Enphase has had a long struggle to get to where it is today. The microinverter pioneer began a major restructuring two years ago and cut prices below the cost of production to gain market share. Along this difficult road long-time CEO Paul Nahi stepped down a year ago, to be replaced wth Cypress Semiconductor veteran Badri Kothandaraman.

This long struggle may finally be paying off. In its second quarter 2018 results, Enphase came within striking distance of its long-sought goal of regaining profitability, reporting an operating loss of only $558,000 versus $76 million in revenues.

But the company is not out of the woods yet. Enphase is dealing with component shortages and faces 10% tariffs on its products, which are made in China, through a new set of retaliatory Section 301 tariffs proposed by the Trump Administration. To add to all of this, the company became the target of a short seller only six days ago.

Prescience Point Capital Management has labelled the company’s turnaround as a “sham”, alleging that the company’s improvements in revenue and profitability have no apparent basis, and calling its recent deal with SunPower “incredibly value destructive”.

All on the products

For its part, Enphase credits much of its improvement to its new product lines. CEO Kothandaraman notes that the company has shed several of its less profitable products, as well as streamlining operations.

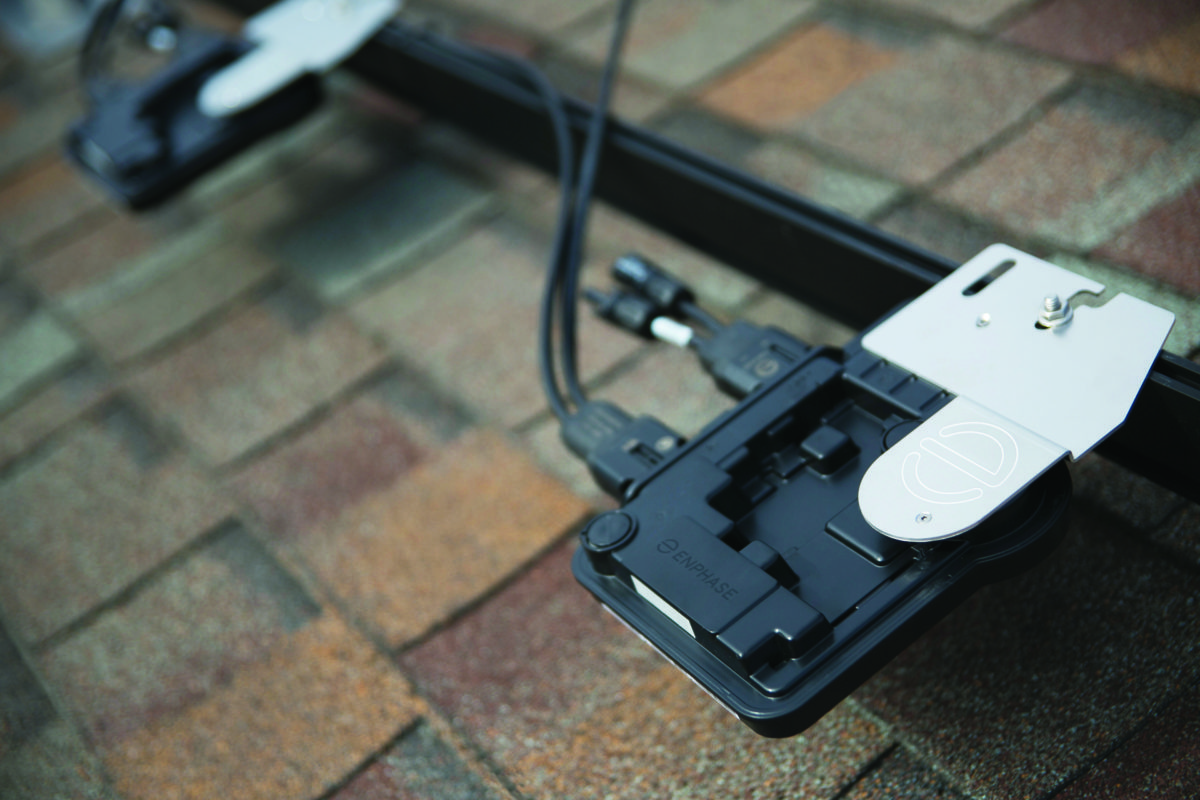

Last year Enphase rolled out its IQ microinverters, which feature advanced grid functions. During Q2 roughly 22% of the company’s microinverter shipments were the second generation in this series, IQ7, and Enphase expects IQ7 to fully replace the first generation IQ6 by the end of the year.

In each generation the company is lowering part counts in part by utilizing ASIC chips, which also make it harder for imitators to copy its designs. Additionally newer generations are increasing the maximum DC power while lowering weight, as well as adding more advanced functions.

During Q2 Enphase began shipping its IQ7x microinverter, which works on modules with ratings up to 400 watts, to U.S. customers. Additionally the company has gained more AC module partnerships, with Solaria joining JinkoSolar, Panasonic and LG. Enphase argues that the AC modules offer significant advantages for installers including reduced installation time.

However the big coup of the company was its deal with SunPower. This not only eliminated a microinverter rival and allows for SunPower AC modules but makes Enphase the exclusive supplier to the residential business of a company whose dealer network comprises the fourth-largest share of the California residential solar market.

Supply side hiccups

But as its technology advances, Enphase is hitting problems on the supply side. The company referenced “worldwide component shortages” including transistors and capacitors, which it says have brought down margins incrementally. A potentially larger threat is the proposed 10% tariffs on inverters from China, as part of the trade wars that the Trump Administration is waging against multiple nations.

And while it ascribes this more to diversification than the tariffs, during the call Enphase revealed that it is in the process of finding another contract manufacturer outside of China to make its products.

Looking to the future, Enphase is preparing the roll-out of its IQ8 product, which as part of its Ensemble system will be able to operate with or without power from the grid. This will create a sophisticated backup product for the U.S. residential market, where customers are often focused on having power in the event of blackouts, but also for places where there is no power grid.

The company has alluded to a major deal in the developing world, and it is possible that more details will be released in its Analyst Day on August 16. This Analyst Day was called following the Prescience Point Short, which caused a drop in the company’s stock price from around $6.50 per share to to the $5-$6 range, but this is still well above the below $1 that Prescience is claiming.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

And to note, the 10% tariifs will affect just the 62% sales within the US. None of the 38% global market share. It will also be good for readers to know a restructuring to their major loan is soon coming. Which will add straight to the bottom line. Very likely, positive quarterly earnings from here on.