Crux released the report Corporate Taxpayer Participation in the Transferable Tax Credit Market finding that since the advent of tax credit transferability, tax credit investment has become an “increasingly standard practice” for all company types and sizes.

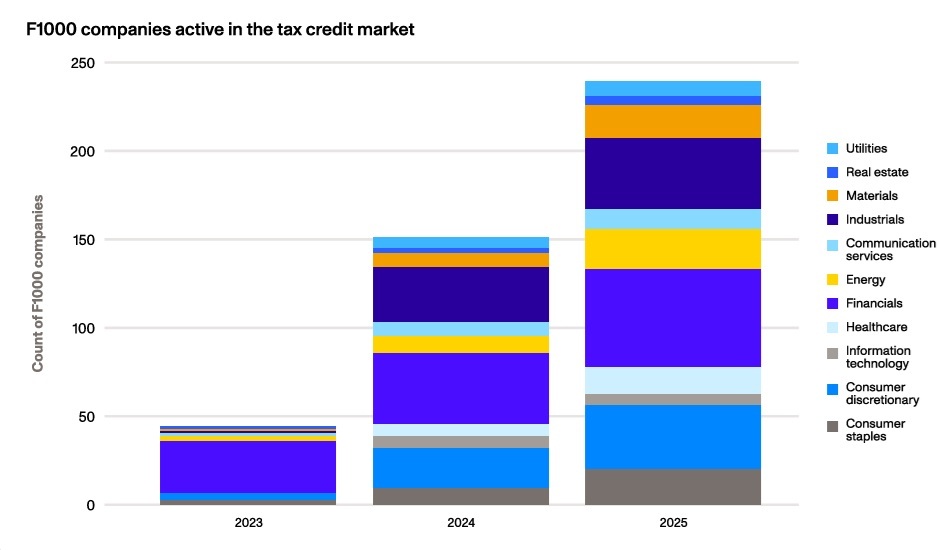

An estimated 243 firms of the Fortune 1000 (nearly 25%) have been active in the tax credit investments in 2025, which includes tax credit purchases and tax equity investments, the company reports. This represents a 60% increase over 2024 levels.

Crux is a sustainable finance technology company that assists with financing clean energy and decarbonization projects, starting with transferable tax credits. The report is based on Crux’ dataset along with publicly available earnings reports.

The report finds that small- and mid-capitalization corporate taxpayers are purchasing tax credits using what it calls “a relatively simpler structure” than the precedent tax equity structure, which is still used by a set of large-cap corporations and financial firms. Large-cap investors make up the majority of purchasers (63%); however, Crux notes that the share of medium and small investors participating in the tax credit market is increasing.

Transferability lowered barriers to entry for small buyers, Crux finds, and developers can now transfer smaller volumes of credits to match corporate tax liabilities for these smaller companies.

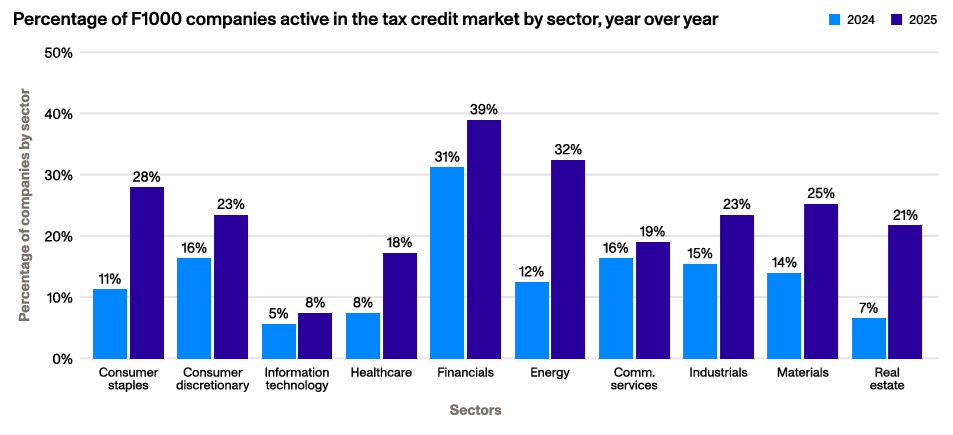

The chart below shows that the financial sector has the highest rate of representation; however, participation rates rose for every industry group.

The energy sector follows closely due to energy companies having high U.S. tax liabilities that lead to strong and recurring demand for credits. The report notes that many energy companies experience earning volatility and use tax credits to smooth annual tax positions. Another factor is that the energy sector sees less risk in investing in tax credits because it is familiar with the concept of clean energy tax credits.

Interestingly the energy sector’s tax credit investment grew 20% over 2024, which is the greatest rate of growth of any sector.

Companies of all sizes that invest in tax credits report effective tax rate (ETR) nearly 3% lower than those who do not participate, the report finds. Crux states that the reason for the lower ETR is because “tax credits are purchased at a discount to face value but reduce federal tax liability on a dollar-for-dollar basis”.

Companies report that the cash savings supports dividends and distributions, reinvestment in the business, and other objectives.

Near-term uncertainty around corporate tax liability caused by the One Big Beautiful Bill (OBBB) has generally reduced prices for tax credits, the report noted, creating opportunities for tax credit buyers to achieve even more significant savings. Crux finds that participating in the tax credit market has become almost an essential element for organizations to remain competitive within their respective markets.

A few of the many benefits of tax credit transferability include:

- Purchasing at a discount creates immediate, predictable financial value.

- For buyers with sufficient U.S. tax liability, it is a cost-effective way of lowering cash tax payments and improving quarterly or annual tax efficiency.

- Tax credits can be incorporated into existing tax-provision and estimated-payment processes with relatively little operational disruption.

- Purchasing credits allows companies to smooth tax profiles.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.