Puerto Rico is an island that is very much in the process of transition, and this applies as much to its electricity sector as anything. After Hurricane Maria, the island has not only had to rebuild its power grid and restore power, but has done so with a heavily indebted public utility that has been the center of corruption scandals.

The island’s political leaders have also put it on a path to 100% renewable electricity by 2050. And oh yes – they are doing all of this with a population that has shrunk by 4% since Hurricane Maria hit.

As you can imagine, the process of long-term planning at the Puerto Rico Electric Power Authority (PREPA – the aforementioned public utility) has been nothing if not complicated. In February PREPA put out a draft Integrated Resource Plan (IRP) written by Siemens, but this was rejected because – among other deficiencies – it did not plan for the move to 100% renewable energy that was being considered when it was issued and passed the legislature in March.

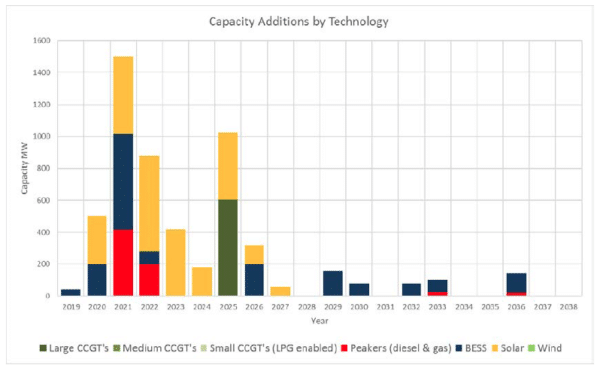

Now PREPA has returned with a new, beefed up IRP. This third draft nearly triples the amount of solar it will deploy to 2.2 GW by 2025, as well as planning to install an unprecedented 920 MW of batteries in that timeframe.

But other than these larger numbers, the new IRP looks a lot like the one that PREPA put out in February.

LNG-fired mini-grids

The new IRP still plans to split the island into eight “mini-grids” in an effort to isolate sections of the island in the event that electricity is interrupted by another major hurricane or other natural disaster.

These minigrids would be powered by a combination of solar and new fossil fuel resources, with a big emphasis on liquefied natural gas (LNG). The various scenarios in PREPA’s new IRP go into a lot of detail about which projects would be shut down and which left on, but the gist is the same in that it proposes shutting down a bunch of older oil-fired units and build a large capacity of natural gas-fired power plants.

As a central feature, Siemens is recommending that units 5&6 of the the San Juan combined cycle plant be converted to burn natural gas, that a land-based LNG terminal in San Juan be developed to supply these units and a new combined cycle gas plant at Palo Seco, and that either a new combined cycle turbine be installed at the Costa Sur Steam Plant or that the contract with the EcoEléctrica gas plant be renegotiated.

The Energy System Modernization (ESM) plan, which is PREPA’s recommended path forward, would also see a 302 MW combined cycle gas plant at Yabucoa with ship-based LNG, the 200 MW Mayagüez peaker plant converted to ship-based LNG, and 18 individual, 23 MW “peaking” units, to replace the eighteen Frame 5 gas turbines (21 MW each) that are currently in operation. It would also feature a renegotiation of the contract for the existing EcoEléctrica gas plant.

This central role for new gas infrastructure based on LNG is similar to the previous draft IRP and is not surprising. Siemens, which wrote the IRP for PREPA, is heavily involved in the LNG business.

“As much PV as practical”

This does not mean that Siemens is ignoring solar or batteries – far from it. In the IRP the company also states that the best plan is to “maximize” the rate of solar installation for the first four years of the plan, to 2022. Siemens recommends that PERPA issue solicitations for solar PV paired (with batteries, depending on pricing) in 250 MW, so add 1.38 GW over the first four years of the plan.

While Siemens recognizes that this is “challenging” given PREPA’s current procurement and approval processes, and recommends that it streamline this process and get some help with internal capacity. Per the IRP:

The urgency of adding as much PV as practical is driven by the need to provide distributed power to critical and priority loads in the MiniGrids as soon as possible, the compelling economics of PV vs. existing fossil generation, and the pending expiration of federal investment tax credits.

Siemens is also recommending that storage be added in blocks of 150 to 200 MW, and that the solicitations for PV and storage be combined so that bidders can provide either or both, as well as extending the investment tax credit (ITC) to the battery systems.

Reliability contributions of DG again overlooked

The word “reliability” shows up dozens of times in the IRP, but the only mention that relates to behind-the-meter generation is Siemens complaining that a proliferation of rooftop and utility-scale solar are challenging the “historical centralized paradigm” of how a utility should run.

Siemens also warns that without “the proper foundation of utility-integrated energy storage and software controls, renewable energy resources could face technical and operational challenges and curtailment of highly valued carbon-free electricity could be required in order for the utility to maintain system stability and reliability”.

To Siemens’ credit, there is a mention of how investments in the distributions system will support the integration of more rooftop solar.

And while the Appendix which directly addresses Demand-Side Resources was not found in the filings available on the PREPA site, in the main document there is no mention of the significant benefits that customer-sited solar and battery storage could make to reliability of the electricity system, and also no mention of distributed energy resource management systems (DERMS) that could make this a reality.

This is in line with the previous draft IRP, which treated customer-sited solar more as an annoyance than a potential asset which could help PREPA solve its greatest problem: ensuring continued system reliability in severe weather events.

Siemens does acknowledge that falling costs for solar and storage will continue to make customers want rooftop solar, and projects that there will be a total of 1.176 GW of customer-owned generation by 2038. However, pv magazine was not able to find any estimates of projected capacities for customer-owned battery systems.

This creates the appearance that Siemens is assuming that there will be no significant volume of customer-sited energy storage, which is totally contrary to the direction of the rooftop solar market. But if you are writing an IRP to maximize LNG dependence and utility ownership of solar assets, such an assumption makes more sense.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

PREPA is the enemy of renewables. They are going to impose a tax to the sun! They are investing in gas,because they say is a renewable source.