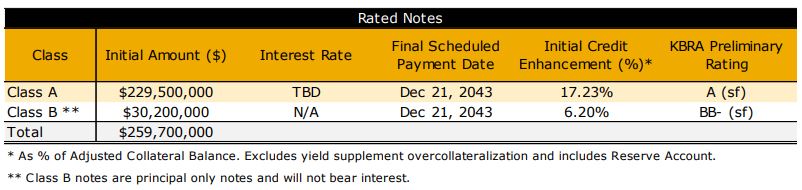

Mosaic has received a preliminary rating of an “A” on $229 million of residential solar loan products that the company hopes to sell into the market. A second batch, $30 million worth of non-interesting bearing principal, received a rating of “BB-“.

The Kroll Bond Rating Agency (KBRA) noted the asset backed security (ABS) was collateralized by approximately $281 million in residential solar loans, and that on the expected closing date of February 6th, 2019, the pool would be would have a principle balance of $260 million left. The average remaining term on the portfolio as of November 30, 2018 is 16.8 years at 4.52%, and just under $30,000 balance. The last payment is expected on December 21, 2043.

This is Mosaic’s fifth ABS transaction, with prior files closing in February and October of 2017, and April and June of 2018.

The portfolio report’s (account login required) “key considerations” for the rating noted that overall portfolio was “overcollateralized,” and that a reserve account of 1% of the total amount of the portfolio will be established.

The layering of risks (noted below) was seen as a risk itself as the interplay between these variables could cause greater defaults than any risk on its own.

- limited performance data and use of proxy data

- the impact of manufacturers

- installers or performance guarantors failing to honor their obligations

- collateral with interest rates and/or monthly payments that may increase

- longer-term consumer loans

- changing technology

- O&M risk born by the borrower

Strong Mosaic management experience was noted as a positive., though Mosaic’s financial health was noted as a “-/+”, even as the company moved to being profitable in 2018 versus 2017. It was noted that:

Mosaic’s reliance on debt financing and equity raises to fund operations increases the risk that Mosaic may not have the resources to originate new loans and perform their servicing responsibilities, but this is expected for a younger company.

Consistent in all solar portfolios reviewed by KBRA is limited performance data from the solar power industry. The solar loans haven’t been through a full business cycle, as most solar loans/leases have been signed while the economy is still in recovery from the last recession. This is seen as a potential negative since these loans have not been stress-tested to see how homeowners react.

The California wildfires were noted as potential risk due to the portfolio’s heavy concentration in California, and the top five states (California – 48%, Arizona – 7%, Florida – 6%, Texas – 5% and New Jersey – 5%), represent almost 71% of the portfolio. No projects from this portfolio were noted as being lost in recent wildfires.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I still don’t understand why it costs so much to finance residential solar and monetize tax credits.