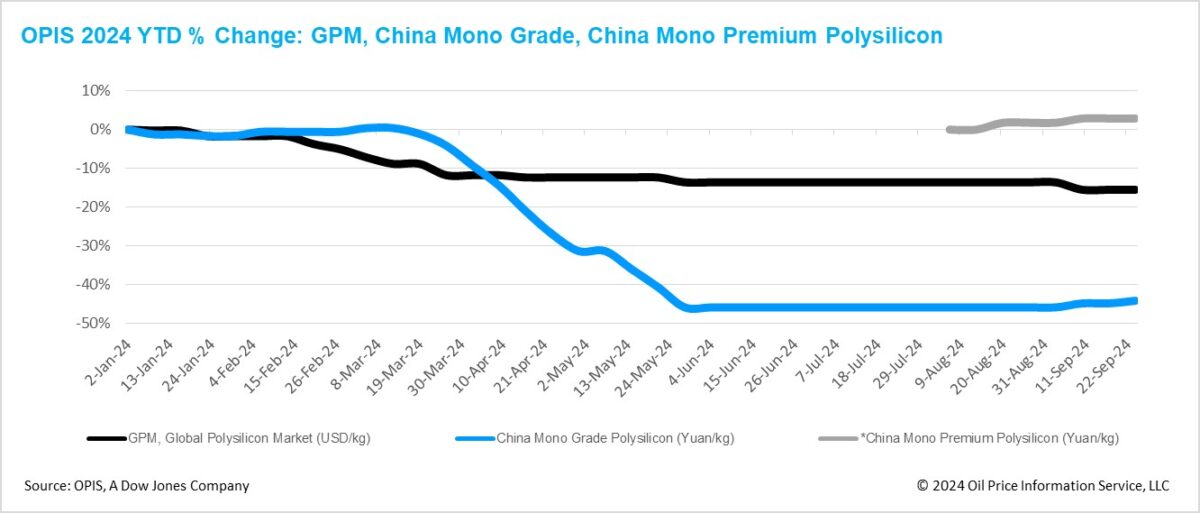

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.068/kg this week, unchanged from the previous week on the back of buy-sell indications heard.

The much-anticipated preliminary ruling from the U.S. investigations into solar cells and modules imported from four Southeast Asian countries has been officially delayed until no later than November 27. The deadline for the final determinations will remain 75 days after the preliminary ruling, though a further extension is possible.

The uncertainty of tariff rates during this period has been described as “dangerous” for global polysilicon suppliers. Reports suggest that suppliers are relying on long-term contracts to maintain price stability and offset financial losses from the first half of the year.

Correspondingly, reports indicate rising purchasing volumes and a reduced push for price negotiations from major global polysilicon buyers, who had previously halted spot purchases and delayed monthly deliveries under long-term contracts. Insiders interpret this as a response to increased legal pressure from suppliers to enforce contract compliance.

Another policy update, though not directly related to global polysilicon, could potentially impact the future layout of global polysilicon capacity. Starting on September 23, the U.S. Trade Representative opened a docket to collect feedback on proposed 50% Section 301 tariffs on polysilicon and wafers from China, with the comment window closing on October 22.

While this has minimal impact on the current international trade patterns in the solar sector, ongoing trade barriers could further encourage the growth of polysilicon and wafer production outside of China, potentially altering the global supply and demand dynamics for polysilicon.

China Polysilicon: China Mono Grade, OPIS’ assessment for mono-grade polysilicon prices in the country, remained steady at CNY 33.625 ($4.80)/kg this week. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for N-type ingot production, likewise held steady at CNY 40.125/kg, unchanged from the previous week.

Market insiders generally agree that polysilicon prices in China have bottomed out and are now expected to experience slow, intermittent rebounds. However, these increases are driven more by commercial strategies than by supply-demand dynamics. Major producers may reduce their financial losses, while less competitive producers could manage to extend their survival during these potential price hikes.

The process of clearing excess capacity in the polysilicon segment is progressing slowly. Sources indicate that polysilicon production for September is projected to be around 130,000 MT to 140,000 MT, while the estimated wafer production for the month suggests a polysilicon demand of less than 100,000 MT. Furthermore, a major producer is expected to bring new production capacity online in the fourth quarter.

Another challenge in clearing the excess capacity is the likelihood that polysilicon will be officially listed as a futures commodity in October or November. Reports suggest that some traders have begun building warehouses to store goods for futures trading; however, there is little indication that major producers or buyers are actively participating in this development.

The current excess inventory of polysilicon has merely shifted from manufacturers to buyers, and achieving a healthy supply-demand balance in China will take considerable time.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.