At pv magazine, we write a lot about policy. But finance is just as essential – if not more so – for renewable energy deployment. The intersection of the two is particularly important for solar, and there is perhaps no event that provides as good of a place to look at this as the Renewable Energy Finance Forum (REFF) Wall Street conference organized annually by the American Council on Renewable Energy (ACORE).

Image: ACORE

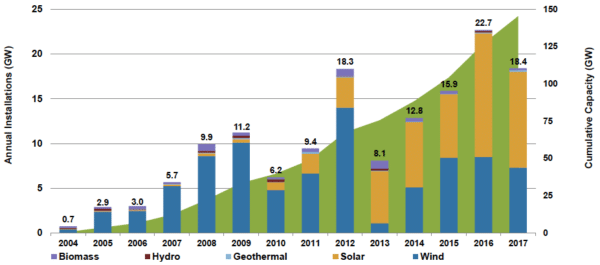

This year’s event showed a remarkably healthy environment for both renewable energy finance and deployment, despite substantial challenges. The 18.4 GW of combined wind and solar deployed in 2017 was the second-largest volume in any year to date, only exceeded by 2016’s build-out in anticipation of the scheduled drop-down of the investment tax credit.

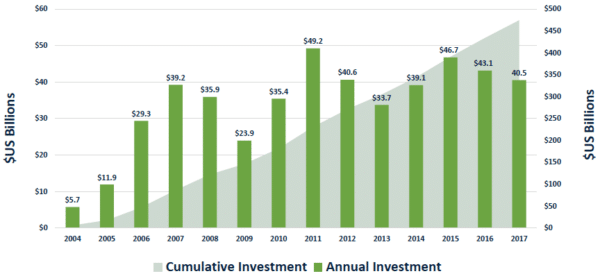

Total investment levels in U.S. renewable energy are less promising, as they fell for the second straight year in 2017. However, this top-line statistic may be less revealing.

Image: ACORE

The story of renewable energy finance over the last year is more one of challenges overcome, and these challenges come primarily from the Trump Administration. The list is long: solar tariffs under Section 201 and other trade actions by the Trump Administration, state-level changes to the Public Utilities Regulatory Policies Act, and the potential for a bailout of coal and nuclear generation.

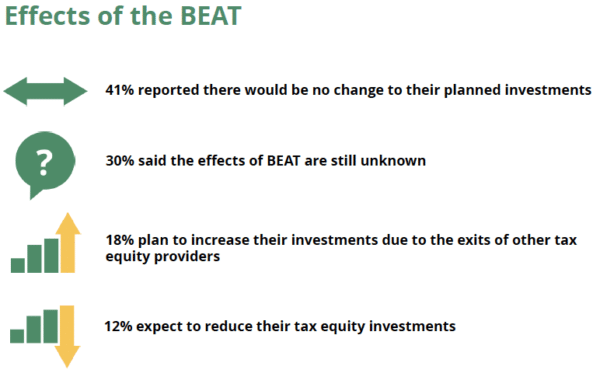

Not the least of the challenges was tax reform. ACORE took a leading role in fighting against the Base Erosion Anti Abuse Tax (BEAT) provision in the tax reform bill, which was whittled down significantly from the threat that it originally represented.

In the long run, BEAT has simply not been as bad as many feared. In his opening address, ACORE CEO Greg Wetstone revealed that there are actually more investors participating in tax equity finance than there was before tax reform.

A number of panelists also noted that the tax equity market remains relatively healthy despite the BEAT provision, even if overall demand is impacted significantly by the lower corporate tax rate. Many observers also noted that it is still too soon to note the full impact of the changes.

Wetstone also notes the increased interest by corporations in renewable energy, as well as a trend of stronger state-level renewable portfolio standards, stating that this was at least in part “a response to the federal retrenchment”.

Market challenges

But against this backdrop of federal policy challenges, the long-term trends of renewable energy finance are increasingly positive, and this could be seen as a backdrop to many of the presentations. Not only are costs falling dramatically for wind and solar, but investors are getting more comfortable with renewable energy installations as asset classes, including pools of rooftop solar installations.

Not all of the changes and trends are entirely positive for renewable energy. In his presentation Invenergy Founder and CEO Michael Polsky argued that the increasing volumes of zero-marginal cost wind and solar is fundamentally not compatible with the current design of wholesale power markets. And while the risk here is doubtless more severe for conventional generation, Polsky argued that this will not work for the entire market.

“If we want more renewables, we have to solve market issues,” stated Polsky. “Having the market just be blown away is not necessarily a solution.”

This was echoed by other panelists. Marathon Capital CEO Ted Brandt warned the audience that if you don’t make money over the term of a power purchase agreement (PPA), that you are unlikely to make money at all, given the ongoing fall in wholesale market prices.

And these PPA terms are getting shorter. As the appetite for longer-term contracts declines, this has even resulted in terms of debt longer than PPA terms, putting more pressure on the “merchant tail”.

Stranded conventional assets

The future of U.S. power markets is hot and crowded, which will make it harder for investors to eke out returns. This is a fundamental result not only of falling prices for renewables, but the decline in power demand overall as electricity use decouples from gross domestic product.

This means renewables crowding out conventional power sources, including the ability of solar and wind coupled with battery storage to outcompete gas peaking plants. And we will continue to see resistance from the fossil fuel and nuclear industries as their plants are driven into retirement.

This ultimately means stranded assets. Ellen Dorsey, the executive director of the Wallace Global fund, noted that the fossil fuel sector was the worst performing sector for the past five years in terms of securities. “We are at the historic moment between the horse and buggy and the car,” stated Dorsey, echoing an analogy used by Tony Seba in describing the mechanics of technology disruptions.

The amount of money that may be lost here is stunning, given the dozens of gigawatts of natural gas plants likely to come online in the United States in 2018 alone. For developers, investors and utilities that are either in denial or have been fooled by bad forecasts, it may be wise to listen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.