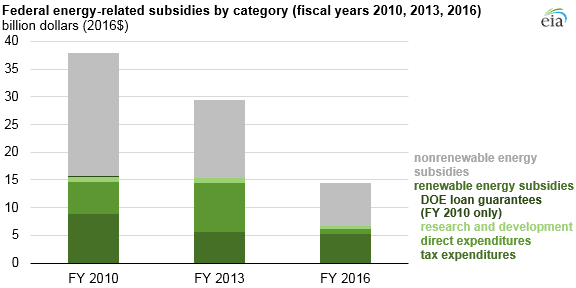

According to a new report by the U.S. Department of Energy’s Energy Information Administration (EIA) the cost to incentivize the massive volumes of solar power being installed in the United States is falling aggressively. In the years for this report, specifically 2013 versus 2016, we saw solar power almost triple in volume deployed, while the cost in tax incentives for those projects fell by almost 50%.

In the third edition of Direct Federal Financial Interventions and Subsidies in Energy, Fiscal Year (FY) 2016, EIA spells out a primary goal of helping ‘people understand energy market interventions, specifically federal tax and direct expenditures that support various parts of the U.S. energy system’.

It is not clear if the report accounts for all financial benefits that flow from government to various energy industries. In particular, the billions of dollars that the Department of Energy spends annually on nuclear waste disposal, insurance, cleanup and various forms of picking up the tab for the nuclear industry are typically not classified as subsidies. However, it does clearly show federal renewable energy subsidies.

In the renewable energy support category above, we see that direct expenditures by the Federal Government have fallen to less than 10% of their 2013 numbers. This money is mostly part of the 2009 Recovery Act. Through the program more than $31 billion was spent in many types of projects: grid modernization, electric vehicles, renewable energy, broader advanced research and more. A rough list can be read here.

This included a number of solar-related projects:

- The world’s largest photovoltaic solar plant (Agua Caliente)

- Two of the world’s largest solar thermal projects that will double the amount of solar thermal

power in the U.S. (Abengoa Solar Inc. and BrightSource Energy, Inc.) - The world’s largest wind farm to date (Caithness Shepherds Flat in Oregon)

- Supported nearly 3,800 jobs last quarter alone (Oct-Dec 2011)

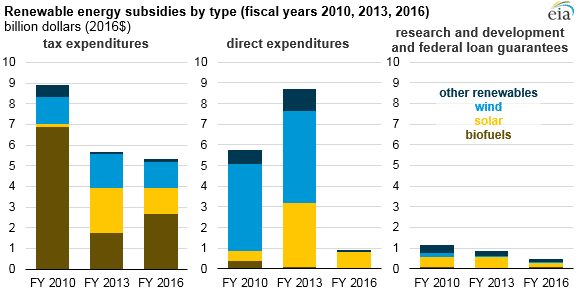

Of the roughly $6.7 billion spent on renewable energy in 2016, 80% came via tax benefits versus loans and grants from the past programs. Tax benefits were the large majority of spending on renewables at about $5.6 billion of the $6.7 billion, and 51% of this went to biofuels.

Most of the incentives for wind and solar went to commercial wind and solar installations from the Production Tax Credit (PTC) and the Investment Tax Credit (ITC). The PTC provided an inflation-adjusted tax credit worth 2.4¢/kWh in 2016, while the ITC provided a deduction equal to 30% of facility installation costs. EIA estimates the PTC and ITC credits taken in FY 2016 at $1.4 billion and $1.2 billion, respectively.

According to this analysis, the cost of the greatest federal subsidy for solar, the 30% tax credit, has fallen by almost 50% since 2013. This speaks specifically to the falling price of solar power as the tax credit is directly based on project costs, and not system sizes.

Considering the solar power industry installed approximately 15 GW of solar power in the United States in 2016, roughly $25-30 billion worth – it seems as though $1.2 billion in tax credits does not fully represent 30% of the installation costs. Assuming that all systems claimed the ITC, this would represent more like $7.5-9 billion of tax credits against a 15 GW installation volume, given 2016 installation costs.

Research and development funding for renewable energy totaled about $850 million in 2010 and 2013 – in 2016 it dropped to $450 million. No federal loan guarantees for solar were provided in 2016, and in recent years the program has helped to finance nuclear and fossil fuel projects, not renewable energy.

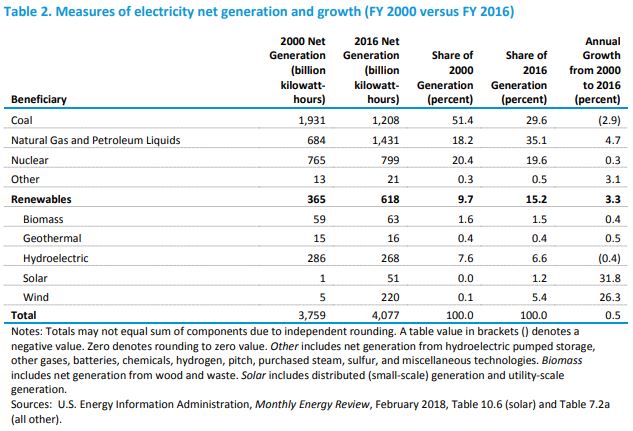

The above chart was found in the report that this EIA article is based upon. In it we see total amounts of electricity produced in the year 2000 versus 2016. Specifically highlighting solar and wind power, annual growth during this period was 32% and 26%, respectively. The values for solar power accelerated past the averages in both 2016 and 2017.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.