While the other two largest U.S. residential solar companies are getting comfortable with more limited ambitions, Sunrun just keeps growing.

During the second quarter of 2018 Sunrun deployed its highest-ever volume of rooftop PV systems at 91 MW, a 20% year-over-year increase. This is more than the 84 MW of combined residential and commercial and industrial solar that Tesla deployed during the quarter, and while direct comparisons are frustrated by Tesla’s lack of transparency around its mix, it is becoming more and more clear that Sunrun has become the largest residential solar company.

Profiting from third-party solar

The irony here is that Sunrun has come to a leadership position by swimming against the current. Tesla and Vivint have both moved away from third party solar – Tesla more than Vivint – as loans eclipse leases and power purchase agreements as dominant form of financing for residential solar in the United States. However, Sunrun continues to carry the banner of third party solar.

And it has not done badly in the process. Sunrun’s revenue grew 31% year-over-year during the second quarter to $171 million, with the majority of this coming from recurring customer payments and incentives, not the direct sale of systems.

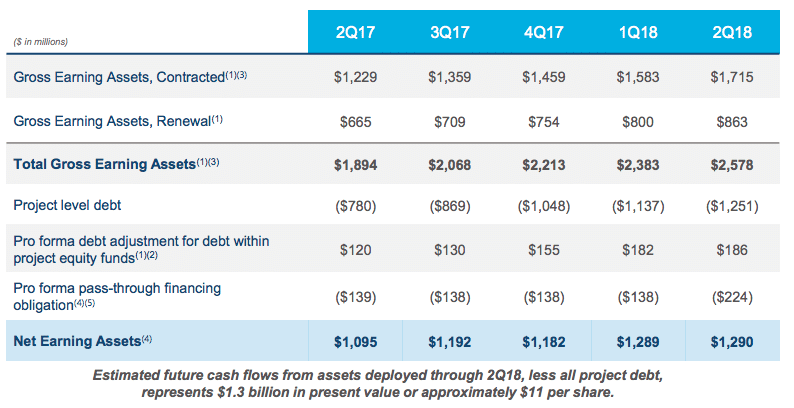

And while Sunrun reported an operating loss of $35.0 million and a net loss of $71.7 million, such losses are not unusual for a third-party solar company, as this model builds value slowly over time. By the end of the quarter Sunrun had accumulated $2.6 billion in financing contracts for residential solar with over 200,000 customers. Minus $1.3 billion in debt related to these projects, this still leaves $1.3 billion in “net earning assets”.

Unfortunately it is not possible to compare this to Vivint or other third-party solar companies, as the metrics used are not standardized across companies. Further frustrating this process is Sunrun’s habit of frequently changing the way it calculates these metrics.

Cash flow was also good, and Sunrun is now sitting on $270 million in cash and equivalents. The company is planning investing some of the war chest that it is accumulating back into the business.

“We are capitalizing on this position by investing in our direct customer acquisition, onboarding platform, and customer experience capabilities, which we believe will increase the moat around our business and deliver a superior cost structure over time,” noted Sunrun CEO Lynn Jurich during the company’s second quarter results call.

Cost reductions

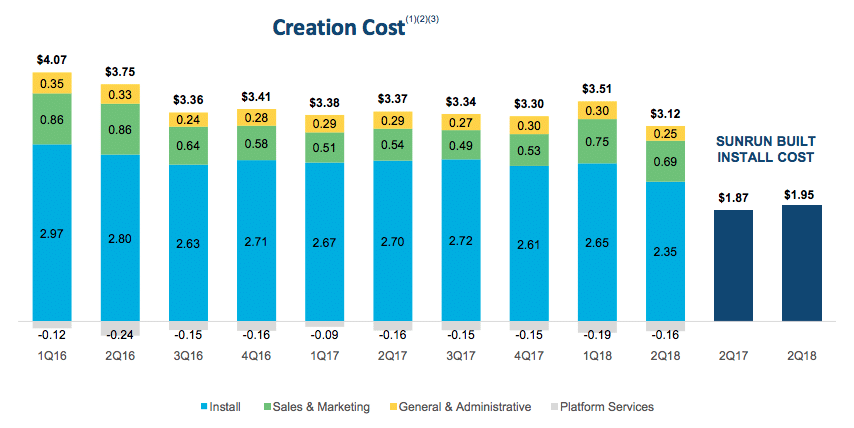

The company has also shown progress in bringing down costs. During the quarter Sunrun reported a “creation cost” for the systems deployed by the company and its channel partners of $3.12 per watt, a 7% fall on a year-over-year basis. This is higher due to higher costs at its channel partners, and for Sunrun-installed systems, installation costs were only $1.95 per watt.

Sunrun’s creation cost has been declining relatively consistently for years due to falling installation costs. However the company is actually reporting higher sales & marketing costs than a year ago, and general and administrative costs are not moving much.

A strong runway

If anything, Sunrun’s position is stronger when you look towards the future, across all fronts. The company expects deployments to rise to 100 MW next quarter, and for FY 2018 deployments to be 15% higher than 2017. There is ample financing for these systems, with Sunrun estimating that it has debt to support deployments through the first quarter of 2019 and tax equity to support projects through the second quarter.

But these top-line metrics tell only part of the story, and Sunrun is in a good position to take advantage of several significant policy developments. California’s recent mandate for solar on all new homes is a major boon to the rooftop solar industry, and Sunrun estimates that it already has new home installations and has engaged with half of the 10 top California homebuilders.

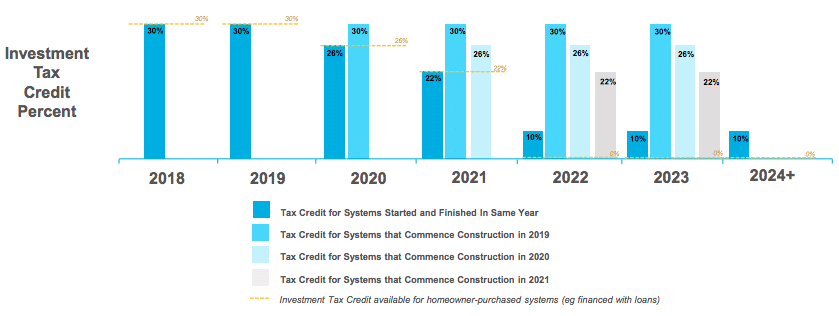

What may be a bigger boon for Sunrun is the June IRS guidance which allows developers and installers to claim the Investment Tax Credit (ITC) for a given year if they incur 5% of project costs – without requiring the start of construction. On the company’s quarterly call, Sunrun Chair Ed Fenster noted that this potentially allows the company to secure modules years in advance of installations and still claim the 30% ITC.

“While we have not finalized our strategy regarding this opportunity, the rule is clearly a favorable development for the Company as it presents more options to extend the higher tax credit levels,” noted Fenster.

Furthermore, this guidance benefits Sunrun more than its rivals who depend on cash loans and direct sales, as this “safe harbor” provision only applies for businesses, not individuals.

But Sunrun’s greatest competition is not against other solar companies – it is against utilities. And here Sunrun has a fundamental advantage. The cost of the systems it deploys continue to fall, while utility rates continue to rise. Which explains why many utilities are doing everything in their power to dismantle the economics of net metering, either through removing the policy or manipulating rate structures.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

So, what about South Carolina? We’re losing jobs down here. Net metering caps are being reached. Pulling out of prime markets and trying to sell in saturated markets. Third party lead generators lying to customers about power during outages and we have no back up battery storage to offer SC residents. When does SC catch a break in all this success?

When the lawmakers who have the right knowledge are voted in, you’ll see the success that much of the rest of the country has experienced.

Sunrun is a pretty good company imo. Albeit on the pricey end for consumers, but still OK.