2016 has been a rough year for the solar industry. Low oil prices, a crash in Asian markets and the collapse of SunEdison started the year off badly, and while these factors are still having an impact on the industry, many companies are now suffering from a new set of problems.

“The combination of slower than expected U.S. demand, the overcapacity situation coming out of China, and global hyper-competitive auctions leading to lower margins has affected the entire supply chain and most of the solar equities are in the red year-to-date,” states Mercom Capital CEO Raj Prabhu.

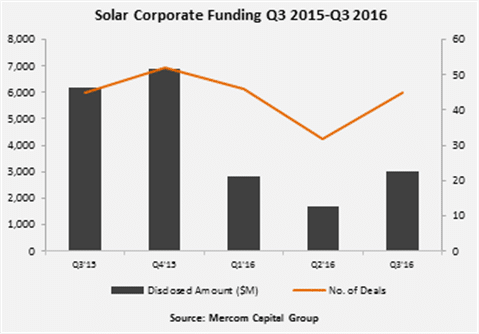

Looking at all categories together, Mercom Capital’s newly released Q3 Solar Funding and M&A report shows $3 billion in corporate funding solar solar during the quarter. This is a 76% increase over the $1.7 billion figure from last quarter, but as this was the worst quarter in three years it is still around half the levels of a year ago.

This holds true for most categories of funding. Public market financing returned to $880 million in five deals during Q3, including one IPO, a dramatic increase from the $179 million in Q2 but less than half the level a year ago. Debt financing was also up 38% sequentially at US$1.8 billion in 24 deals, but again less than half the volume in Q3 2015.

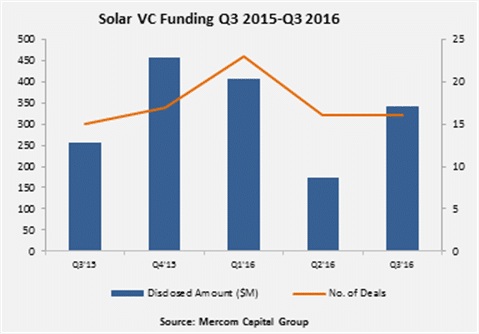

Exceptions were venture capital funding, which is up nearly 40% year-over-year to $342 million in 16 deals. This was heavily impacted by the $220 million raised by residential solar loan company Solar Mosaic, which has pioneered a solar finance model which it likens to crowdfunding.

Distributed solar project funds also continue to attract capital, but the amount that they have raised dipped slightly from a high in Q2. Mercom reports that residential and commercial funds raised $1.1 billion in five deals during the quarter, compared to $1.36 billion last quarter.

Mercom notes that yieldcos have been another bright spot, as some of the only stocks whose valuations have increased year-over-year. “They are coming back a little bit, even though SunEdison is bankrupt,” Prabhu told pv magazine. “That is a sign that certain areas are recovering.”

These yieldcos continue to sweep up projects, and were responsible for some of the larger project acquisitions during the quarter. Notably, NextEra Energy Partner’s $218 million acquisition of a 24% stake in the Desert Sunlight project the largest reported project M&A transaction during Q3.

In that vein, project finance remains strong. All of the deals in Mercom’s list of the top 5 large-scale solar projects funded during the quarter are above $100 million, with Magnetar Capital raising $397 million to refinance its portfolio of 135 MW of UK solar projects.

However, Mercom notes that overcapacity and falling prices are spelling trouble for manufacturers. “Most of the manufacturers were in positive territory at the end of last year,” notes Prabhu. “I look at it today, year to date, most of them are negative. The dynamic has changed.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.