Due to the state’s revolutionary 2019 Building Energy Code requiring solar power to be installed at time of construction for all newly built homes, over time California home buyers could see per unit prices drop to rates approaching that of some of the world’s largest utility scale solar installations ($1/W in the United States). And if this seems hyperbolic, first let’s lay out the case for why this move by California is about to revolutionize residential solar in our country.

Outside of energy-nerd circles (used here endearingly of course), the dramatic and continuous fall in the price of solar panels is beginning to be acknowledged by the general public. Known as “Swanson’s Law” (a cousin of sorts to the more famous “Moore’s Law”), since the mid 1970s solar panels have gone down about 20% in price every time the volume we ship annually doubles. Put more simply, solar panels are at least three times cheaper than they were just a decade ago. While remarkable, and with every indication that this astounding trend will continue (some data shows the decline speeding up), that’s still just the panels.

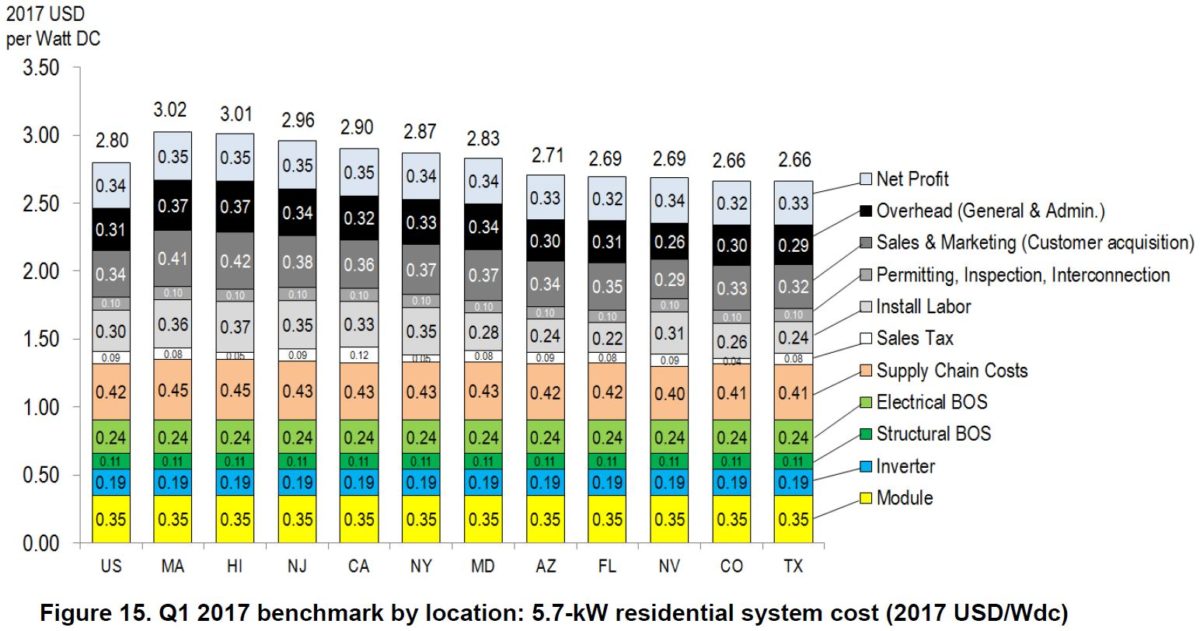

What’s different here in the Golden State can be described in just two words: soft costs. For rooftop solar, some of these soft costs include permitting, financing, installation labor, cost of customer acquisition, paying suppliers, … and then of course hopefully some profit is left over for the company if they want to stay in business. Because these soft costs are greater for smaller installations, the U.S. Department of Energy (DOE) estimates soft costs can be almost two thirds of total costs.

Furthermore, soft costs aren’t decreasing as fast as hardware costs. However, this move by California is likely to bring down soft costs sharply, as it is expected to put downward pressure on nearly every one of these soft cost categories. For newly built homes, in many cases it eliminates them altogether.

The first piece of evidence comes from data provided to us by DOE’s National Renewable Energy Lab (NREL) in their annual U.S. Solar Photovoltaic System Cost Benchmark: Q1 2017.

We’re going to use this document as our base of discussion because the $3.17/W value that the California Energy Commission (CEC) decided (see page 38) to use in describing the potential costs per home for solar power, was based on the 2016 version of this document (including 2% inflation from that 2016 value).

Our standard solar power system is 3,015 watt system, composed of nine 335 W panels. It is assumed this power class will represent the base Tier 1 product available to the market. We chose this value as it is close (slightly larger) to our estimates of what the CEC is requiring under the new code.

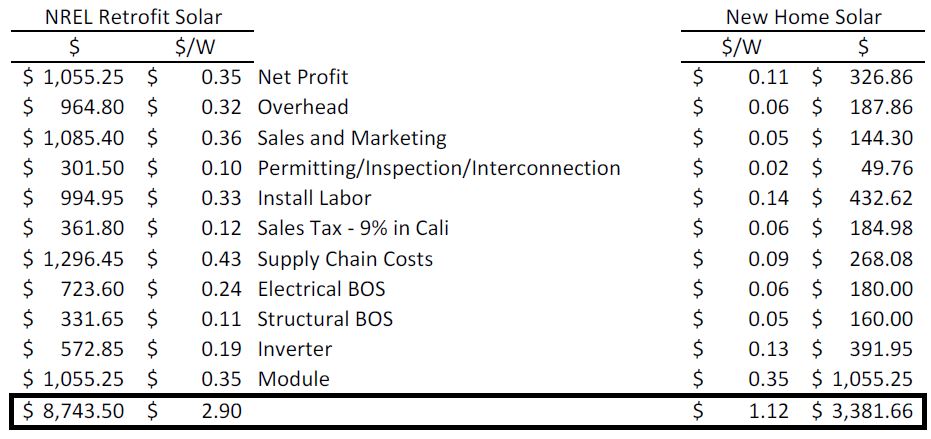

pv magazine chose to use values for net profit, overhead and sales & marketing for the new home solar that match up with the standards per the National Association of Home Builders cost to build a home in 2017. And it is here that we see the fat fall away. The residential retrofit solar power industry simply cannot compete with the efficiency of including an extra feature in an already being built new home. This is not an attack on the creative engineers that figure out these solutions – but a recognition of reality. Savings: 81¢/W!

Permitting/Inspecting/Interconnection costs – instead of costing 10¢/W and requiring whole departments, this couple of sheets of paper will be piggybacked on an already existing paperwork process, including an interconnection application. These costs are estimated at 2% of all hardware and labor costs. Savings: 8¢/W.

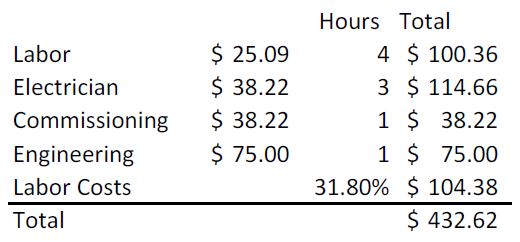

Install labor costs will halve due to the efficiency of building at time of construction. You can almost hear the sigh of relief from many solar installers, not having to snake their body through the sweltering, insulation filled attic with your skin inches away from the shingle penny nails that poke through exposed on the interior side of the attic crawl space. Since California has higher labor costs than the national average, we used labor costs of $25.09/hr and electrician costs of $38.22/hr, as per NREL. Labor time was estimated at four hours, electricians at three, plus one more for commissioning. An hour for designing the layout was also included. Savings: 19¢/W.

Supply chain costs were looked at closely by NREL when they decided 43¢/W as the standard value. Local installers, buying from local distributors pay multiple layers of markups as products move through many layers. National homebuyers, reaping the benefits of economies of scale much like utility scale developers, will pay a standard 15% markup for shipping and storage. This 15% value is noted as the base value by the NREL report. It is a valid argument that smaller and custom builders will pay some of these fees. Savings: 34¢/W.

Electrical balance of system costs are a large variable on every project because homes are so different, and the upgrades needed vary so greatly. Will we need a new electrical panel? How will we snake the conduit from the roof to the inverter? Is the house up to code? In a new house, all of this is clean and the panels can be planned into the overall construction plan of the house. In fact – the basic costs here are as is: 30 feet of conduit and copper, a single external disconnect switch, a 20 amp fuse and $100 worth light goods (boxes, washers, bolts) to connect the wires. Savings: 18¢/W.

Structural balance of system is really just racking. And 11¢/W for flush mount residential racking is a great price – but even that is expensive compared to what can be done with a clean canvas.

The above QuickmountPV system needs a total of sixteen of their Quick Rack assembly units. You need nothing else but to attach your solar panels afterwards. These units can be bought in bulk, direct from manufacturer, probably at $10/each by a national home buyer. Savings: 6¢/W.

The NREL report suggests standard inverters can be purchased at 13¢/W – and that’s what we went with in this report. There is an argument that module-level electronics will be needed in order meet Rapid Shutdown requirements in NEC 2017 – this could be met on our model project at 4-8¢/W with various solutions. Savings: 6¢/W.

These numbers are not far from what Andrew Birch, former Sungevity CEO, showed us in Australia recently – $1.34/W to retrofit residential solar power versus $2.90 to do the same work in the California, mostly due to savings from those same soft costs that U.S. home builders have obviously figured out.

And there still are a few black swans out there that could drop pricing further. Will an integrated solar+housing material manufacturer like Tesla or RGS Energy deliver a product that combines the cost of racking+structural BOS (40.3¢/W), while also dropping solar labor installation costs (3¢/W) by combining that with the roofing material install time? Tesla’s Solar Roof does this, however, as of yet it is aimed at premium roof replacements and will seemingly cost much more than the base installs with commodity hardware modeled here.

With all these categories added up, this eliminates more than half the cost of a residential system, bringing down the total to $1.12 per watt. From there, the elusive $1/watt is only a few years away in terms of system cost declines.

Adding it all up we come to one last number – the California Energy Commission projects* that a 3,015 watt solar power system will generate, roughly, 133,630 kWh in a 30 year lifetime (4,785kWh/year 1, 0.5% annual degradation). At a system cost of $3,381 – that’s a lifetime cost of electricity at 2.5¢/kWh.

The CEC noted that systems at $3/W will cost new homeowners about $40 a month in a 30 year mortgage. Using these calculations the monthly mortgage payment will be $17 versus the same $80/month savings projected.

*The output of pv systems varies depending on climate and location within California, per the charts starting on page 39. For purposes of this document, we averaged the statewide numbers and then scaled them to our 3kW system.

These values are before incentives. In 2020, the homeowner would be able to claim a 26% tax credit against their solar system costs and in 2021 22%. After that, the residential solar tax credit expires. There are no state level solar power incentives in California – just expensive electricity and time of use rates.

Criticisms of the mandate

The biggest criticisms of California’s requirement seem to largely fall into two camps. Some academics, intellectuals, and other garden variety wonks have decried this move because it doesn’t align perfectly with their espoused pet framing. These are largely bereft of any real salient or tractable points, and come off as sour grapes because the naysayer wasn’t first consulted for his self-aggrandized oratory.

From the other flank comes the sophomoric dollar to dollar comparison of constructions costs for rooftop solar versus utility scale. These arguments are championed by those with a requiem for a vision of wide open swaths of landscape striped with clean lines of panels on aluminum rack-mounting laid out with mathematical purity like a giant monocrystalline Zen garden that’s been freshly raked.

Looking at the contrasting hot mess of residential one-off installations, a literal piecemeal, it is easy to see why the proponents of this utility-scale-is-the-best-scale position immediately throw out a dollar-to-dollar comparison with the current cost norms of residential solar construction. This ignores the fact that residential solar generates electricity directly at the point of use (the sun already has an innate distribution system) while utility scale is still dependent on transmission and distribution from the grid. The US grid is estimated to be a $5 Trillion dollar asset, and utility-scale solar and other forms of centralized generation get that for free in the calculation (not to mention all other non-generation costs).

Remember, distributed energy and efficiency just saved a $2.6 billion upgrade to that $5 trillion grid asset in California.

The only lucid comparison for residential solar prices are not the wholesale cost of utility-scale generation, but the retail rates of electricity paid by the consumer. This requires a necessary shift in thinking. The default perspective for most energy wonks is to first consider the generation asset, and then the journey of the produced electricity through the grid, and then finally almost as an afterthought we note the consumed energy service. Instead we should start with the point of use for the consumer’s energy service need, then we trace backwards to see how that need can best be met.

This monumental move by California shifts the playing field in unprecedented ways. Now residential solar will be much better able to leverage economies of scale across a wide variety of soft costs in ways that just weren’t possible before. Even for the wonkiest of wonks this will likely require a fundamental shift in thinking about how we characterize these assets and energy services.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very true cost of material and labor. The,home could be faced to the South for the most Solar gain it. Also more insulation for a much more efficient home.

The other area to work on is to make the Utility work with the home and not add false fees like they have in Arizona. Battery systems should also get an incentive with no extra,fee. We need to ALL work together.

Agree. In MN you cannot install a disconnect so, ironically, if the power goes off you cannot use the power your own roof is generating. The electric company requires that the voltage is dumped so it does not power the lines being repaired and kill the person doing the work. And yet you can have a home generator with a disconnect for the exact same situation. Codes need to be updated so that the full benefit of the distributed system is realized. Another benefit no one seems to comment on: security. Our grid is so vulnerable and a successful attack will send us back to the Bronze Age (but mass-starvation and other horrors first) but a truly decentralized system would help prevent that.

The excess energy generated by solar panels in California is parlayed back to the utility by offsetting excess electricity with that provided by the utility. The utility benefits at year end with the solar production being negated by the utility provided energy.

The home owner should be allowed to sell the excess from solar to the next door neighbour. After all many, many homes built today are a matter of feet from each other. I acknowledge that a separate meter would be required however this would cost less than $200.00

Good article. Hard to believe it takes a state mandate to drive down the cost of solar on new construction to close to price of solar on existing construction in AU. If we had AU solar pricing I think you would see a lot more solar uptake.

Great article. The trend supports my long term belief that the smartest thing to do in regards to residential solar is to wait. Solar now at roughly $2.80/kw means that small home that requires a 5 kw system which would, in much of the USA, produce 20-25 kwh of electricity per day, would cost $14,000. Since the initial investment for solar represents the bulk of solar cost, from a ROI perspective, it makes great sense to wait 3-5 years until the cost of a 5K solar system drops to $5,000. The difference here for a fully financed system is thus: Monthly cost of $14,000 at 5% = $75. Monthly cost of $5000 at 5% = $27. At $1/kw, solar makes enormous sense in much of the USA. The cost of waiting is negative since postponing a solar installation will roughly reduce its cost by $2,000/year.

But waiting will cost you the 30% federal tax credit. In Michigan, it would also cost me getting into true net metering (which is being replaced).

As an installer, I see profit and overhead dropping from 23% to 15%, every business owner is different, but I still have to keep my lights on, pay myself, cover taxes, insurances, vehicles, etc. The WORST that would do is take us to $1.50/watt – and that still makes a great case for this policy. The issues I see are overwhelming the grid, not electrifying the entire load (leading to too-small installs, leading to expensive retrofits) and ignoring the envelope. CA code likely helps with the envelope, but you’d get more bang for your regulatory buck by requiring a very low HERS score, and all-electric homes, with a south-facing exposure (both for passive management and for future solar). Add in a solar-ready requirement for conduit, and let the homeowners realize they can save vast tracks of $$ by install solar. As it is, this policy, while an step towards the solution, actually complicates the complete solution (zero carbon).

New science has opened a supplement or alternative to pv. Ambient heat, a huge untapped reservoir of solar energy, larger than earth’s fossil fuel reserves can now generate electricity 24/7. See aesopinstitute.org

Visualize a small shed next to a home containing 25 4′ x 6′ thin panels. It will produce 35 kW during peak daily heat and continue generating some power all night. Imagine the implications!

I’ve owned a residential solar installation business for over 32 years, and have many issues with the arguments laid out here. My biggest issue is that the author implies that those who disagree with his assessment “come off as sour grapes”, thus categorically dismissing any criticism. This is an unfair generalization by the author that assumes he can’t be wrong and anyone who disagrees must be doing it because their feelings were hurt and not because they have a valid point.

Well, here are some of my valid points that clash with his. First, modules at $0.35/watt? Are you joking? Modules have a real cost to produce. It’s true, prices have come down over the years, but at a huge price to the industry. Over three quarters of the manufacturers have gone out of business in the last few years and those that are left are struggling to make a profit. At current prices, the real cost of production is higher than the market price. Seeing prices drop by more than half in the future is a fantasy. The reality is prices have been flat for the last four or five years, and, if anything, are inching back up, (partly due to new tariffs, which were not mentioned). We reached the bottom a couple years ago. There will be little or no more downward movement in (top tier) panel prices in the future. Inverter prices are still on the decline, but don’t expect too much more. There is a real cost to produce them, too.

The biggest problem I have with the assumptions here are about labor costs. The author thinks installations can be done with only eight man-hours of on-site labor, for a cost of only $432. This is laughable. This must assume that the crew does not get paid for restocking and loading the trucks, driving to the sites, picking up rental equipment – (which was apparently assumed to be unnecessary), setting up ladders, cleaning up, etc.. And, the reality is that most new construction solar installations require at least two visits to the site, to coordinate solar installation phases with the phases of the construction. Conduit needs to go in the walls after framing and before sheet rocking. Standoffs and roof mounts have to be installed in coordination with the roofing. Inverters cannot be mounted until the finish wall is completed. There is no scenario where a single installer can get these tasks done in four hours in a single visit. New construction just doesn’t lend itself to less than two site visits, which INCREASES the cost, relative to retrofitting, that can be done all at the same time. In the real world, we have to charge more for new construction, due to these added site visits, along with additional staff time to meet with and coordinate with the builder and subs.

And, what about installation support? No one needs to be paid to sit for four hours at the building department to get permits? No one gets paid for materials acquisition and handling? No project managers are needed? No supervisors? No pay for sitting inspections? No required OSHA weekly meetings for safety? No travel pay? No training pay? No warehouse maintenance pay? The reality is that labor costs in the solar industry include a lot of unallocable time – time needed to keep crews well trained, working safely and jobs moving forward – that are not directly assignable to a specific job. These costs are significant, and get spread out over all jobs and cannot simply be ignored, or shoved into profit and overhead.

As far as integrated solar modules, such as roof shingles, it’s important to realize that no manufacturer has been successful in bringing such a product to market profitably. No integrated product in the past has survived more than five years of production before failing, mostly due to a much higher price, and hesitation by both homeowners and installers to take the risks associated with these unproven products that have a consistent history of problems and failure.

There are many other problems with the assumptions here, but the examples given should be enough to debunk the $1/watt myth. I know, for my business, $1/watt for profit and overhead would not be enough to stay solvent, let alone pay for actual job costs. Insurance, building lease costs, labor rates, vehicle expenses are all going up with inflation at a rate faster than the decline in materials pricing and soft costs can offset. The net result is that pricing in the residential sector has been flat for years, and needs to go back up to offset these real world costs of doing business if we are to have a sustainable solar industry. The idea that our installations can be done at less than a third of present costs is not realistic and would lead to a degenerative industry of under trained, under supervised installers who will be hastily installing the cheapest, lowest quality junk they can find.

Is this where we want to see the industry head? No doubt many will enter this fray. But, for my company, we will stick to our tried and true practice of serving our customers with excellence in all categories, and not just be fixated on lowest price. Assurance that your investment will perform as expected for years to come, and that the company responsible for servicing your warranty will be there for you when you need them, are more important than having a low cost substandard installation installed by a volume discounter.

Besides, there is no need to reach this absurd price point. Even at $3.50+/watt the value proposition is excellent. Almost every bid shows the project being cash positive in year one, and saving many tens of thousand dollars over it’s lifetime. It’s totally doable, with quality equipment, well trained staff and the security of knowing your installer will continue to be around to be your partner in power production for the life of the system. We will not be joining this race to the bottom.

> those who disagree with his assessment “come off as sour grapes”

This is aimed more toward the economists who say residential solar power is terrible relative to utility scale. Less so for those who are going to criticize the article. Point taken though.

> modules at $0.35/watt

While it is a viable point that people are losing money at this price, its a real price – and the price will go lower. As panel efficiency continues to increase, panel price per watt will continue to fall.

> The author thinks installations can be done with only eight man-hours of on-site labor, for a cost of only $432.

https://recordsetter.com/world-record/install-residential-solar-photovoltaic-system/17463

> No one needs to be paid to sit for four hours at the building department to get permits? No one gets paid for materials acquisition and handling? No project managers are needed? No supervisors? No pay for sitting inspections? No required OSHA weekly meetings for safety? No travel pay? No training pay? No warehouse maintenance pay?

No, there won’t be a single person who has to sit at the building department for the solar permits. The reason being is that permits will done as part of the whole house permits that are already being paid for. Solar person comes out to do install only, not run to AHJ. And all those other payment types – the house building industry already figured out how to manage those costs inside of their current structure at far lower costs than the solar industry.

John Weaver – your response is fair on some points, but “Some academics, intellectuals, and other garden variety wonks have decried this move because it doesn’t align perfectly with their espoused pet framing” – struck me as a bit shill. My “pet framing” is we should set the problem as “reduce carbon to zero” – so requiring spray foam and all-electric homes might be a much better policy than requiring a minimal amount of solar per home (3kWh seems to be the number – an all in house with transportation is likely to be 5-7kWh). So if focusing on the actual problem we are trying to solve (and I love me some PV) is pet framing, well, better put Benji in the frame.

“The author thinks installations can be done with only eight man-hours of on-site labor, for a cost of only $432. This is laughable.”

What is laughable is that you don’t have it already. I’ve seen 30 kWp turnkey systems in my country with ~$1000 equivalent of labor costs. You Americans are shooting yourselves in the foot willingly while the world is leaping ahead.

John – Five thumbs up (if I had them) for your abrupt reality discourse of the real world solar installation costs. This author is a rose-glasses-optimist who claims he is an “installer” yet is so obviously naive in the real world of business. I suppose his childish name calling and devious twisting of logic will be heaped upon us for disagreeing with him…

I am also an installer (just got off of the roof 3 hours ago) who is running a real business with real world costs. Doing it for the past 22 years. We could go on with the complexities of running a business, but I doubt the Pollyannas (spelling?) of solar advocates would never comprehend these real cost things until they try walking in our moccasins and try starting up their own solar business (which might last a full year and leave them bankrupt). Go for it!

There is no reason the neighbor next door can’t sell his excess kilowatts tp folk other than the Utility.

Most homes in The West are built very very close to each other. A good heavy duty cable would reduce the cost of electricity to $0.015 per k/w and both neighbors would benefit.

Any arguments out there? – Other than the California Public Utility Commission.

There is no such thing as k/w. I appreciate your advocacy but it is diluted to water by not knowing the basics. The relevant units in this discussion are kW and kWh

I wonder if this policy will open the door towards a DC wired home that takes better advantage of the native energy production of solar.

I think that argument is over. Almost all electronic devices including LED bulbs depend on AC. If you want to go UP in voltage or DOWN you must have AC.

Bullshit sales pitch by a modern day snake oil salesman!

Well done. One could see the Mathias statement is a little harmonious with the suade shoe salespersons selling Partial Pie in the Sky.

Wait a few more years and one will be able to purchase solar ON A FOOTAGE

BASIS FROM Lowe’s or. Best Buy

I am not a fan of California politics, but I do think the decentralization of electrical networks is a step in the right direction. Anything that gives individuals more autonomy and control over their own domain is a good thing.

Lets hope this is just not an underhanded effort to get home owners to build the electrical grids, while power hungry electric companies and politicians reap the benefits. The true measure of that will be if legisilation doesn’t prevent home owners from operating their PV system autonomously. You know, that standard “safety” BS… because the minions are not intelligent enough to keep from hurting themselves?

I have my doubts that California can pull this off correctly. Thats ok though, hopefully the rest of the Nation will learn from their mistakes and benefit from it.

$1.5 a watt is probably a more realistic price for the near term, but the gist of the article strikes true: the CEC way over-estimated costs for 2020.

I’m no solar expert, but where do you get electricians for $38 / hour! That’s a total joke. Please send me their contact info. I’d like to hire them.

Makes me very skeptical of all the other numbers.

I have been working in photovoltaic solar for over 20 years, and I think this blanket policy is a bad idea because the purpose of a home is to create a living space that typically includes shade, while the purpose of PV modules is to be generate power and they cannot do that effectively when shaded. I am a proponent of passive solar home design, and community or utility-scale solar, and would much prefer to shade my house with a deciduous tree than to cut the tree (mine or my neighbor’s) down so that my “required solar” could perform its function. This is not “sour grapes”… this perspective comes from basic engineering design principles.

What happens at night when the sun doesn’t shine? How is the home getting power at 9pm on a hot steamy night?

That depends on whether we are talking about the near future (say 2020) or farther scenarios where renewables are meeting a higher portion of electricity demand.

Solar is not currently meeting all of the electricity demand in California and these homes will still be connected to the electric grid, where are other sources of generation. Some of these, like hydro and gas, offer varying degrees of flexibility and are “ramped up” in the evening. Additionally, California imports a large amount of the electricity that its residents use, and more in the evenings.

As more solar comes online, there is an increasing emphasis being placed on battery storage. Current lithium-ion (or other) battery technology can allow solar generation to meet evening demand.

How very high penetrations of solar and wind (80%+ of demand) will work on large grids is currently a theoretical subject, as no nation or nation-sized grid known to pv magazine staff is there yet, although Denmark is getting relatively close. This should be an easier issue to solve in places like California, where solar output varies less on a seasonal basis, but the details of how that will happen is beyond the scope of the comments section of this article.

@ John Weaver- Where in the US can one buy modules at $0.35/ watt? Or are you expecting that price point in the next 10 years?

Even when module prices were lower, before the tariff scare, even foreign made modules where no where close to that price, even for a high-volume direct purchaser.

This I think is a valid point, but if we’re going ‘high end’ – we’re going to 50¢/W LGs that a national buyer can get at a great price with a contract rate. If we’re going ‘cheap’ – big buyers can get at 40¢/W. By 2020 – the Section 201 tariff will have faded to 20%, and prices will have fallen, efficiencies increased, etc – prices are back to 35¢/W.

I do note that supply chains costs are 15% – that adds to the price of modules. Those supply chain costs will be higher for one off home builders. But not national buyers aiming for the cheapest shipping container from Yingli’s docks at the end of the month.

California paving the way and leading the green-energy movement in the states. How do these panels fare against strong winds and heavy rains?

The south orientation for houses was recommended by Socrates. It’s also implicit in Chinese Feng Shui IIRC.

Pvinsights gives a current price for a multicrystalline PV module as 25.2 US cents per watt. I assume their prices are fob major Asian ports. 35c/watt cif San Diego looks more than generous.

I’m sorry, but the assumptions made in this article are obscenely incorrect. I’m not sure if I’m more disappointed in the author for what appears to be a complete lack of understanding of CA New Home solar, or PV-M for publishing it and continuing to reference it. (I missed it the first time around, revived recently in the RUN article, it’s now (disappointingly) likely to get a few more reads.) I caution anyone drawing conclusions from this article to seek other sources.

CBD exceeded my expectations in every way thanks . I’ve struggled with insomnia on years, and after infuriating CBD because of the from the word go time, I for ever knowing a complete evening of restful sleep. It was like a force had been lifted misled my shoulders. The calming effects were gentle yet profound, allowing me to inclination free obviously without sensibilities punchy the next morning. I also noticed a reduction in my daytime anxiety, which was an unexpected but welcome bonus. The cultivation was a minute earthy, but nothing intolerable. Blanket, CBD has been a game-changer for my siesta and uneasiness issues, and I’m thankful to keep discovered its benefits.