Cross-party discussions and the resulting uncertainties about future developments and political support continue to burden the European PV industry. Unlike in Spain and Poland, for example, this does not necessarily seem to be slowing down the growth of solar in Germany.

After a successful year in 2023, the new year began with promising figures. More than 1 GW of PV was deployed in Germany in January and this growth should continue unabated in February. This can be deduced from the sales figures of manufacturers and wholesalers.

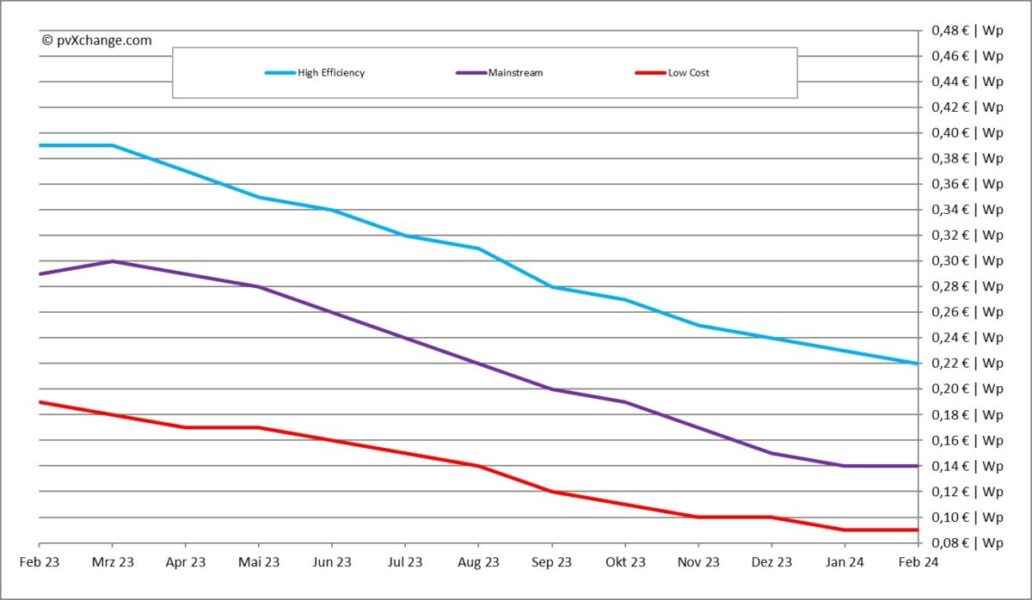

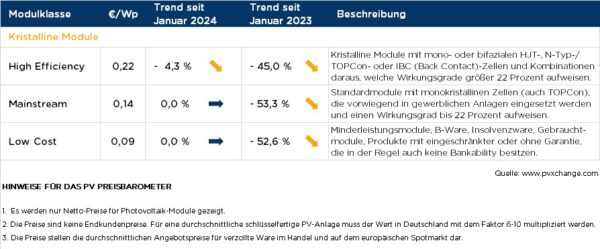

However, higher demand is colliding with the hesitant shipment strategies of manufacturers. Apparently, after the shock of large inventories caused by overproduction last year, capacity in China has been significantly reduced and market oversupply has been curbed. This is an attempt to stop the dramatic price slide that began last year.

However, this is only happening gradually at the moment. There was no longer a significant downward correction in prices in February, but rather a sideways movement. A small price drop was only observed for high-efficiency modules.

Module prices were on a downward trend due to existing stocks from last fall, with volumes starting to slowly flow out. Nevertheless, installers are well advised to stock up on modules and inverters in good time for the next few months. Future module deliveries will be delayed and products will be slightly more expensive.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.