There are those who say that given the ongoing ability of Chinese manufacturers to keep cutting costs for crystalline silicon, that no other technology can really compete in the long run. But if there is an end in sight for First Solar, it didn’t show in the company’s Q4 and full year 2018 results.

Instead, First Solar appears to be on top of its game and has completed the bulk of its transition to the new, large-format Series 6, with its second factory in Vietnam coming online in the first two months of 2019, to add to its factories in Ohio and Malaysia.

This year the company expects to ship around 5.5 GW of PV modules. Even at this volume CEO Mark Widmar estimates that the company is “fully sold out” through the end of 2020 and First Solar’s current 12 GW of bookings includes shipments scheduled through 2023.

The company shipped 900 MW of product during Q4 of 2018, and while it did not break that down between its Series 4 and Series 6, what is clear is that Series 6 is currently being used almost entirely for projects that First Solar develops and builds.

First Solar’s revenues and profitability were also not bad for a company that is still retooling; it brought in $691 million during Q4, and managed to eke out a slim 1.6% operating margin and a net income of $52 million.

Over the course of 2018 the company’s revenue and profitability was similar, and First Solar burned through around $440 million of its war chest during the year, retaining a healthy $2.5 billion in cash and equivalents at the end of 2018.

As the company moves into 2019 it expects shipments to pick up as more factories ramp. First Solar’s new 1.2 GW factory in Ohio is not set to come online until the end of the year, and when it does this will put First Solar at over 7 GW of annual capacity, as one of the largest PV makers on the planet.

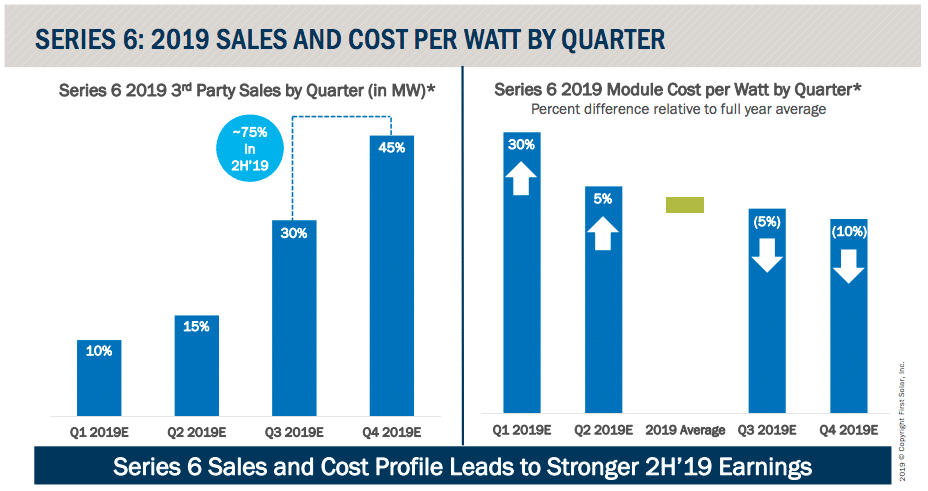

This will also give First Solar the ability to support more third-party sales of the Series 6, and the company expects 45% of Series 6 shipments to go to third parties by the fourth quarter of 2019.

First Solar also sees per-unit costs continue to fall with the ramping of its factories, as well as efficiency gains. The company’s Series 6 is already offered with ratings as high as 445 watts, and it notes that the average watts per module rose by 10 from October 2018 to February 2019.

Despite all of this First Solar did appear to miss its Q4 2018 guidance, and the company also lowered its 2019 margin guidance slightly, with what Widmar describes as “minor adjustments to ramp and start-up costs”.

However, First Solar still expects to bring in $3.25 to $3.45 billion in 2019, with positive margins and a net cash balance – despite $110-$130 million in production start-up and ramping costs.

Help us bring you the most relevant news by taking our pv magazine USA audience survey

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.