Manufacturing incentives in the U.S. Inflation Reduction Act (IRA) have driven significant investment in the United States, to the relief of many investors; developers; engineering, procurement, and construction service providers (EPCs); and installers. Module manufacturers were the quickest to react to the climate action policy package, increasing production capacity of the final stage of module assembly, as this is the easiest segment to expand. More than a dozen module manufacturers have announced plans to set up or expand factories in the United States, mostly aiming for gigawatt-level annual production capacity, since the IRA was announced.

Notably, First Solar has been a major driving force behind this movement in the U.S. In fact, the company has just announced the location of its fifth manufacturing facility, which is located in Louisiana and will bring its total capacity in the United States to 15 GW by 2027, accounting for a quarter of total module capacity in the country. First Solar’s thin-film module capacity is critical for the realization of long-term demand in the US because it is immune to the riskier economic and political climate of traditional, crystalline-silicon supply chains. No other company has yet overcome the inherent technical challenges and higher costs of thin-film compared to crystalline modules, meaning that a technology shift will not likely be the way forward for the US to meet its energy independence goals.

Domestic content

In May this year, the Department of the Treasury issued clarifications about the 10% bonus tax credit available on top of the investment tax credit for using locally manufactured components in projects. Notably, the decision to list PV cells as the furthest upstream component has already started to drive a second wave of manufacturing capacity announcements at cell level. With 18 GW of cell capacity already planned, more announcements are expected, especially as project developers will require US-made cells to meet the higher domestic content threshold in 2026 and 2027.

Despite 22 GW of announced new wafer production capacity, by 2027, clarification of the domestic content bonus has disincentivized additional ingot and wafer manufacturing investment. The formula that determines what qualifies as “domestic” allows cell manufacturers to include the direct costs of sub-components as “domestic,” including polysilicon, ingot, and wafer production costs.

This applies even if, for example, the wafer is imported from another country. Ultimately, developers will be able to qualify for the domestic content bonus without those local components, which harms the business case for establishing such critical manufacturing nodes in the United States.

Geopolitical issues

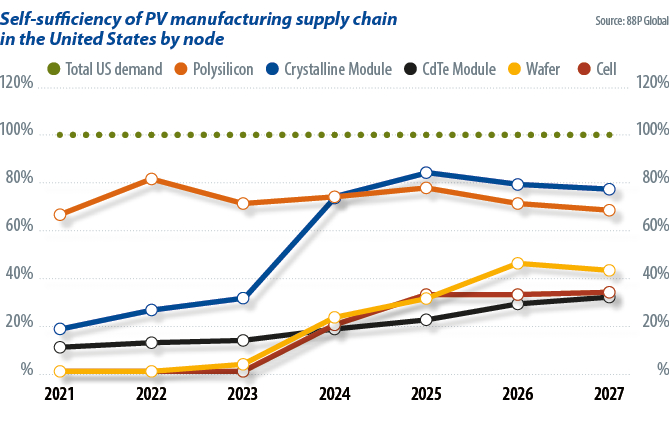

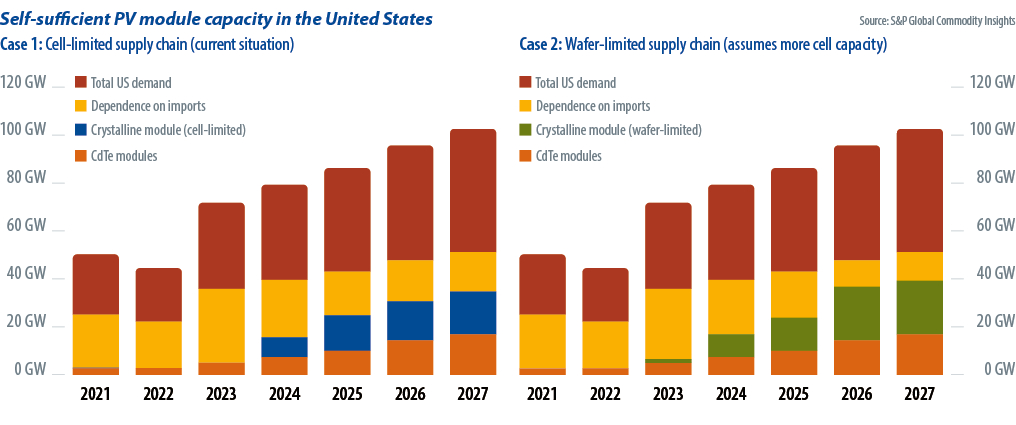

The U.S. will build out a massive base of local cell and module capacity but many manufacturers will still largely rely on polysilicon and wafer imports from China and Southeast Asia. For the crystalline module supply chain, cell capacity will be the bottleneck for manufacturing self-sufficiency, based on currently announced capacity, a fact which is reflected in the crystalline module (cell-limited) values of the chart below.

The United States will reach 68% self-sufficiency in the current situation and guidance for the domestic content bonus is expected to drive cell production capacity. Wafers would then become the bottleneck, if cell capacity does expand as expected, but they would only add a 5 GW cushion in terms of planned capacity and would therefore only increase self-sufficiency potential to 76%. In either case, between one-quarter and one-third of demand will depend on module imports, a factor which continues to threaten critical manufacturing nodes economically.

In general, between 12 GW and 20 GW of demand, on an annual basis, over the next five years will be subject to potential risk from tariffs and restrictive trade policy, such as the Uyghur Forced Labor Prevention Act. That prospect threatens the timely supply of modules to developers and EPCs, from an availability standpoint. While the United States has shown the ability to recover from a tough year, in 2022, the inherent risks of an import-based supply chain have been demonstrated to affect the market.

Conversely, the United States has been one of the largest markets for solar installations globally, despite its historical reliance on foreign supply chains for more than 80% of its demand. The twin factors of the scale of IRA incentives and the price premium for modules that the U.S. market commands, will continue to make the U.S. a key target for module suppliers aiming to expand capacity and serve domestic customers. Even in the current situation, the United States will achieve record-breaking self-sufficiency levels that will make the market less risky.

Alex Kaplan is a senior market analyst on the clean energy technology team at S&P Global and is the lead researcher for the North American solar market. Before joining S&P Global, he was a market analyst with Omdia, specializing in distribution utility technologies such as advanced electricity metering and network communications. Kaplan holds a degree in natural resource management from the University of Texas at Austin.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.