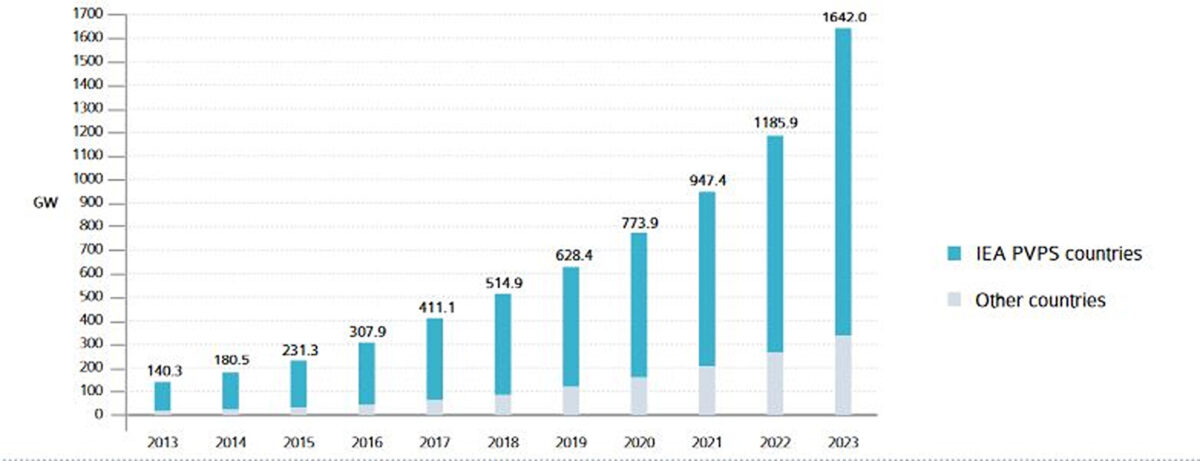

The global PV industry has massively grown in 2023, with unprecedented installation volumes reported throughout the year and even more projected for 2024, according to the “Trends in PV Applications 2024” report published by IEA-PVPS.

Unprecedented PV installations and China’s dominant market

China has spearheaded this expansion, installing an astounding amount of PV capacity to absorb its manufacturing surplus. Chinese installations alone make up over 60% of global PV deployment, a reflection of the country’s aggressive investment in renewable energy as well as its manufacturing capacity to meet both domestic and international demand. The report notes that while China is surging ahead, other regions are experiencing growth at a relatively modest pace, underscoring the concentration of PV power generation within the Chinese market.

Other regions, notably the United States and the European Union, have also shown significant progress, although their rates remain lower than China’s. Countries like Germany, Spain, and the Netherlands in the EU are making notable strides, but they are not yet approaching the sheer scale of China’s efforts. These regional variations reflect differences in policy support, market demand, and the logistical challenges each region faces in scaling PV installations.

Inconsistencies in global PV metrics and capacity estimation

A particular challenge highlighted in the report is the lack of a unified approach to measuring PV capacity globally. Different standards and methodologies, particularly in AC/DC conversion ratios, off-grid volumes, and undeclared systems, lead to estimation discrepancies across regions.

And in some cases, this discrepancy can be vast enough to cause severe measuring ambiguities. In China, for instance, the volume of capacity stemming from centralized AC/DC conversion uncertainties is nearly equivalent to total installations in the entire EU and greater than those in the USA. This discrepancy emphasizes the need for improved standardization in PV reporting practices so that accurate global comparisons and market forecasting can be ensured.

Overcapacity and price declines: navigating market instability

The explosive growth in PV manufacturing has also created overcapacity, leading to a substantial decline in PV prices, a trend that has persisted throughout 2024. While this overcapacity benefits consumers by making PV systems more affordable, it has also placed financial strain on PV manufacturers.

China’s overcapacity has intensified competition, particularly in the EU, where prices have fallen sharply due to surplus Chinese products targeting the European market after fulfilling domestic demands. The USA and India have somewhat shielded their markets from this impact due to protective measures, highlighting the disparities in PV market openness and competitiveness.

Moreover, manufacturers globally, including those in Europe and China, are increasingly struggling as older production lines become less competitive in the current market landscape. Many manufacturers are opting to pause or close older production lines, reducing operating costs in response to thin profit margins. This consolidation reflects a maturing industry where only the most efficient manufacturing lines remain operational, pushing companies toward technological innovation and cost efficiency.

Distributed PV growth and improved grid efficiency

The report indicates that more than 40% of PV installations are distributed systems located directly at the consumption point, minimizing energy loss compared to centralized power sources. PV’s distributed nature allows it to serve local communities effectively, reducing transmission and distribution losses within electrical grids.

For this reason, PV is projected to account for 8.3% of global electricity consumption in 2024, up from 5.4% of total production in 2023, highlighting PV’s efficiency in delivering electricity to consumers with minimal loss. This distributed setup means that PV is in an excellent position to meet rising global energy needs with greater efficiency.

Rising PV penetration and the shift from marginal to baseline power

An increasing number of countries are reaching high levels of PV penetration, with approximately 20 countries with higher PV penetration rates of over 10%. This shift indicates PV’s progression from a supplementary power source used primarily for peak demand to a reliable source of baseload power.

The implications of this shift are substantial: PV is no longer just a means to offset peak electricity demands but is now displacing traditional baseload generation methods, reshaping electricity grids, and influencing energy policy and market dynamics.

Environmental impact and CO₂ avoidance

Reflecting PV’s shifting role in electricity grids, the report’s methodology for calculating avoided CO₂ emissions has evolved. Whereas in past years, PV was considered to offset peak power, it is now increasingly viewed as a replacement for baseload power. This adjustment in methodology reflects PV’s greater impact in high-penetration countries, where it offsets a significant portion of baseload power, rather than just supplementing peak demand.

It is important to stress, though, that the report’s CO₂ avoidance estimates are not definitive studies. Rather, they serve as an illustrative guide for policymakers, industry operators, and end-users seeking to understand PV’s role in reducing emissions and meeting climate targets.

Conclusion: Shaping the future of global PV markets

The 2024 Trends Report offers valuable insights into PV’s transformation from a marginal energy source to a critical component of national energy systems worldwide. The rapid rise of installations, particularly in China, underscores the need for unified capacity reporting standards and raises questions about market stability amidst manufacturing overcapacity and fluctuating prices. As more countries adopt PV at scale, and as its role in supplying baseload power grows, PV’s environmental and economic contributions continue to expand.

For market participants, policymakers, and end-users, these insights highlight both the immense potential of PV and the strategic decisions required to sustain its growth and integration into global energy systems.

Authors: Melodie de l’Epine and Ignacio Landivar

This article is part of a monthly column by the IEA PVPS program.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.