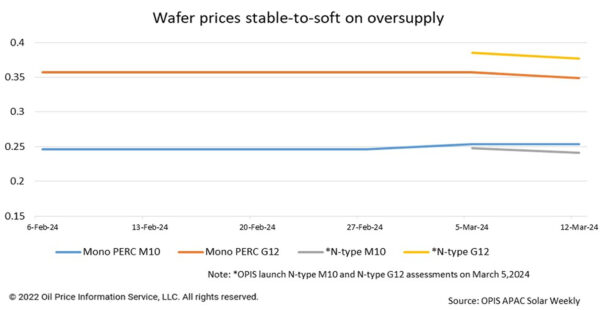

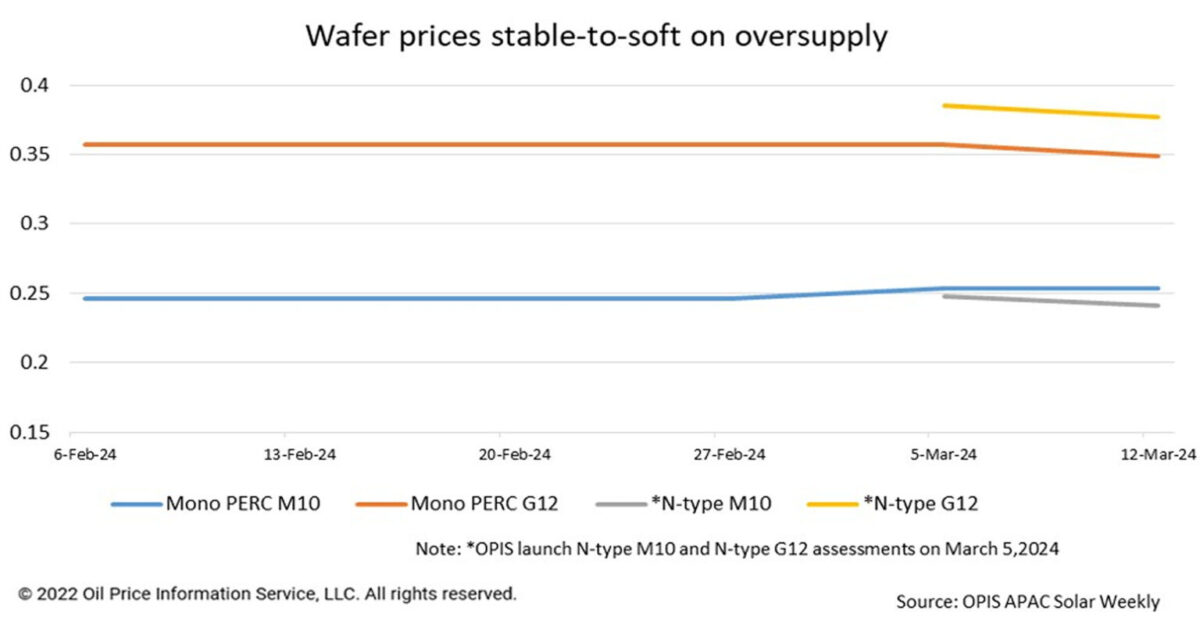

FOB China prices for wafers have mostly fallen this week, mainly attributed to an oversupply scenario outweighing demand.

Monocrystalline PERC G12 wafer prices decreased by 2.24% week-over-week to $0.349 per piece (pc), while N-type M10 and G12 wafer prices dropped by 2.82% and 2.08% week to week-over-week to $0.241/pc and $0.377/pc, respectively.

The only exception was monocrystalline PERC M10 wafers, which trended flat week to week at $0.254/pc thanks to its manageable production output.

As outlined by a market expert, the fundamentals of the wafer market are currently defined by elevated inventory levels, high production costs, and heightened operating rates.

The high inventory level of wafers has placed a lot of strain on the wafer suppliers. A source from a major wafer producer expressed the challenge of sales being very tough, stating that without offering discounts on quotations, securing an order is practically impossible.

According to a source from a small-scale manufacturer, there’s a notable price variance among the quotes for N-type M10 wafers in the market. Despite the mainstream price standing at CNY1.93 ($0.27)/pc, some manufacturers have resorted to quoting as low as CNY1.8/pc to bolster sales.

According to the Silicon Industry of China Nonferrous Metals Industry Association, the wafer market’s average operating rate has currently exceeded 85%. The resurgence of downstream demand is one of the factors driving wafer manufacturers to maintain high operating rates, said a market participant.

Furthermore, the polysilicon prices stand relatively robust at present, which necessitates that wafer manufacturers maintain high operating rates to mitigate non-silicon production expenses, the source added.

Additionally, OPIS has gathered from market insights that certain downstream manufacturers are requesting wafer producers to slightly modify the size of current M10 wafers to enhance the power generation area of modules. Currently, wafers sized at 183.5 and 183.75mm are being explored based on the M10 182mm standard. Wafer factories can achieve these sizes without the need for equipment updates.

Moving forward, it’s inevitable that wafer inventory will continue to accumulate rapidly. A source observed that some wafer factories are contemplating production cuts to reduce inventory. It remains to be seen if the wafer production output in March can meet the 70 GW or more that the Silicon Industry of China Nonferrous Metals Industry Association has projected.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.