Forty-four percent of electric utility executives in a global Deloitte survey said their utility would explore a distributed energy resource management (DERM) solution over the next two years. A DERM solution outranked all other digital capabilities being explored, among the 81 executives surveyed.

While U.S. utilities have so far explored DERM solutions on a pilot scale, the technology reached the major leagues with a deployment connecting 50,000 distributed solar and storage systems in Australia, using a DERM solution by PXiSE, a division of Sempra Energy.

A DERM solution enables a utility or aggregator to manage distributed energy resources (DERs), including small-scale solar and storage. DER owners are typically compensated for participating in a DERM solution.

The DERM solution in Australia is expected to engage participating DERs to help balance supply and demand in real time, and to provide the grid services of reactive power and frequency control.

Deloitte’s survey report, “Creating the utility of the future,” noted that new market entrants may use a DERM solution to aggregate output from DER owners and bid it into wholesale electricity markets.

A DERM solution, sometimes called a virtual power plant, requires a communication software platform, communication-enabled hardware, and DERs that can be remotely controlled. Vendors developing software platforms include PXiSE, GE, Hitachi, and Virtual Peaker, while a group led by the Electric Power Research Institute has developed a standard communications profile that DERs can use.

Other digital technologies that utility executives surveyed said they would explore in the next two years included the field of analytics, artificial intelligence, and machine learning (42%), cybersecurity solutions (38%), and blockchain (27%).

Separately, asked to list the top three shifts in the electricity market having the biggest impact on their business, 46% of utility executives included “influx of new solar energy,” which Deloitte’s report said “may reflect in part the impact of competition from distributed solar, and in part the impact of solar power’s variability on the grid.” Another 37% of utility executives included “new entrants in the market” as one of the top three impacts, while 21% included “influx of renewable energy from wind.”

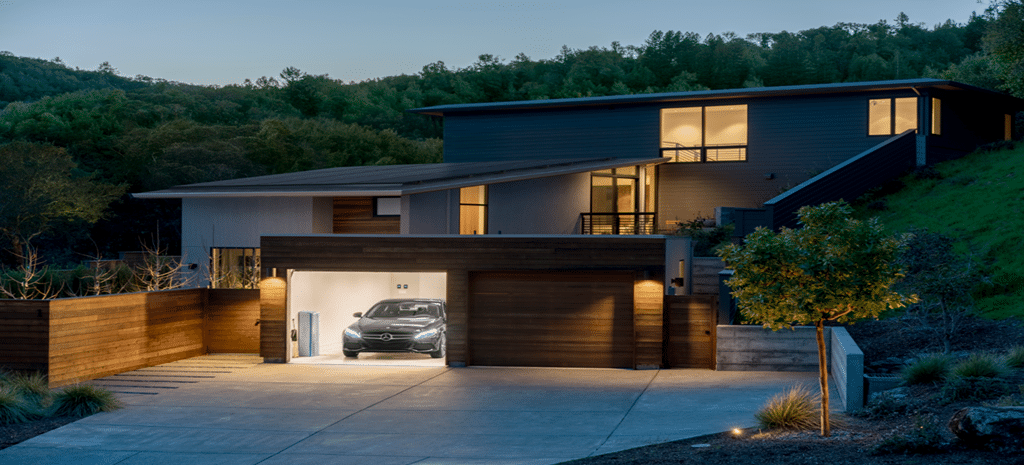

A Deloitte graphic on “The future utility customer” anticipates a “smart home platform”—including sensors, a smart meter, smart appliances, and time-of-use rates—which could help capture more value from solar and storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

These DERMs and DR are the future for Utilities and also means savings for users