The U.S. Congress is actively debating repeal of solar and wind tax credits, including the Investment Tax Credit, which covers 30% of installed system costs, and the Production Tax Credit, which subsidizes renewable-sourced electricity generation.

Despite the blow that tax credit repeal would deal to renewable energy project values, analysis from Lazard finds that solar and wind energy projects have a lower levelized cost of electricity (LCOE) than nearly all fossil fuel projects – even without subsidy.

LCOE is a measure of cost-efficiency of generation sources across technology types. The metric is based on lifetime costs divided by energy production and calculates the present value of the total cost of building and operating a power plant over an assumed lifetime.

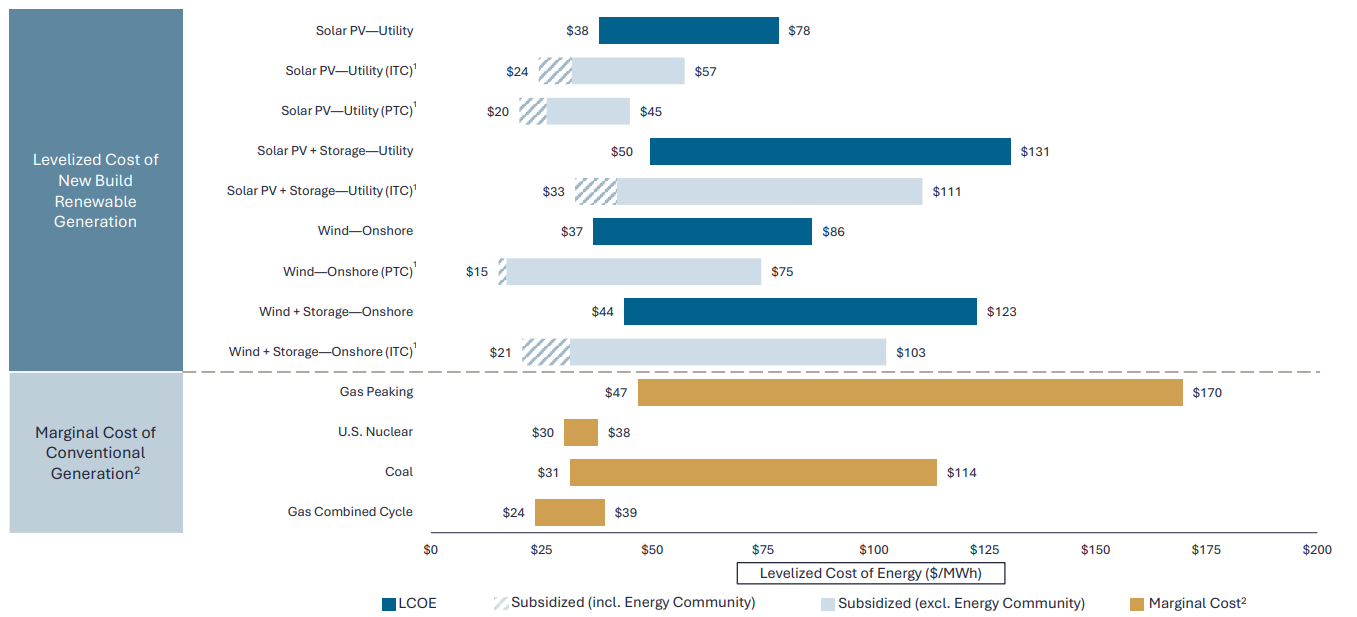

Lazard’s analysis finds that unsubsidized utility-scale solar, without tax credits, ranges from an LCOE of $0.038 per kWh to $0.078 per kWh, while onshore wind registers the lowest possible LCOE over the narrowest range, from $0.037 per kWh to $0.086 per kWh.

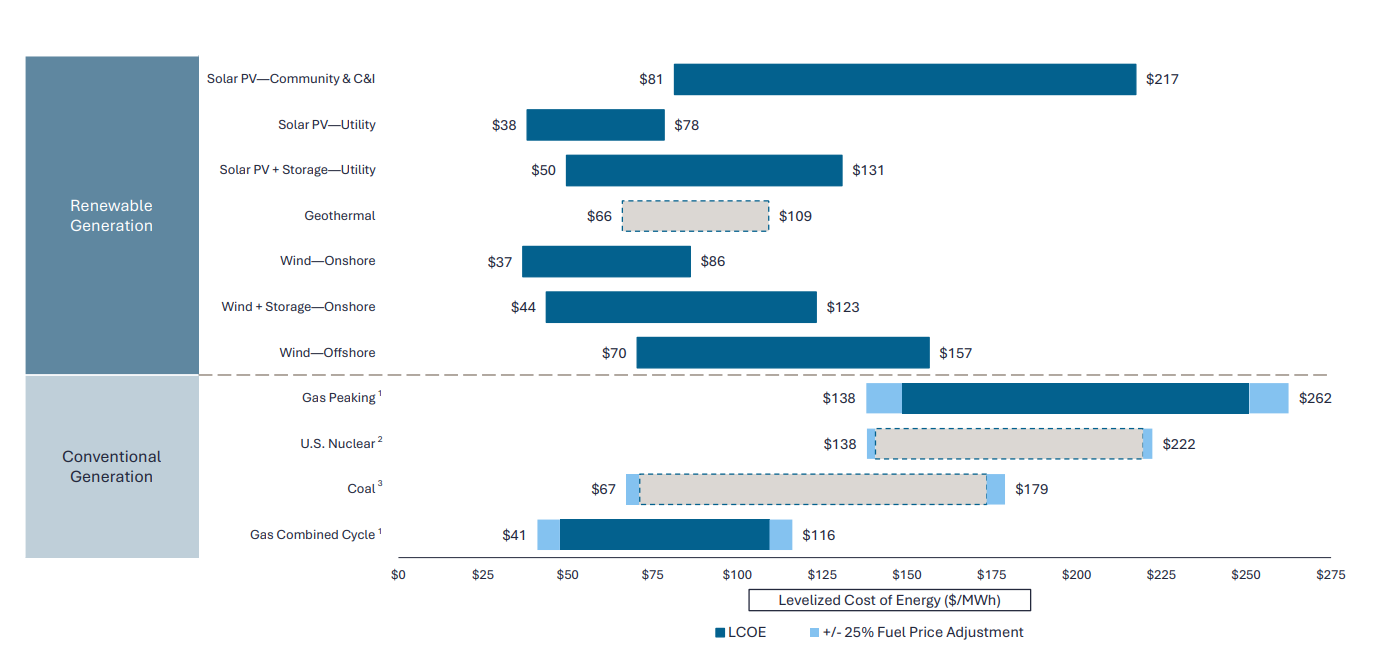

Utility-scale solar with energy storage co-located ranges from $0.05 per kWh to $0.131 per kWh, while natural gas peaker plants are far more expensive at $0.138 per kWh to $0.262 per kWh, accounting for a plus or minus 25% fluctuation in current gas prices.

With subsidies included, the cost advantage is even stronger. Utility-scale solar is as inexpensive as $0.02 per kWh, while onshore wind is as low as $0.015 per kWh.

Notably, these two subsidized lowest-cost technologies are cheaper than the lowest-cost marginal cost of fossil fuel, meaning that the most cost-effective combined cycle natural gas plants that are already built and operating are more expensive electricity generators than new-build solar and wind.

This solidifies solar and wind power’s ability to be a replacement technology, rather than a complementary source of power. However, the Investment Tax Credit and Production Tax Credit are currently needed for new-build renewable energy to beat the marginal cost of the cheapest sources fossil fuels operation, underscoring their importance to accelerate the energy transition to decarbonized sources.

Lazard’s analysis makes it clear, however, that even without tax credits, solar and wind are more cost-effective than new-build gas and coal, making them a more sensible investment for the U.S. power sector.

What’s more, Lazard finds that gas, coal and nuclear projects are more sensitive to the cost of capital, suggesting that the higher-for-longer interest environment further supports renewable energy investment.

“On an unsubsidized $/MWh basis, renewable energy remains the most cost-competitive form of generation. As such, renewable energy will continue to play a key role in the buildout of new power generation in the U.S.,” said the report. “This is particularly true in the current high power demand environment, where renewables stand out as both the lowest-cost and quickest-to-deploy generation resource.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Very good article especially important in todays politics. Facts over misinformation. Anither interesting sector is wholesale coal costs of .10 to 13 kwh. AI fact checked coal vs renewables with your analysis dead on. Coal will increase utility costs, cause more pollution in surrounding cities 100s o of miles away from their facilities. Astma will rise affecting children and senior’s.

A sociopath running our country.

The real cost of wind and solar need to include where the power will come from when the sun does not shine or the wind does not blow. This analysis neglects to include the effects of this issue! Basically the effects of wind and solar The realistic cost savings are the cost of the fuel that is avoided. This needs to include the cost to have NG plants on line ready to pick up the load when the solar and/or wind becomes not available.

If you want to get in rapid solar deployment, just mandate solar canopies on ALL existing large hot asphalt parking lots within 5 years. That’s what France has done. France, the country with the highest % of nuclear generation in the world.

Here in the US, there’s a glaring mismatch between the self interest of relatively wealthy owners of leased residential & commercial properties with large parking lots and their tenants, who pay the utility bills. We have already made generous IRA investment incentives for solar development available to wealthy property owners & investors with big parking lots. But we haven’t required them to use it.

But this short-sighted investment “calculation” ignores the obvious micro grid synergy of solar canopies shading hot asphalt parking lots, with non-flammable on-site BESS and Vehicle-2-Grid chargers that generate, store & redistribute the cheapest renewable energy right where most utility rate-payers live, commute & work. No new utility transmission, interconnection, site acquisition, or other site improvement spending required. These benefits are so obvious to the owners of new health care facilities in my county, they’ve already covered 80% of their parking with solar canopies. They get it.

the article refers to generated cost problem comes in when you have to figure in non generated cost. solar and wind are not a 24/7 generator of electricity.

That cost is included in the research. Go read the report, it’s linked. It is extremely detailed, and they estimate the entire cost over the lifetime of the plant. “unsubsidized utility-scale solar, without tax credits, ranges from an LCOE of $0.038 per kWh to $0.078 per kWh, “- “Utility-scale solar with energy storage co-located ranges from $0.05 per kWh to $0.131 per kWh”. Co-located storage (batteries) means the plants don’t require other power plants to pick up the slack for intermittency. They call it spinning and non-spinning reserves, and it is priced into the figures. So even a plan built with the battery storage capacity to avoid taking energy from other spinning reserves (like gas plants) is cheaper than gas. They also expect massive decreases in the cost of storage over the coming years. Over the lifetime of the plant, solar is a better investment and it is already easier for countries with the solar potential to get financing for solar projects. Lazard are a huge investment banker, not a bunch of hippies. They only care about the profitability and sustainability of an enterprise.

This is all correct, and I agree we do need much more solar and wind rolled out.

However, these costs do not capture the big picture. Today, the cost per kWh is very competitive, and we should continue to roll out more. In the future, the “cost of renewables” will increase dramatically, since it will rely on a combination of more onsite battery storage (24 hour storage), and offsite, fossil fuel peaker plants.

Our grid as a whole needs to have ~99.9999% or better reliability, or less than an hour a year on average of downtime. Relying on sun or wind might get us to 99% or 99.9$, but cannot the extreme reliability we have come to expect.

High reliability, fuel dense peaker plants with very low annual utilization and extremely high cost per kWh will have to be part of the solution. The sooner we include this in the narrative, the better, lest we be accused of misrepresenting the reality of the situation.

I am tired of people crying about using fossil fuels. If Electricity from the utilities company are so cheap then why does it cost me less to heat my house with propane huh?????

Even better is a new wood stove and that is even cheaper to heat your house.

BTW…… wood aka trees are also a renewable resource.

I like saving green not being told to be green.

But wood stoves are dirty and cause air pollution. This is why they are banned in heavily populated areas. Rooftop solar with batteries and heat exchangers are clean and were affordable while the 30% tax credits are still allowed for 2025.

If solar us cheaper then there shouldn’t be any tax credits. The energy companies will do solar anyway since it’s cheaper. If you give tax credits it will only line the pocket of energy companies at tax payer expense. Let the market dictate the industry.