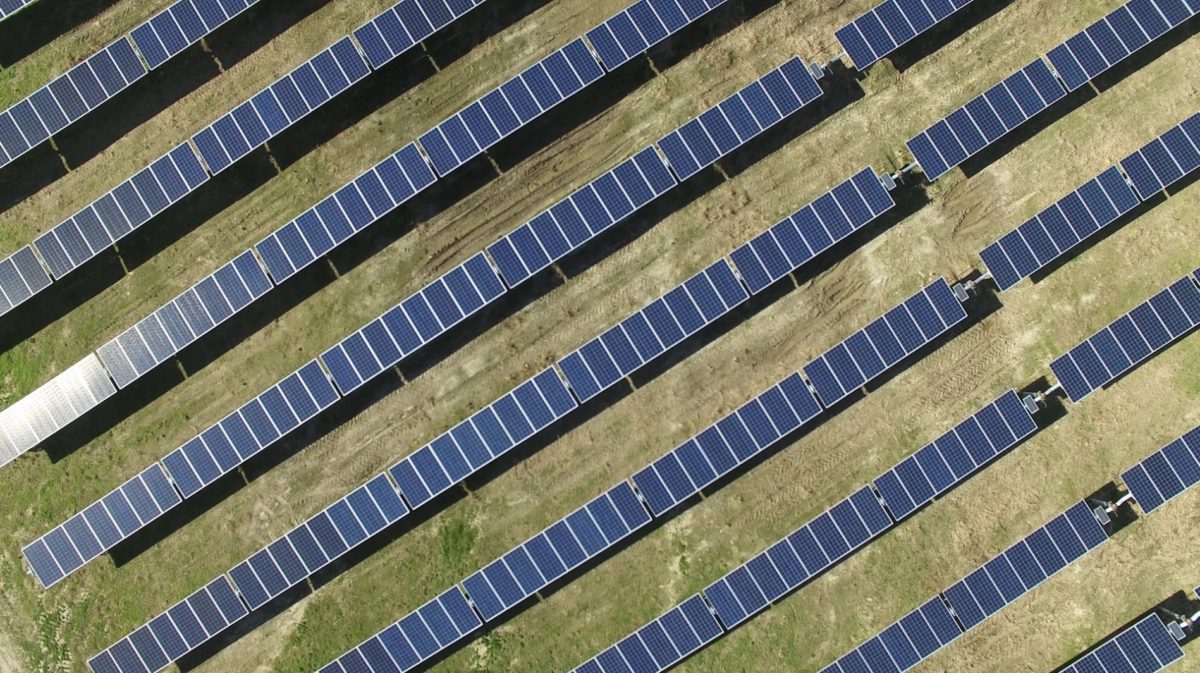

However when we look at corporations; deeper pocket buyers looking for sound investments in the future rather than spur-of-the-moment trends, we see one commodity has skyrocketed to this mandatory apex: renewable energy. Bloomberg New Energy Finance (BNEF) has released the 2H 2019 Corporate Energy Market Outlook, which shows that corporations are flooding to sign renewable energy purchase contracts like never before, making 2019 an unprecedented year for clean energy investment.

BNEF has found that through the end of July 2019, corporations have signed contracts to purchase 8.6 GW of wind and solar, which is up from 7.2 GW through the same point last year. Focusing on just the United States, U.S. companies have purchased 5.95GW of renewable energy this year to date, which nearly matches the entire 2018 purchase figure.

In fact, the only downward trend in the world of corporate renewable purchases has come from green tariffs with regulated utilities. These deals have accounted for 1 GW through seven months, well behind pace for the 2.6 GW purchased in 2018. However this is not a sign of weakness in the future of the market, but rather a shift in the preferences of buyers.

The void left by decreasing green tariff deals has been filled by virtual power purchase agreements (virtual PPA) . Virtual PPAs have accounted for 82% of all U.S. deals so far through 2019.

Oh, and special recognition should be given to Texas. The Lone Star State has become the de facto home of U.S. corporate renewable deals, with 40% of all activity ion this sector coming through Texas in 2019. Texas is a sunny state, that sun leads to peak pricing during the summer. While you don’t have to be an investment genius to realize the economic potential of that correlation, the actual investment geniuses have, hence the strength of the Texas corporate solar market.

And with all this talk of corporations buying renewables, naturally what comes to mind is the flow of large corporations moving to be powered by 100% renewable energy. The RE100 is a global corporate leadership initiative which, along with other functions, tracks how many corporations have made that 100% commitment. Through July, 33 new companies joined the RE100, bringing the grand total to 191 companies. However the progression towards all of these corporations going 100% renewable by 2050 at the latest has stagnated. In fact, the 7.8TWh of clean electricity deals signed by existing members in 2019 outpaces the combined procurement of the 33 new members. In all, the initiative is facing a shortfall of 189TWh in progress by 2030.

If you needed any other reason to root for these companies to overtake that shortfall and meet their goals, just know that BNEF predicts that overcoming the shortfall would lead to 94GW of renewables build, and $97 billion in new investment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.