SolarEdge’s own worst enemy at the end of Q2 were the expectations set as a result of a stellar performance in prior quarters. The company grew megawatts shipped by 23% quarter-over-quarter, but missed earnings per share projections by $0.03 and after hours traders immediately pushed the stock down.

Image: SolarEdge

The company noted that growth was flat in its U.S. residential sales but that commercial growth continued. Additionally, in the earnings call a 23 MW-AC ground mount project in India was referenced, one of the largest the company has supplied to date. Other “larger” utility scale projects were also referenced, but not specifically (SolarEdge told pv magazine about a 53 MW-AC system at Intersolar North America 2018).

A new utility-scale product will be rolled out in four parts through 2020. HD Wave technology should make its way into utility-scale projects, possibly as early as summer of 2019. However, SolarEdge cautioned that the current stage of product development meant slipping timelines was still possible. A new commercial optimizer is being developed to more “perfectly” fit into the market’s financial and technical requirements.

Because of potential new tariffs in the United States, SolarEdge noted it can expand manufacturing at its Romania and Hungary facilities at the same, or lower costs. To balance out the volume of its Chinese manufactured product, the company projected that within the next two quarters it can expand to meet optimizer demand in the US, and that within two to four quarters it could do the same for inverters. It was noted that this might lead towards European manufacturing facilities shipping product to the United States, and Chinese facilities shipping product to Europe.

52% of the company’s revenue was from North America, 36.3% from Europe and 11.6% elsewhere on the globe.

Financials

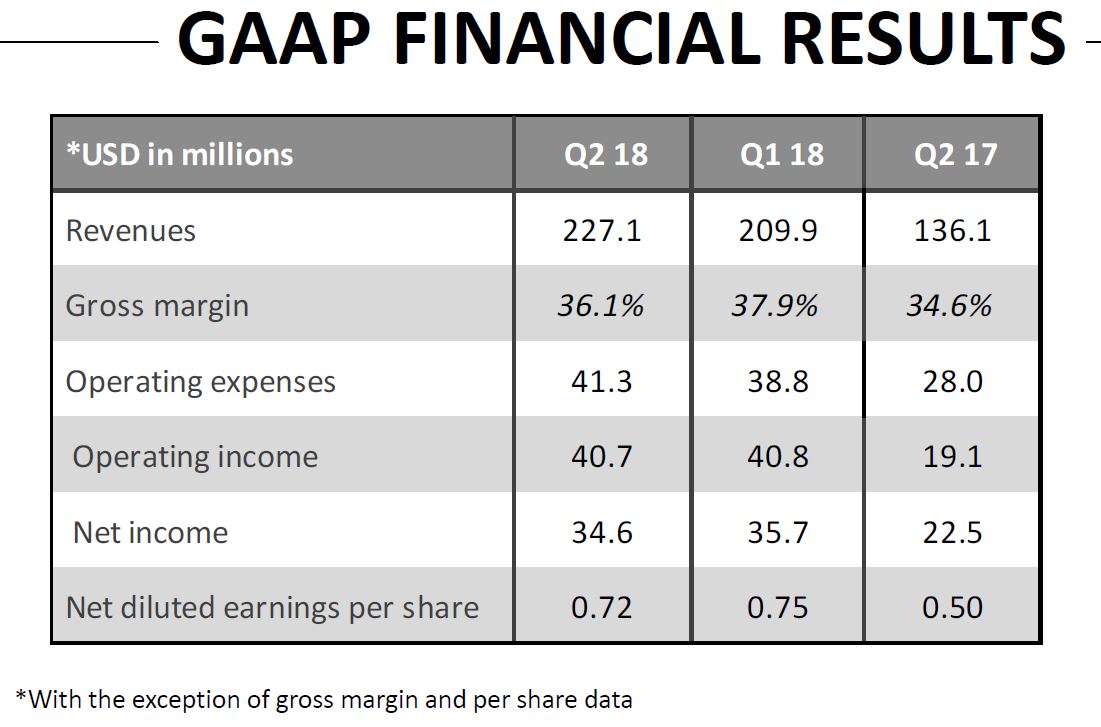

The company reported record revenues of $227 million, up 8% from $210 million in the prior quarter and up 67% from $136 million year over year.

SolarEdge’ gross margin fell to 36% from 38%, in the prior quarter and up from 35% year over year. Operating income was $40.7 million, essentially unchanged from $40.8 million in the prior quarter and up 113% from $19.1 million year over year. Earnings per share was $0.72, down from $0.75 in the prior quarter and up from $0.50 year over year.

Looking forward to Q3, the company projects revenues to be within the range of $230 million to $240 million, and gross margins are expected to remain within the range of 36% to 38%.

The company ended the quarter with $437 million on hand.

Hardware

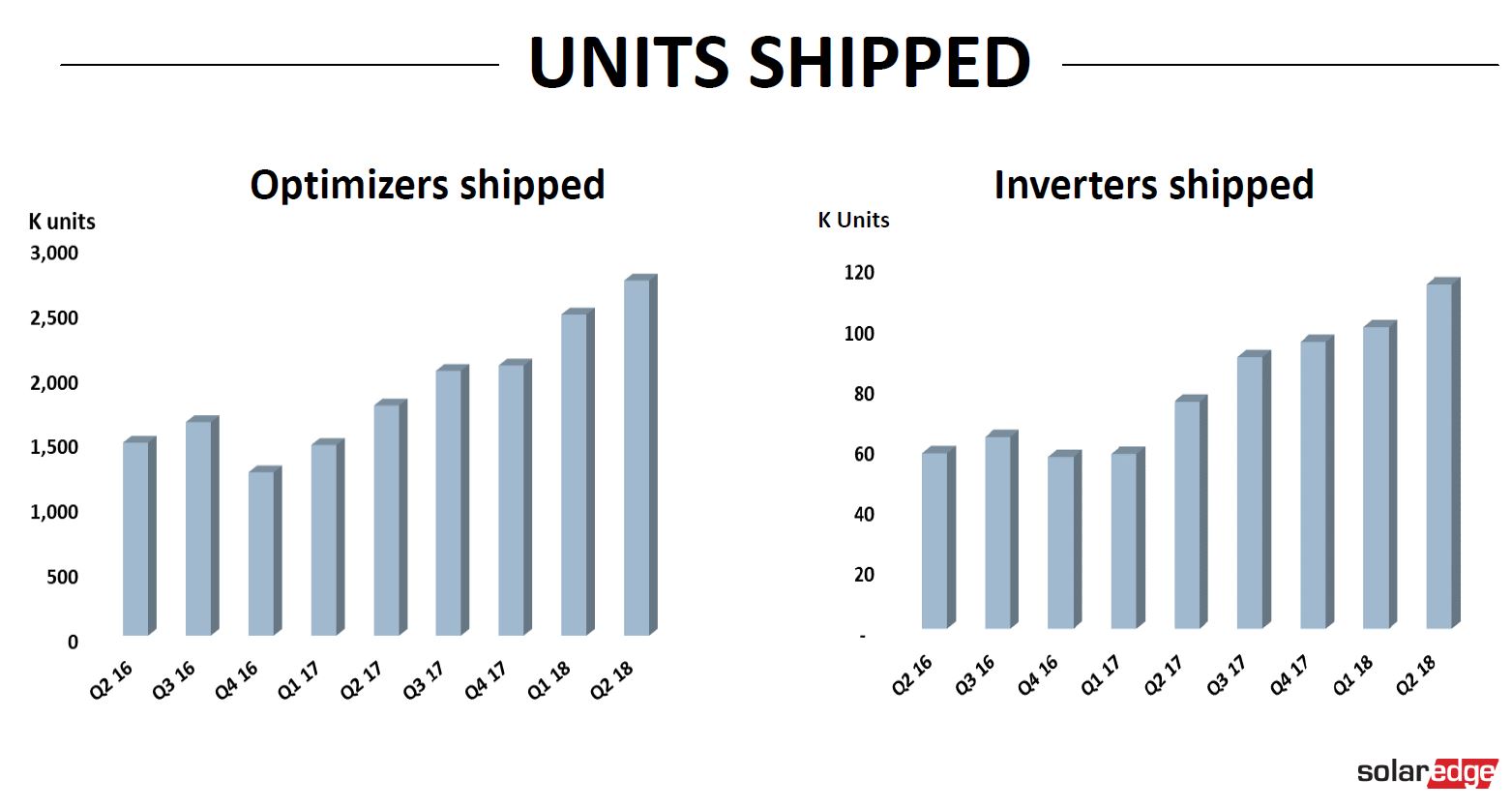

Financials notwithstanding, the company continued its upward trajectory in hardware shipments. The company increased shipments to 985 MW-AC, a 23% increase from 800 in the prior quarter, and a 75% increase over 563 in Q2’17. The company shipped more than 114,000 individual inverters during the quarter, coupled with 2.7 million optimizers.

The company has also continued to grow its commercial footprint, which hit 43% of all MW shipped. The expansion into commercial and utility projects has lowered the company’s average selling price per watt, however, SolarEdge has been able to maintain margins within these sectors.

With growth still significant – but slower – for the quarter, the market reaction was swift. In after hours trading, SEDG was down just over 11% at the end of the earnings call.

Considering such strong growth numbers relative to a year ago – 75% growth from 1,018 MW to 1,785 MW in the first half of the year – we must assume that SolarEdge is taking market share from other companies as no one in their right mind projects 75% global growth, but that the global volume is also growing. SolarEdge could represent up to 4% of the 100 GW or more that will be installed this year.

But as far as the stock market goes, sometimes you can never be good enough.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.