Making high-efficiency solar at scale is a hard game, a game that has bested more than a fair share of companies. And while SunPower has managed to scale to one of the world’s largest PV makers on the back on of its Maxeon Interdigitated Back Contact (IBC) solar cells – the highest-efficiency solar products available on the mass market – the company has struggled for years to gain profitability.

Today, SunPower took a major step towards reimagining its business with the launch of its A-Series PV modules, the first product to incorporate its New Generation Technology (NGT) cells in the U.S. market.

Graphic: EnergySage

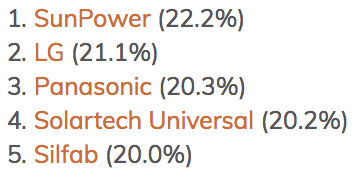

Like Maxeon, NGT is a IBC product, with layers of copper and aluminum that extract electricity off the back of the cell, and no gridlines or busbars on the front. And like SunPower’s X-Series and E-Series, the A-Series panels offer very high efficiencies, from 21.5-22.3% at the module level.

This is still higher than any other mass-market solar manufacturer, including SunPower’s biggest competitor in the U.S. market, LG Solar – even when accounting for LG’s new NeON R product, which also uses IBC cells.

Cost war

But not only is NGT based on much larger 6” wafers – a development that is likely the result of ongoing advances in monocrystalline ingot casting in China – but SunPower says it uses a less expensive manufacturing process. The company has consistently declined to offer details on how much NGT reduces costs, but CEO Tom Werner has stated that through manufacturing efficiencies and higher throughput NGT will be on par with mono-PERC technology.

(Photography by Paul Sakuma Photography) www.PaulSakuma.com

That’s the right benchmark to be aiming for. Driven by the rise of massive mono ingot and wafer factories owned by LONGi and Zhonghuan and the spread of PERC cell technology, mono-PERC products is coming to dominate not only the rooftop but also the utility-scale market, and both Jinko and Hanwha’s new U.S. factories are making mono-PERC products.

And these two factories would have a price advantage against SunPower’s imported products in the U.S. market, were it not for the exemption from tariffs that SunPower has secured. As such, SunPower actually has an advantage here, as both Jinko, Hanwha and nearly all other companies with PV module factories in the United States must still pay the Section 201 tariffs on the cells they import.

Over 400 watts

Not only is SunPower’s A-Series based on larger wafers, but the overall module is 10% longer than the X-Series or E-Series modules, at 40” x 72.2” (the company says that the weight is similar). This allows SunPower to produce the first over 400 watt module for the rooftop market, with A-Series products coming in at 400 and 415 watts.

SunPower says that it expects to ship up to 100 MW of A-Series modules this year, and to reach 250 MW of annual manufacturing capacity by year’s end. By the time it completely converts its Fab 3 in Malaysia to NGT, it will have 800 MW of capacity, some of which is enabled by higher throughput in the NGT process.

It remains to be seen if this will allow SunPower to turn to profitability. The company has taken all the right steps, both in lowering the cost of its products and shifting to focus on rooftop solar markets where the advantages of its high-efficiency products are the greatest, and has had to pay for these investments. Now we will see if all of this work pays off in dollars and cents.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Excellent article.

Thanks Carl.

So what are the dimensions? Larger than a typical 72 cell? Sometimes smaller panels fit better for residential

As stated in the article, they are 40″ x 72″ – a little wider than a standard 72-cell module.

Sun Power marketing policy is its greatest disadvantage. When we can go to the store and purchase a Sun Power panel just like its competitors , Sun Power is ready to do business. Pricing and availability are the straws that is breaking the camel’s back