For many years, Florida was not a leading solar market. Despite ample sunshine, a combination of restrictive structures in the states’s electricity sector and a lack of utility interest meant that the state lagged behind others like California, North Carolina and Massachusetts.

However, Florida is now making up for lost time. Led by Florida Power and Light’s (FPL) 30 x 30 program, every major utility in the state is deploying large-scale solar in its service area. And, as revealed in a report by the Smart Electric Power Association (SEPA), these numbers are starting to add up.

However, Florida is now making up for lost time. Led by Florida Power and Light’s (FPL) 30 x 30 program, every major utility in the state is deploying large-scale solar in its service area. And, as revealed in a report by the Smart Electric Power Association (SEPA), these numbers are starting to add up.

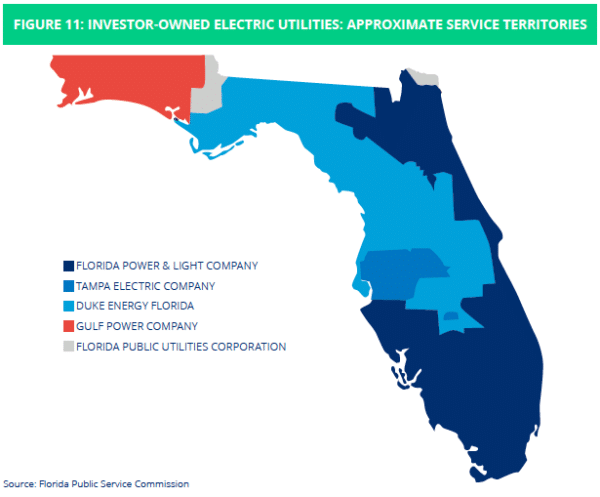

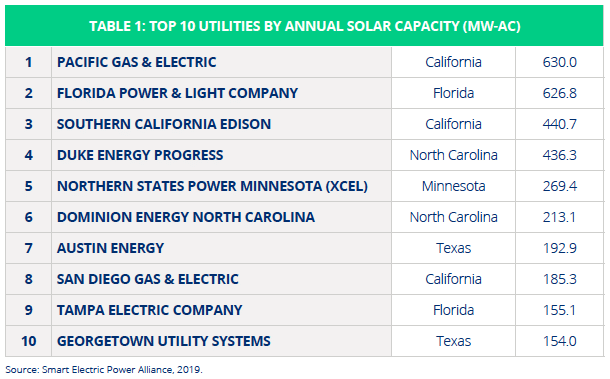

SEPA’s 2019 Utility Solar Market Snapshot shows Florida more than doubling its installed solar capacity in 2018 to nearly 1.7 GW, with FPL alone (dark blue) installing 627 MW. This was the second-highest volume of any utility in the nation after California’s Pacific Gas & Electric Company, and Tampa Electric also broke into the top 10, adding 155 MW. This is a sharp contrast to last year when no Florida utility was in the top 10 for newly installed capacity.

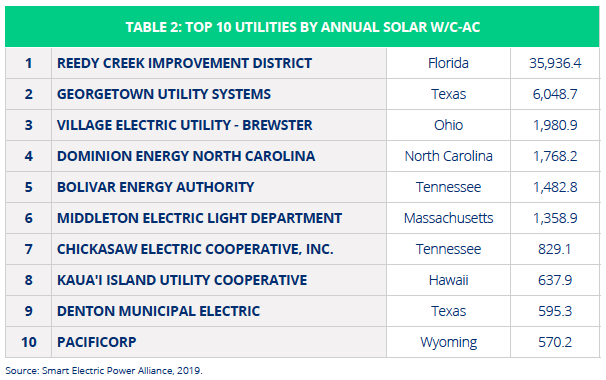

In terms of climbing the ranks, FPL has been surpassed by the Reedy Creek Improvement District, which is a semi-public utility that provides power to Disney World. Reedy Creek put a 52 MW solar plant online last year to power two theme parks, which put it to a stunning 36 kW per customer. This is five times more than any other utility in the nation, but it is unclear how many “customers” the tourist attraction claims, and if giant imaginary rodents are among them.

Nor is the development in Florida limited to large-scale solar. Despite the fierce struggle by the state’s utilities to keep their customers from installing rooftop solar, in 2018 the Sunshine State added 86 MW of residential solar, making it one of the leading markets in this segment.

Minnesota, Texas rise

While Florida (and specifically FPL) are the biggest success stories, the report also shows major progress in Minnesota and Texas. Minnesota’s 47% increase in installed capacity to 843 MW during the year was strongly driven by community solar progress in the service area of its biggest utility, Northern States Minnesota Power, a subsidiary of Xcel.

This is not to say that Xcel deserves much credit for this as this progress comes after the the utility did everything that it could to stall the state’s nationally-leading community solar program. Furthermore, the state’s community solar market is expected to slow, after a series of regulatory changes driven by Xcel. Regardless, Xcel still added the 5th-largest volume of solar of any utility in 2018 at 269 MW.

Texas was also a bright spot – or rather, its municipal utilities were. The combined 347 MW added by Austin Energy and Georgetown Utility Systems made up the majority of the 509 MW which was added in Texas last year, which increased the state’s installed capacity 39% to 1.8 GW.

But while Texas was the fourth-largest solar market over the course of 2018, this is just the beginning. Municipal utilities may have driven Texas’ solar market to date, but there is currently a much larger capacity of projects that have been approved for interconnection in the state (currently at more than 7 GW) than the munis have demand for.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Uh, Texas has more than 7GW of solar with interconnection agreements. This is up nearly 3GW from ERCOTs December 2018 GIS report. With more than 58GW of proposals. Very impressive growth rate!

Even the fossil fuel companies in Texas are buying solar.

Thank you for that update! I hadn’t checked the ERCOT queue in a while, and lo and behold, you are right: there is more than 7 GW of solar approved. I’ve edited the article to reflect this.

This should be re-titled as, “Florida Utilities Do What They Do Best and Monopolize Solar.”