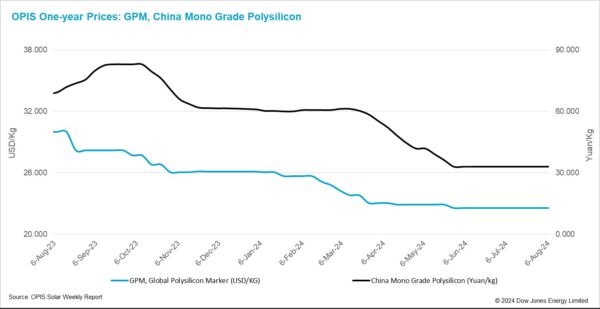

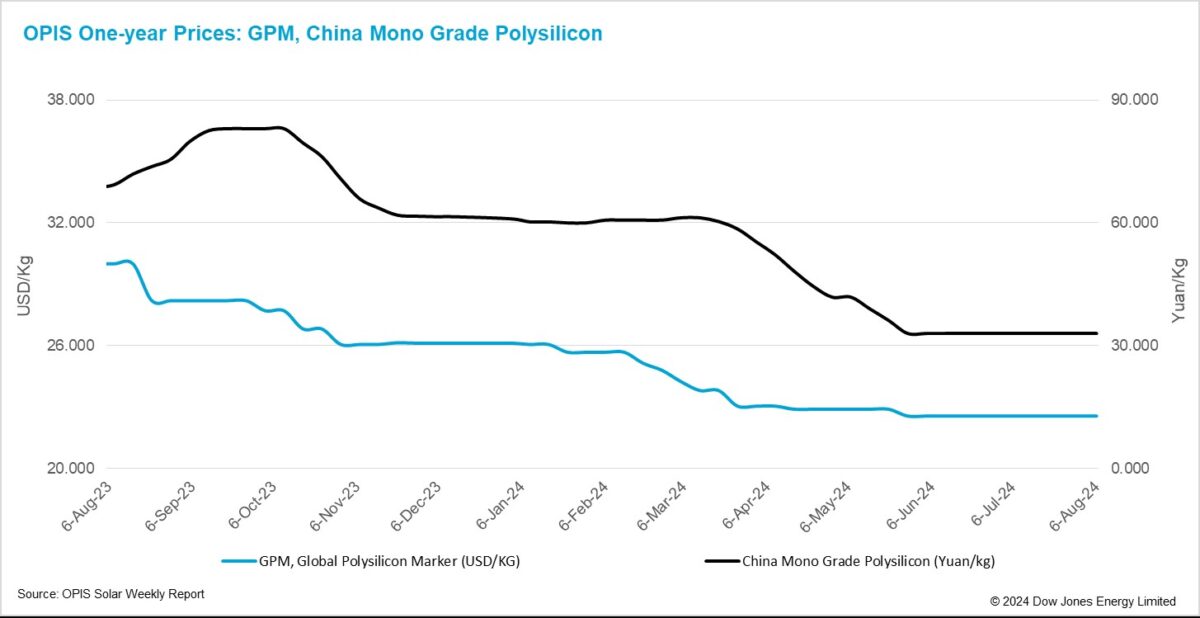

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.567/kg this week, reflecting stable market fundamentals.

Industry insiders in the global polysilicon market are currently upset by the news of a delay in the preliminary ruling results of U.S. investigations into imported cells and modules from four Southeast Asian countries.

According to a source, the deadline for the countervailing duty investigation, originally expected around July 18, has been delayed to September 30. The preliminary results of the antidumping duty investigation, initially expected at the start of October, are now anticipated to be delayed by a week, with the possibility of further extension until the last week of November.

Other sources concurred, with one noting that “being postponed to November is a high probability event.” It is highly likely that the U.S. will wait until after the 2024 presidential election to release the specific results of the tariffs, the source added.

Another industry insider noted that the uncertainty surrounding major integrated manufacturers exporting modules to the U.S. has prompted them to consider every way possible of postponing their monthly purchases of global polysilicon secured with suppliers under long-term contracts during this period.

Uncertainty about the operations of these major enterprises has also intensified as a result. “Given that high gross margins from U.S. module prices are currently the only significant source of potential profitability for supply chain manufacturers, they can’t afford to abandon this market, despite the increasing trade barriers,” said an industry insider. The source added that more module manufacturers are reportedly delivering small module orders by paying a deposit at U.S. customs during this window.

The global polysilicon market is poised to endure another two to three months of a prolonged “winter chill”, a market observer concluded, noting that during this period, minimal price fluctuations are anticipated due to subdued market activities.

A market observer offered a long-term perspective, suggesting that with the support of U.S. trade policies, demand for global polysilicon should remain steady in the coming years. The next major factor likely to influence global polysilicon prices will be changes in the supply-demand dynamics between global polysilicon production and newly established ingot capacities outside of China and the four Southeast Asian countries – a shift that may only become significant after a few years.

China Mono Grade, OPIS’ assessment for mono-grade polysilicon prices in the country, remained steady at CNY 33/kg ($4.60/kg) this week, marking the tenth consecutive week of stability. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for N-type ingot pulling, is reported at CNY 39/kg ($5.44/kg). Sources indicate that Chinese polysilicon manufacturers are still grappling with ongoing production cuts and persistent cash losses.

According to an upstream source, a major Chinese polysilicon producer with an annual capacity of 300,000 mt has scheduled only 13,000 mt for August. Similarly, another leading manufacturer of comparable scale plans to produce 8,000 mt in August.

Recent market consensus suggests that polysilicon prices have bottomed out and are unlikely to decline further, leading to reports of wafer companies and traders beginning to stockpile polysilicon.

According to a market participant, wafer companies are increasing their price inquiries for polysilicon, and some with stable cash flow have expressed intentions to stockpile, although no concrete actions have been observed yet.

“A slight rise in offers from some polysilicon manufacturers has already been seen this week, though this increase has not yet impacted actual transaction prices,” the source added.

Spot and futures traders have also boosted their inquiries concerning polysilicon prices. Multiple sources have disclosed to OPIS that China’s polysilicon is set to be listed as a futures commodity in October. This development could prompt some traders to hoard and build inventories, potentially driving up polysilicon prices.

Nevertheless, according to a market survey done by OPIS, there are still some industry insiders skeptical that listing polysilicon as a futures product will have a major positive impact on price increase.

“Given the current supply and demand scenario, I believe that listing polysilicon as a futures commodity will not result in a major increase in pricing, as the difficulty of driving up polysilicon prices is matched by the challenge of reducing polysilicon inventory,” a market source commented. “At the moment, the polysilicon inventory of 200,000 to 300,000 mt is massive, and it is improbable that all of it would be hoarded by dealers; not to mention that polysilicon production is still ongoing.”

Another market source offered a different perspective, noting that the success of listing polysilicon as a futures commodity also hinges on support from major polysilicon producers. If current low prices persist, these leading producers could potentially drive smaller competitors out of the market. However, listing polysilicon as a futures commodity might absorb surplus production capacity, potentially leading to a price rebound and providing a lifeline to smaller producers – a scenario that major producers are currently hesitant to support.

In the early stages of listing a product as a futures commodity, market operations are often underdeveloped, a market veteran commented, adding that this is particularly true for polysilicon, a product with only a few market participants and easily manipulated prices. “Given the current inactivity in the polysilicon market, it may not be an ideal time for a futures commodity launch, thus a major price shift is not predicted,” the source concluded.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.