The U.S. residential solar market can be difficult to pin down. Thousands of installers across the country go about their business every day in the service area of hundreds of utilities, and this affords few centralized sources of decisive data about what is happening.

And while the quarterly results of leading solar companies offer insights, these only show the biggest companies, and not the “long tail” of regional and local installers who put the majority of solar panels of the roofs of customers.

One of the few views that we have into this space is EnergySage’s semiannual Solar Marketplace Intel reports, which provide detailed information on many aspects of the residential solar market, including trends of products that are offered and sold through the company’s online solar marketplace.

High efficiency wins the day

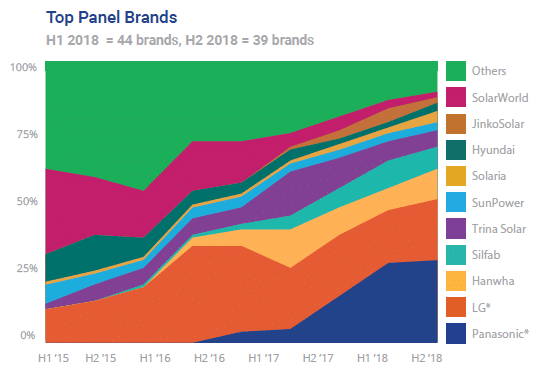

One of the trends shown again this quarter was the increasing dominance of Panasonic and LG in U.S. residential solar. Each increased their share on the marketplace by 3% during the quarter, and together their products are now featured in over half of the quotes offered in the EnergySage marketplace.

Both companies offer products with distinctly higher efficiencies than the average solar panel rolling off the assembly lines. Panasonic’s exclusive offering is its Heterojunction Intrinsic Thin Film (HIT) modules, which sandwiches a layer of crystalline silicon between two layers of amorphous silicon. This provides the extra juice push its modules to efficiencies of 19.1%- 20.1%.

Both companies offer products with distinctly higher efficiencies than the average solar panel rolling off the assembly lines. Panasonic’s exclusive offering is its Heterojunction Intrinsic Thin Film (HIT) modules, which sandwiches a layer of crystalline silicon between two layers of amorphous silicon. This provides the extra juice push its modules to efficiencies of 19.1%- 20.1%.

The majority of LG Solar modules offered on the marketplace are the company’s high-efficiency NeON2 and NeONR modules, which feature copper wire interconnection and back contact designs, respectively. Overall LG’s products fall into a similar efficiency range, spanning from 18.4% to 21.1% for its highest efficiency models.

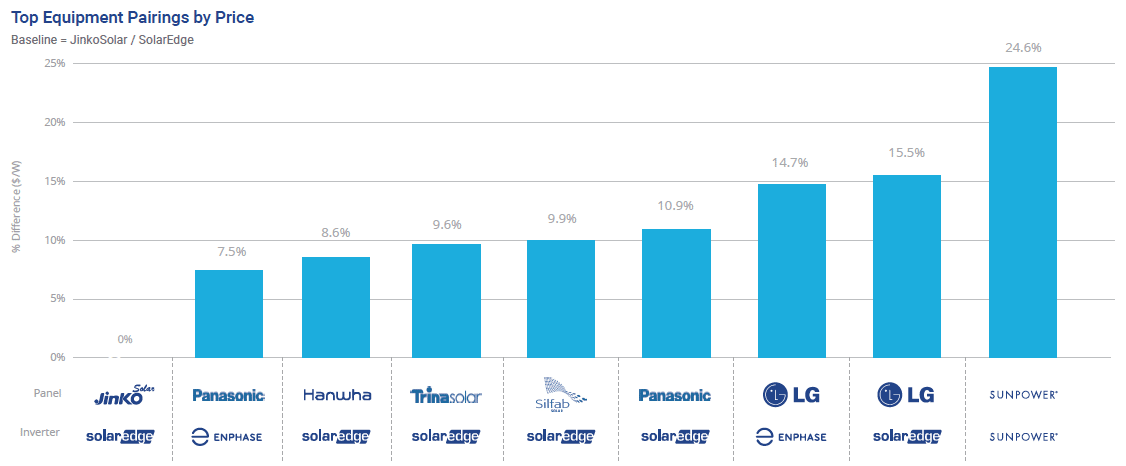

And while both Panasonic and LG products are above the average in terms of efficiency, both also command a price premium. EnergySage identifies LG products paired with either SolarEdge or Enphase inverters as some of the most expensive tandems involving common module brands.

But both Panasonic and LG also have another advantage, in that both companies offer rebates for their products used in systems sold through the EnergySage marketplace. These are the only two module brands to do this at present, which may provide an additional boost to already healthy market shares.

Less showing from SunPower

What is also notable is the relatively slim share of quotes featuring SunPower products. Despite SunPower’s installer network having a combined national residential market share second only to Sunrun, the company’s modules didn’t make much of showing in the bids sent out on the EnergySage platform.

SunPower modules are also easily the most expensive among the popular brands, and the relatively higher frequency of Panasonic and LG may point to the price competition among high-efficiency products. Another factor may be that the dealers who offer quotes involving SunPower products are also offering other products, and EnergySage notes that as many as 20% of the installers on its site offer SunPower products.

U.S. modules MIA

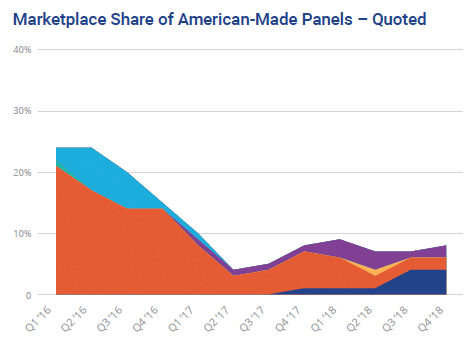

One of the conclusions made by EnergySage in its market report is that despite the imposition of Section 201 tariffs by the Trump Administration, the share of U.S. modules offered on the marketplace fell to a low of 7% during 2018.

However, to blame this entirely on the tariffs may be mistaken causation. Suniva shut down its U.S. manufacturing before the Section 201 trade case even took off in 2017, and in the aftermath of the trade case SunPower bought up SolarWorld’s U.S. factory and switched it over to its own products. Other than First Solar, whose products are used almost exclusively in large solar farms, these were the two largest U.S. module makers.

However, to blame this entirely on the tariffs may be mistaken causation. Suniva shut down its U.S. manufacturing before the Section 201 trade case even took off in 2017, and in the aftermath of the trade case SunPower bought up SolarWorld’s U.S. factory and switched it over to its own products. Other than First Solar, whose products are used almost exclusively in large solar farms, these were the two largest U.S. module makers.

In fact, between the shutdown of SolarWorld and the ramping of the JinkoSolar and Hanwha Q Cells factories, which are currently underway, First Solar has been the only module maker with an annual manufacturing capacity in the United States in excess of 200 MW.

So the actual story may simply be that there aren’t that many U.S.-made modules available – at least until the four large factories currently underway ramp.

Enphase wins back market share

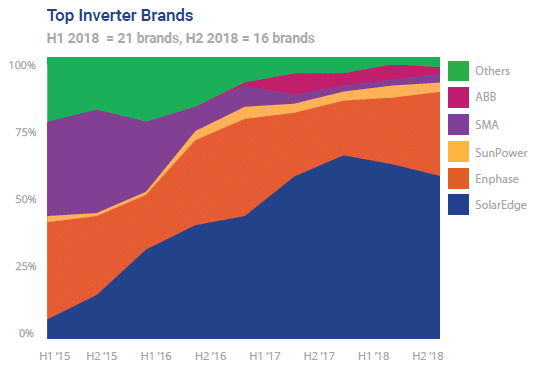

Another story told by EnergySage’s market data is the revival of Enphase. Enphase had claimed a significant portion of the U.S. residential inverter market by 2013, but as early as 2014 was beginning to lose market share in California while SolarEdge grew its presence every year, a trend that continued at least through 2017, when it surpassed Enphase in that market.

Enphase had to do something, and embarked on a severe three year restructuring, went through a few CEOs, and cut the price of its products to below the cost of production while it brought costs down. These were extreme and frankly risky moves, but at the end of it Enphase has returned to profitability, and if the EnergySage market place is indicative of larger trends, it may even be regaining market share in the United States, as Enphase shows gains in both the first and second half of 2018.

Enphase had to do something, and embarked on a severe three year restructuring, went through a few CEOs, and cut the price of its products to below the cost of production while it brought costs down. These were extreme and frankly risky moves, but at the end of it Enphase has returned to profitability, and if the EnergySage market place is indicative of larger trends, it may even be regaining market share in the United States, as Enphase shows gains in both the first and second half of 2018.

Given that these two brands have come to dominate the bids put out through the marketplace, Enphase’s gain has been SolarEdge’s loss – again, at least on the EnergySage marketplace. Not that SolarEdge is exactly hurting for business, as the company has made increasing inroads into the commercial and industrial market.

Bigger systems, lower prices

The larger, slower takeaway from EnergySage’s Market Intel report is that prices for residential solar continue to fall, with system prices falling 2.2% from the first to the second half of 2018, to land at only $3.05 per watt. Prices have been falling every half-year since EnergySage began the report in the second half of 2014, though this price decline slowed from the second half of 2017 to the first half fo 2018 when the Section 201 tariffs hit.

And as this happens, systems are getting larger. The average capacity of a PV system sold through the EnergySage platform increased from 8.9 kW in the first half of 2018 to 9.6 kW in the second half of the year, with these systems offsetting an average of 94% of customer use.

It’s important not to draw too many conclusions from the EnergySage Marketplace Intel report, as the PV systems sold through EnergySage represent only 3-4% of the total sold in the United States last year. However this portion is growing, with the company’s triple-digit annual growth well exceeding the larger residential solar market.

And as EnergySage grows, they will have more information to share.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I just installed 39 Neon2 330 panels with the IQ6+ enphase inverters myself August 2018. By self installing I was able to buy the best premium equipment on the market rather than some cheap crap. The LG panels look better as well.

I looked into Sunpower but the problem is they do not sell to the public so this was automatically not a choice for me. Their products do look great though and they really should consider opening their product to the DIY market as this will continue to grow as people realize how easy it is.

So my system is 12870 DC and 11310 AC max output but probably more like 10900 at the main panel after loses. So DC cost is $1.55 per watt installed after tax credit and $2.33 before.

I also built a huge structure to install the panels on included in the cost. The system was only actually about $23k before the tax credit. So really it could have been $1.25/watt if it was installed on the roof.

The more interesting math is the lifetime cost per kWh. Figure on average my system will produce 18,000 kWh per year over 30 years at least for a total of 540,000 kWh. This works out to about 3.7 cents per kWh compared to my current average of about 11 cents from the utility. I would bet this rate will increase over the next 30 years so the rate variance will increase over time.

I think it is a pretty good form of diversification in my investment portfolio and a really fun conversation piece as well.

That’s great! Although I wonder how many homeowners have the requisite level of technical expertise to install their own PV system. I personally don’t endorse anyone installing PV who is not a licensed electrician, or at least is not working with a licensed electrician.

I installed my system consisting of 36 Panasonic panels and Solar Edge inverters in June 2018. I handled all the installation myself with the exception of hiring a licensed electrician for a few hours to assist with a couple of connections and to ensure everything I was doing was up to code. My payback will be just over 8 years with the tax credit. I had the same philosophy as Chris….to keep my costs under control I would install the unit myself and purchase the best quality products. For the long run it will be a great investment and I have been extremely satisfied so far.

I just was talking to my barista at starbucks this morning and an employee there is doing her own system soon as well. I hope to be able to advise her a bit along the way.

The DIY solar network is a force for sure.

My utility required me to have a permit pulled by a licensed electrician. After working with him to wire things up I was able to see how simple it is with the micros. Definitely a good idea to have someone with years of experience look everything over for a small fee.

I may go negative this billing cycle.

https://enlighten.enphaseenergy.com/pv/public_systems/fNDA1422112/graph