Corporate renewables purchases have driven 12% of all utility-scale solar and wind installed nationwide, yet looking ahead, corporations that buy solar or wind power under a long-term fixed-price agreement could experience “significant financial downside,” the Rocky Mountain Institute (RMI) cautions in a marketing document for its Business Renewables Center.

Corporations could consider financial hedges, as RMI advises, for the price risk associated with off-site renewables purchases. Corporations could also specify that solar generating plants include storage, while states could act to increase electricity consumption during solar generation hours.

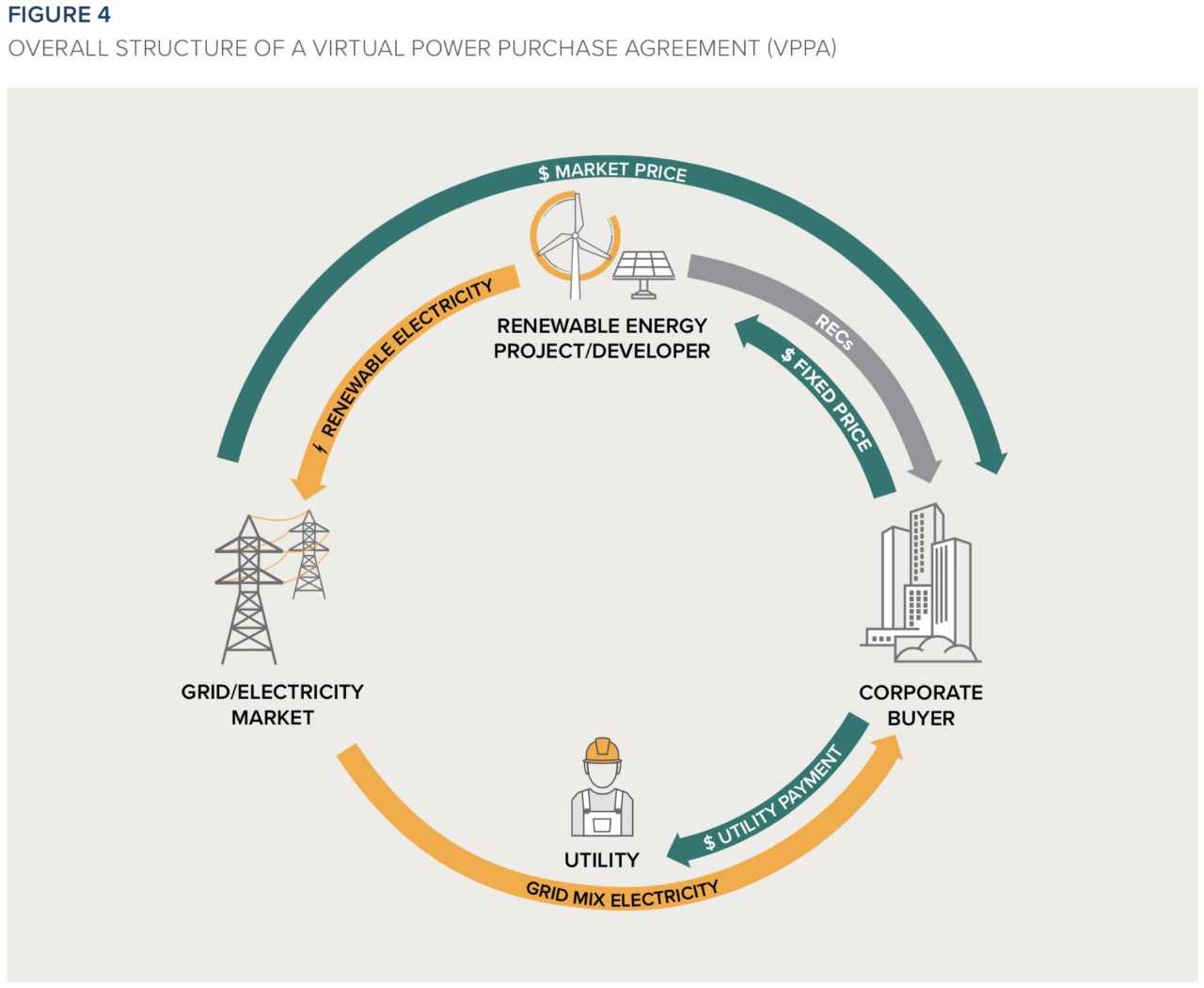

About three-quarters of corporate off-site renewables procurements involve a long-term power purchase agreement (PPA) that is offset by the sale of power at varying wholesale rates. These agreements are known as virtual or financial PPAs, to distinguish them from on-site, behind-the-meter PPAs.

The price risk arises from the mismatch between paying a fixed price for solar electricity over 10-20 years, and receiving an offsetting but continually varying wholesale price for the solar electricity sold onto the grid. This arrangement is illustrated in the RMI graphic below:

Price risk is primarily driven by the dynamics of supply and demand. As more solar is added to the grid, the wholesale market price of electricity will fall during peak solar generation hours, unless there is a corresponding increase in demand during those hours.

More solar on the grid could be expected if solar costs decline over time, said Rachit Kansal of RMI, “which means that generators will bid in at lower prices, which could lead to a longer-term trend toward decreasing prices.” Mr. Kansal co-authored a proprietary RMI report, Corporate Purchaser’s Guide to Risk Mitigation.

More solar on the grid would also be expected as states raise their renewable portfolio standards.

Price risk could be mitigated by a financial hedge, as suggested in the RMI marketing document. Texas solar developer Miguel Oneto, for example, has used a financial hedge from Goldman Sachs.

Or a corporation could enter a virtual PPA that combines solar with storage, to store some solar power for later sale when wholesale prices may be higher. As an example, Recurrent Energy has signed a virtual PPA for 150 MWac of solar and 180 MWh of battery storage, with two community choice aggregators in California as the offtakers.

The price risk would also be mitigated if demand were to increase during solar generation hours—e.g., due to additional storage on the grid to absorb solar power; or widespread daytime charging of electric vehicles; or real-time (dynamic) pricing of electricity. California regulators are reviewing a proposal to allow utility customers the option to choose real-time pricing of electricity, which would shift some demand to times with low wholesale prices.

While such demand increases are possible, their likelihood, magnitude, and profile during peak solar hours are currently unpredictable.

The RMI document mentions four other types of risk beyond price risk:

- Basis risk, whereby the wholesale prices a corporation receives from selling renewable electricity may decline more than the retail prices a corporation pays a utility for electricity,

- Shape risk, which relates to the uncertain profile of a solar power plant’s generation over time, and how that generation will match up with the profile of wholesale prices,

- Volume risk, the uncertain total amount of solar generation over a year, and

- Operational risk, which is the risk of a solar or wind plant’s operational downtime or under-performance.

RMI suggests the following measures to mitigate the five types of risk:

RMI’s Business Renewables Center is a “membership platform that streamlines and accelerates corporate purchasing of off-site, large-scale wind and solar energy,” according to an RMI web page.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Even 20 years is a short time in the energy market.

The majority of buyers are highly capitalized with assets and businesses tied to energy only by growing demand.

A big shift in government policy might impact the value/cost, but the bigger the disruption, the greater and broader the political pushback, making such changes unlikely.

And no one is ignorant of the growing need to match generation with demand, but the growing difference in prices for solar and wind vs fossil fuels is driving investments in storage. Higher investments in fixed storage will finally fund deploying new unproven storage technologies that today are seen as too risky. Using Lion for grid storage was seen as too risky 5 years ago. No longer.

Bufford, are you saying that shutting down the 0.2% of California energy being generated by Californian coal is going to impact our utility rates?