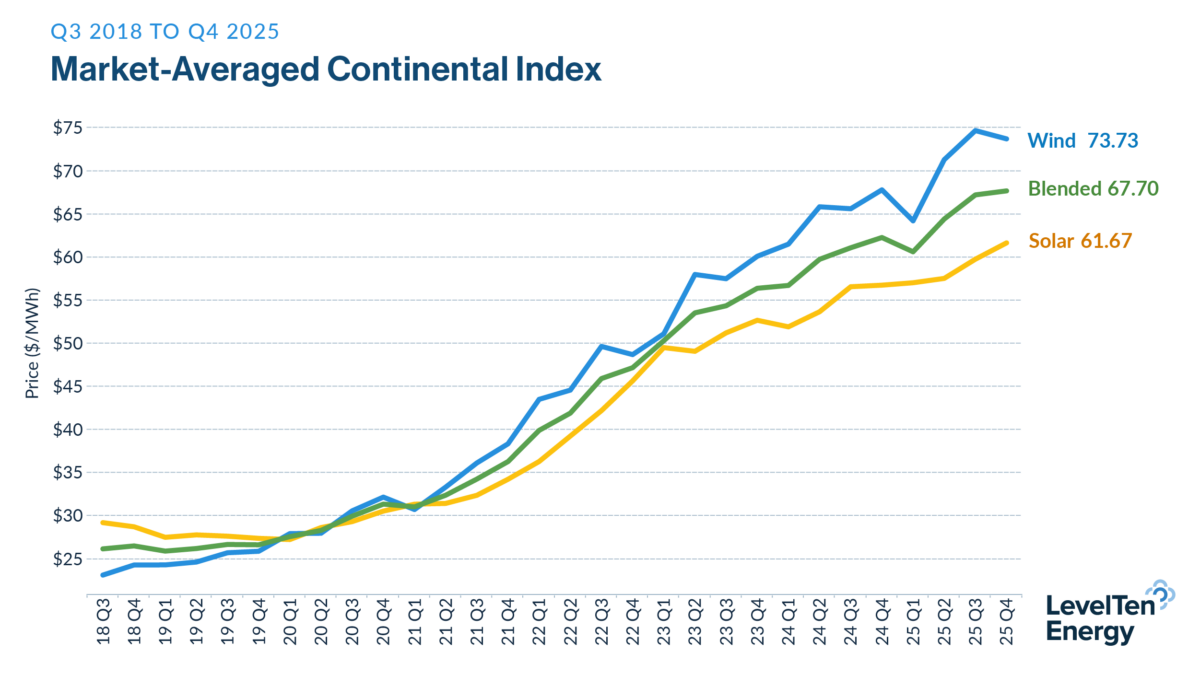

Renewable energy power purchase agreement (PPA) prices continued their upward trajectory in the final quarter of 2025, driven by persistent policy headwinds and a shifting tax credit landscape.

According to the Q4 2025 PPA Price Index from marketplace operator LevelTen Energy, solar P25 prices rose by 3.2% following a 4% increase in the third quarter.

While solar costs climbed, wind PPA prices saw a slight dip, declining 1%. However, on an annual basis, both technologies have seen prices surge by nearly 9% compared to the same period last year.

Post-OBBBA

The market is currently adjusting to the “One Big Beautiful Bill Act” (OBBBA), which introduced tax credit cuts. LevelTen noted the second half of 2025 was defined by “ruthless” prioritization as firms scrambled to safe-harbor projects.

Despite these challenges, a November survey of developers representing over 230 GW of capacity found that more than 75% of projects slated to go online before 2029 expect to successfully retain access to tax credits.

This clarity has allowed some developers to dial in pricing by removing risk premiums that had previously accounted for OBBBA-related uncertainties, said the report.

Regional pricing

The report highlights significant price disparity across North American ISOs. For solar, P25 prices reached as high as $115 per MWh in ISO-NE and $81.03/MWh in PJM, while ERCOT remained the most competitive at $49 per MWh.

| ISO Market | Solar P25 Price ($/MWh) |

| ISO-NE | $115.00 |

| PJM | $81.03 |

| MISO | $64.95 |

| CAISO | $62.00 |

| ERCOT | $49.00 |

In the wind sector, ERCOT has seen a massive 19% year-over-year price hike, fueled by an ongoing boom in data center development and a premium on available capacity.

Buyer headwinds

LevelTen pointed to several factors that could continue to apply upward pressure on prices:

- Tariff uncertainties: Ongoing Section 232 investigation tariffs are adding direct development costs.

- Permitting hurdles: “Harsh” new federal permitting procedures have stalled substantial amounts of development nationwide.

- FEOC: The industry is still awaiting guidance on Foreign Entity of Concern (FEOC) rules, which are expected to add compliance costs and further complicate tax credit qualification.

Corporate strategy

Many corporate buyers are now pausing or adjusting their procurement strategies due to proposed updates to the Greenhouse Gas Protocol (GHGP) Scope 2 standards, said the report. The updates, expected to be finalized in 2027, may introduce more stringent accounting for hourly matching and physical deliverability.

“The current uncertainty has caused some buyers… to adjust or even delay their procurement strategies,” the report said.

LevelTen encourages industry players to weigh in on the proposal, as 97% of companies tracking emissions currently utilize the GHGP.

As buyers and sellers work to establish a “pricing equilibrium,” the report said in markets where contract values are challenging, sellers may need to find more transactable pricing levels to get deals done.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.