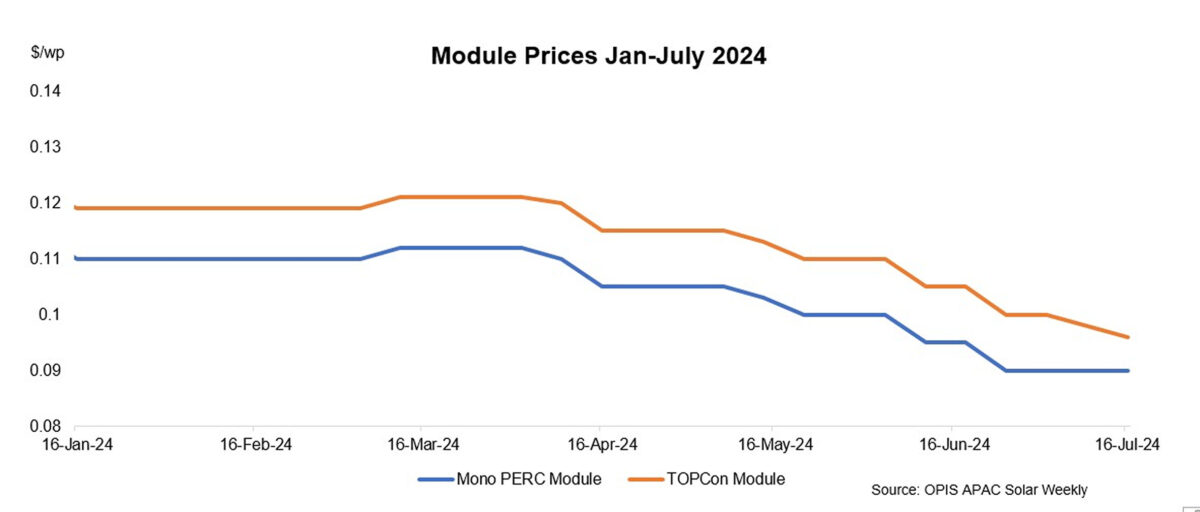

Prices in the module market were assessed stable-to-soft for the second consecutive week. The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China was assessed at $0.096/W, down $0.002/W reflecting discussions heard while Mono PERC module prices were assessed stable at $0.090/W from the previous week.

The TOPCon market was rather “chaotic” in the week to Tuesday with prices heard in a wide range. Some Tier 1 module manufacturers continued to offer cargoes at $0.100/W FOB China while lower offers from Tier 2 and Tier 3 module sellers had emerged at $0.085/W FOB China. These low prices were “distorting” the market and creating a false impression that mainstream TOPCon prices had rapidly fallen so low in a short period of time, a market source said.

Market participants OPIS surveyed expected further declines in TOPCon prices in the coming weeks as module makers compete to secure new orders and clear inventories. Although module makers are already burning cash and there is a limit to how much lower prices can fall, Tier 1 players are in a better cash flow situation compared to the smaller players in the market. However, several big players have already announced losses in the first half of the year and if this vicious cycle of non-stop price war continues, the industry will start to see a market consolidation very soon, an industry source said.

Business has slowed considerably with buyers enquiring for smaller volume of cargoes compared to before and sales performance this quarter has been dismal, a module seller said. Sales projections for the third quarter were equally bearish as module prices were expected to fall further with no market recovery in sight, the seller added.

The spread between TOPCon and Mono PERC prices has started to narrow. It is not surprising for Mono PERC prices to be slightly lower or similar to TOPCon prices as module makers are selling based on their Mono PERC inventory levels, a market source said. OPIS heard majority of discussions of Mono PERC at $0.090/W FOB China though a few sellers kept offers at $0.093-0.095/W FOB China.

In the Chinese market, the Ministry of Industry and Information Technology (MIIT) published proposals seeking public opinions on the “Regulatory Conditions for Photovoltaic Manufacturing Industry (2024 Edition)” and “Administrative Measures for Announcement of Photovoltaic Manufacturing Industry (2024 Edition)” on July 9.

One of the proposals was to raise the minimum capital ratio for new construction and expansion of photovoltaic manufacturing projects to 30% from 20% previously for wafer, cell and module production. Amongst the other proposals, MIIT guides photovoltaic enterprises to reduce photovoltaic manufacturing projects that simply expand production capacity.

One market veteran OPIS spoke to expressed skepticism that such measures would curtail production expansions and restore supply and demand balance in the Chinese market as capacity expansion plans are announced almost every day. Any positive impact from these measures would take at least two to three quarters from the implementation date for any improvements to be seen, the veteran added.

OPIS assessed the forward pricing curve for U.S. delivered duty-paid (DDP) mono PERC modules lower this week, indicating softer market values. Prices for PERC modules slated for Q4 delivery averaged $0.291/W ranging from $0.240-0.365/W on a DDP U.S. basis, while prices for 2025 delivery averaged $0.315-0.319/W ranging between $0.270/W and $0.365/W DDP U.S.

A producer noted that demand has weakened due to uncertainties surrounding U.S. tariff policies, while more competitively priced cargoes are emerging from Southeast Asian countries like Indonesia and Laos. The potential tariffs are expected to impact delivery schedules, and freight volatility remains a concern for buyers. Trade sources shared that TOPCon modules for spot loading from Indonesia and Laos are at $0.24/W to $0.28/W on a DDP U.S. basis.

In response to potential tariff complications, there has been an increase in Indian module shipments to the U.S., as buyers are cautious about purchasing from Southeast Asia. According to an industry source, May module shipments from India to the U.S. reached approximately 1 GW, accounting for around 20% of U.S. module imports. The source noted that India had previously represented a smaller share of U.S. module imports before May. Additionally, the source reported a 10-15% decline in Southeast Asian module imports in May compared to March and April.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.