Green hydrogen, also called renewable hydrogen, is generated by using renewable electricity to electrolyze water. Although touted for decades as the magic clean energy carrier molecule, green hydrogen has only picked up momentum in the past few years.

In the world of hydrogen, colors have come to signify the method of production, and currently, Clean Energy Associates estimates more than 99% of the market for hydrogen is still served by the grey or black/brown variety, which uses fossil fuels for its production, emitting vast amounts of carbon dioxide to the atmosphere.

CEA estimates approximately 100 million tons per year of fossil-derived hydrogen are used in refining, fertilizer, chemical and other industries. To achieve global carbon reduction goals, these quantities should be decarbonized as soon as possible.

In parallel, new, more challenging uses of green hydrogen are being developed, which could decarbonize hard-to-electrify sectors such as the steel industry, long-haul transportation, shipping, aviation, and even long-duration energy storage.

Fossil-derived hydrogen is very low-cost; therefore, lowering the cost of green hydrogen—both via innovation and subsidies—is a top priority. For newer hydrogen applications, the cost pressure is even greater. For green hydrogen to compete with fossil-derived hydrogen and replace fossil-fuel-powered uses, scale is of the essence. Achieving scale in green hydrogen production will require subsidies and policy support, at least in the early years.

Scaling-up scenarios

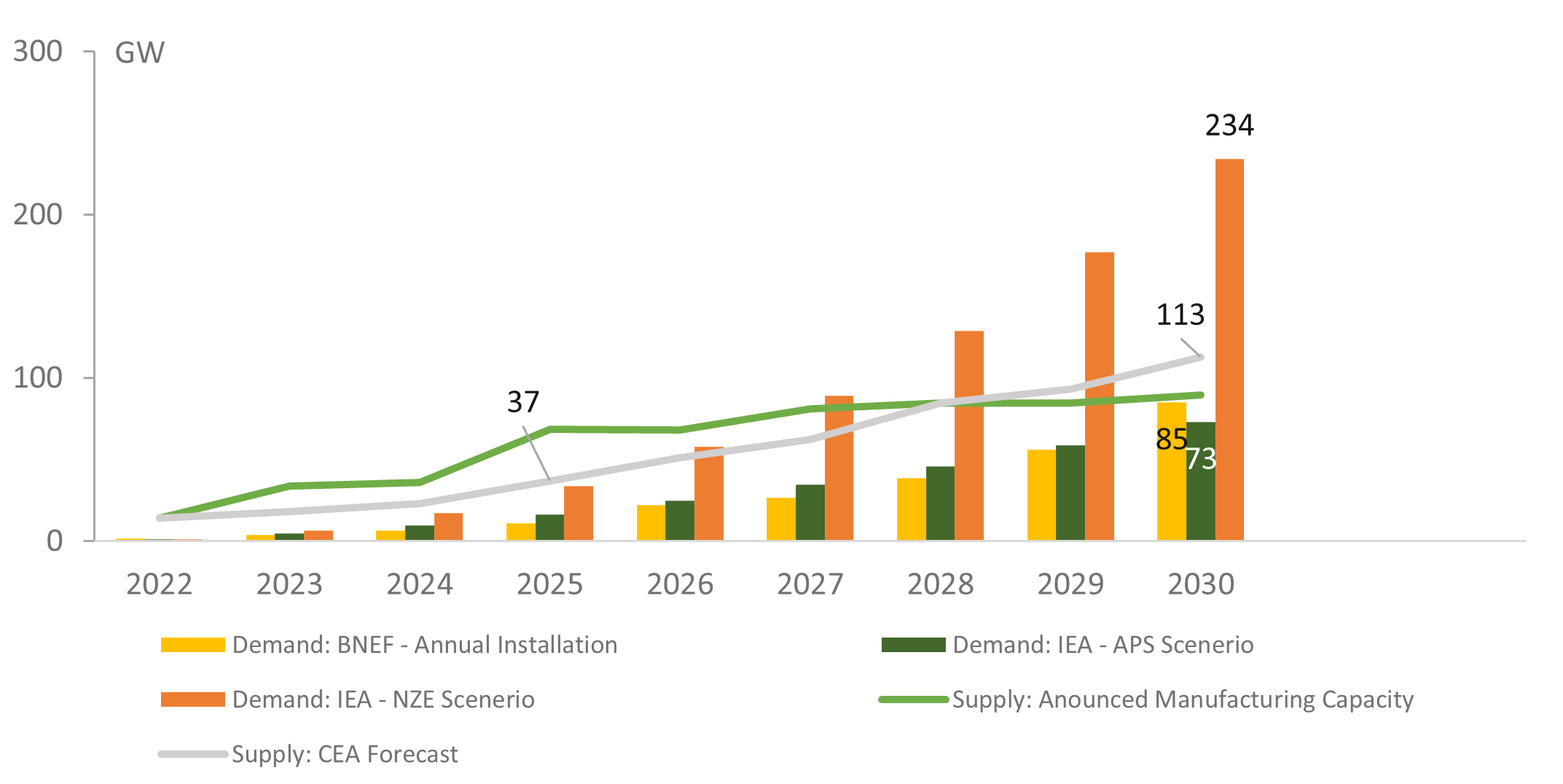

The International Energy Agency’s Net Zero Emission scenario calls for 720 GW of cumulative electrolyzer development by 2030 and 2,100 GW by 2050. IEA’s Announced Pledges Scenario assumes that all aspirational goals announced by governments are met in full, and calls for 260 GW of cumulative electrolyzer capacity by 2030.

Bloomberg New Energy Finance predicts 240 GW of cumulative capacity by 2030. My company, Clean Energy Associates, forecasts that manufacturing capacity will reach 113 GW by 2030, based on applying discounts on announced manufacturing capacity expansions globally.

More than 100 GW of shipments are forecasted by the end of this decade, in stark contrast to just 1.3 GW of electrolyzers shipped in 2023. Shipments must scale up by almost two orders of magnitude within a few years, a formidable challenge.

Global manufacturing capacities

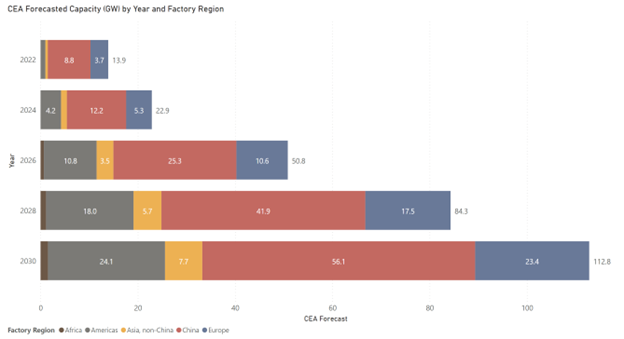

China currently dominates global nameplate capacity, but shipments lag behind due to underutilization. While the U.S. and Europe anticipate rapid growth in capacity, Chinese suppliers have aggressive expansion plans as well, and are projected to hold approximately 50% of the global capacity through the end of the decade.

China is supporting the electrolyzer industry by planning very large green hydrogen/ammonia projects, mostly by state-owned enterprises, where the big players have opportunities to win bids and establish a track record. At this point in the development of the industry, no supplier has experience commensurate with the multi-GW projects planned within the decade.

Main electrolysis technologies

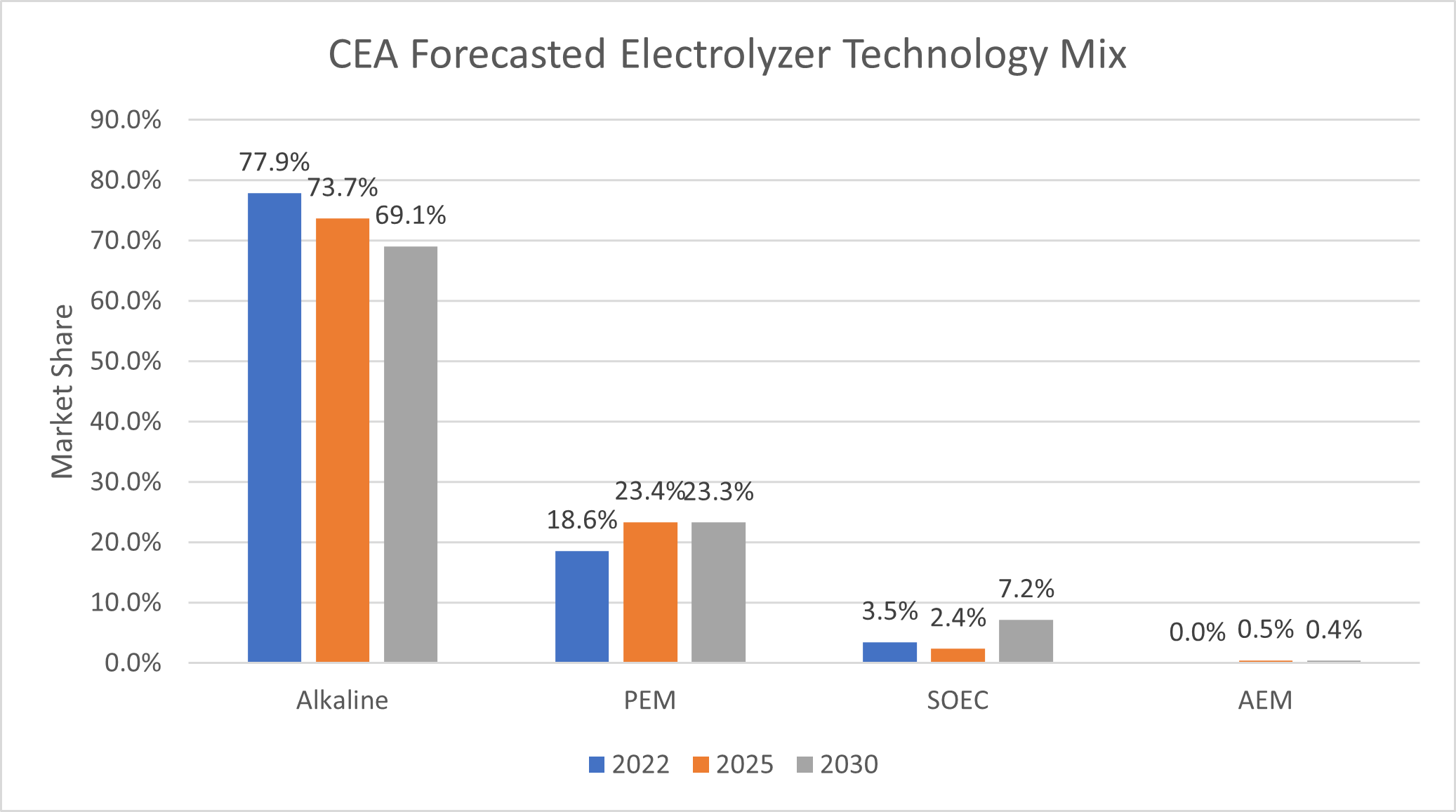

There are four main electrolyzer technologies:

- Alkaline, the oldest and most mature.

- PEM (Proton Exchange Membrane) which is several decades old and considered mature, but has much higher cost.

- AEM (Anion Exchange Membrane), still under development.

- SOEC (Solid Oxide Electrolyzer Cell), which has niche applications and lacks maturity.

Alkaline has the lowest cost. This is particularly true in China, where suppliers have developed very mature supply chains with low costs over the years, which they can now take advantage of as they scale up. CEA’s forecast (see chart below) of the electrolyzer technology mix shows a predominance of alkaline technology through the end of the decade.

Electrolyzer system cost

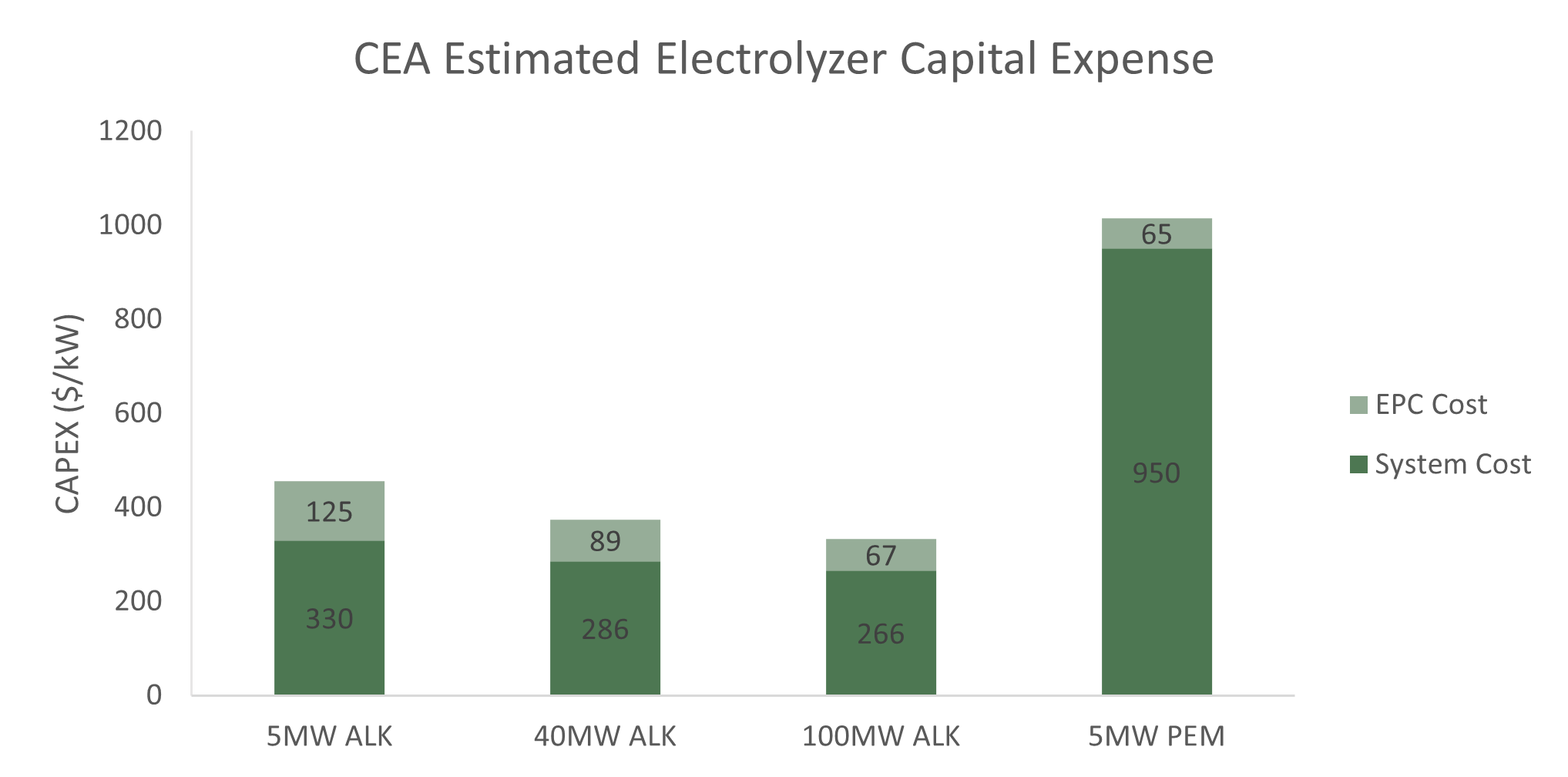

The total CapEx of a complete electrolyzer system, including the electrolyzer stack, balance of plant, and engineering, procurement, and construction cost for various system sizes, is shown below. CEA calculated the figures below for China; CapEx costs are expected to vary significantly in other regions.

Although PEM technology allows simpler system design and has lower EPC cost, the very high cost of the PEM stack leads to a very high total cost for the system. The high cost of PEM is due to the usage of iridium and platinum, as well as titanium, to protect the components against the very acidic conditions in the stack.

Iridium usage in the current PEM stacks is around 0.56 g/kW. The current global iridium supply of eight tons a year can only support 14 GW of PEM annual production, even if all world’s iridium were to go to PEM electrolyzers. Given the momentum behind PEM electrolysis, meeting iridium supply challenges will be essential to achieving hydrogen production targets worldwide.

Green hydrogen cost

The levelized cost of hydrogen is a rather complex calculation with three main factors. One is the cost of electricity. When green hydrogen is produced, clean electricity is required, which is chiefly solar and wind — and these sources are variable.

The second factor is the utilization rate (which depends on the capacity factor of the solar and/or wind producing the electricity).

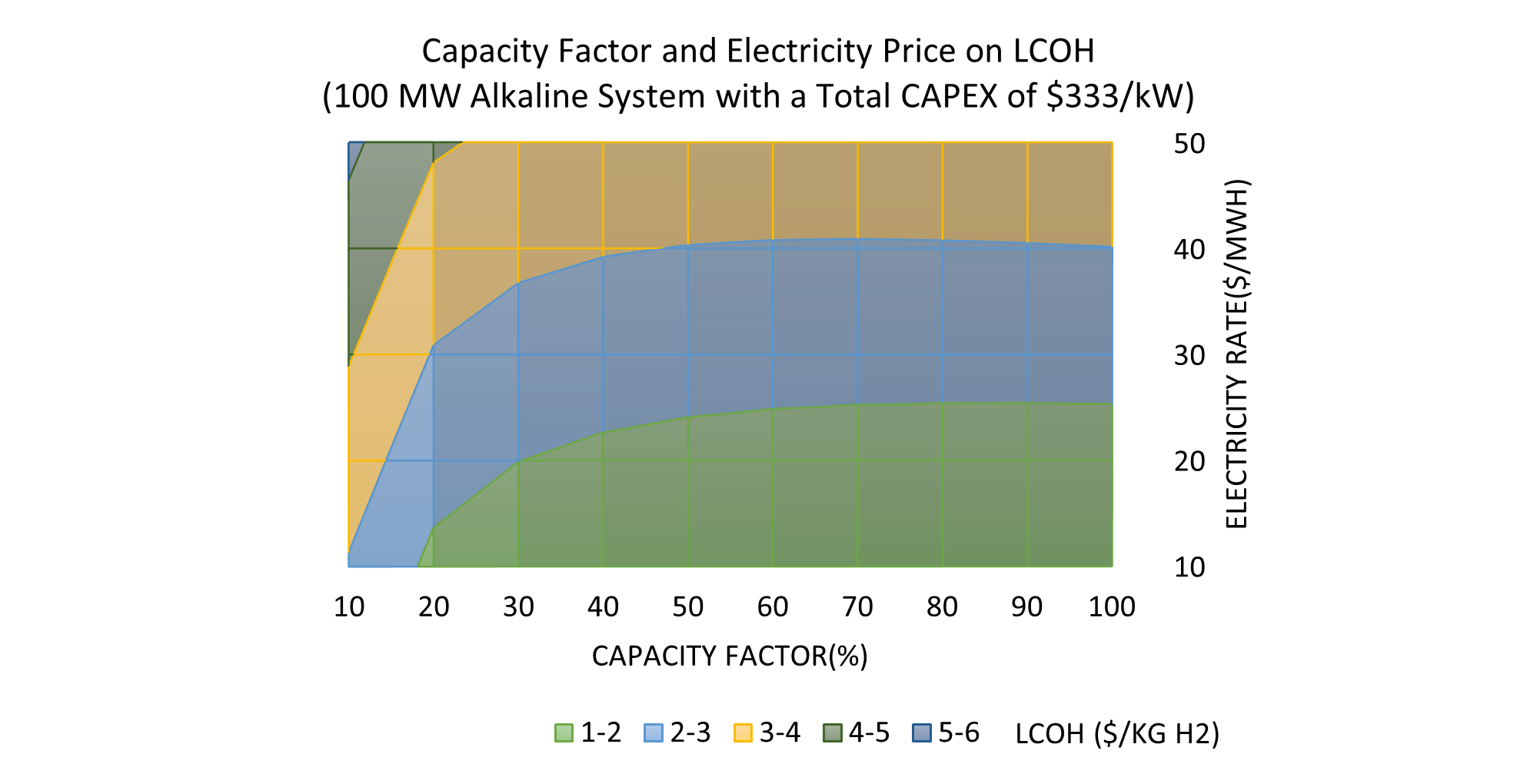

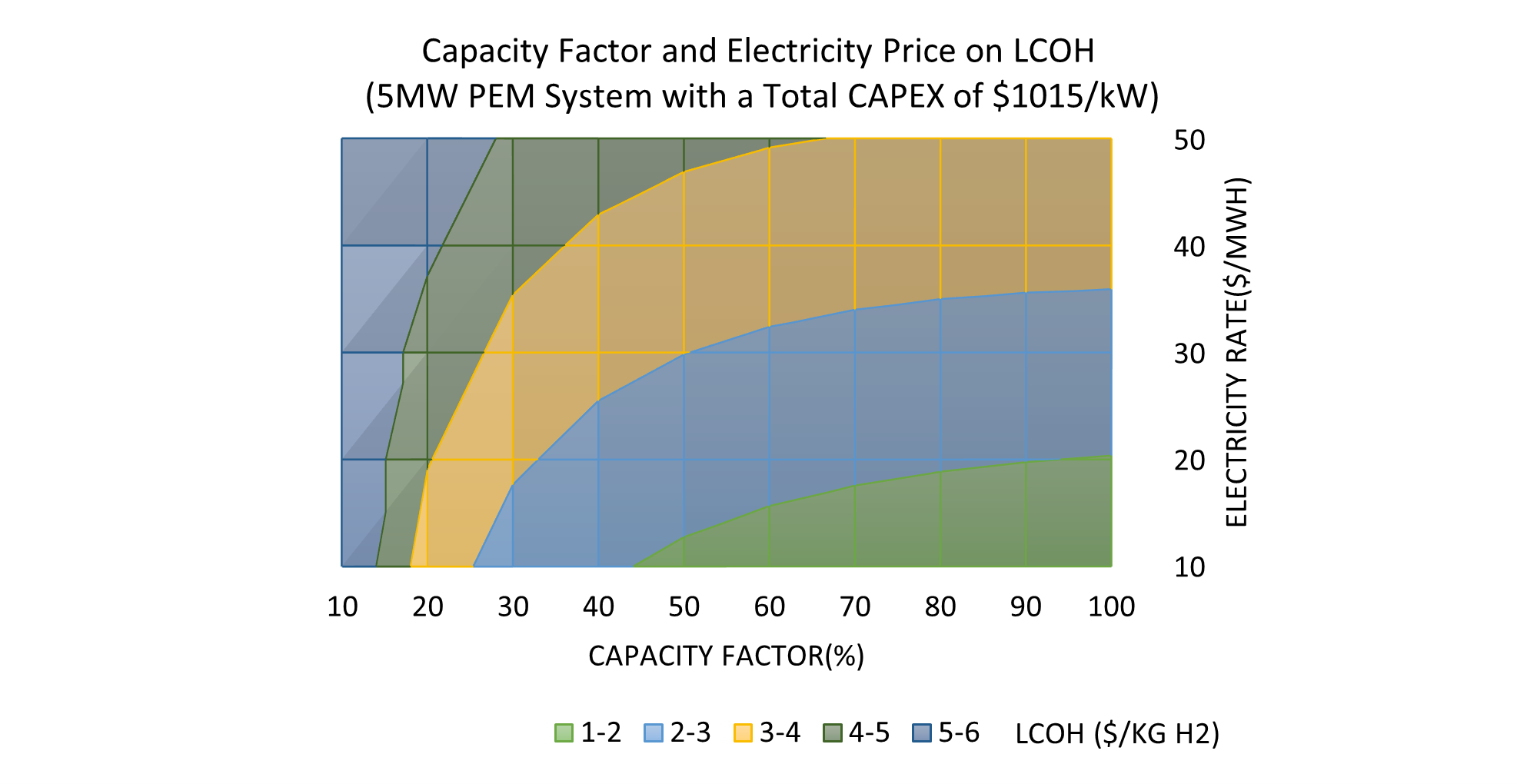

The third is equipment CapEx. The following charts show CEA’s analysis of the interdependence of capacity factor and electricity cost at different CapEx levels.

Green hydrogen must compete with fossil-derived hydrogen, which costs between $1/kg-$2/kg (and is marked as the lower green region in the charts). We can observe that the high cost of the PEM system limits the green area to even higher capacity factors and lower electricity prices.

It is obvious then that the most suitable locations for market-competitive green hydrogen production are those where renewable energy can be available with a good capacity factor and at low cost. In other regions, subsidies and policy support are necessary until the technology scales and costs decline.

Renewable energy plants may need to be overbuilt to achieve such high capacity factors. However, clean energy transported via the grid, under tight regulatory restrictions, could be allowed to feed electrolyzer systems at high capacity factors.

The amount of clean energy that will be needed to produce green hydrogen is staggering: 100 million tons would require 5,000 TWh of renewable energy for its production, which is about 100 times the annual electricity consumption of Greece. It is therefore paramount to avoid the “cannibalization” of existing renewable energy capacity to produce green hydrogen, as this could lead to the increased use of conventional fossil power and may actually worsen global carbon emissions.

To this purpose, the additionality principle is expected to be applied in most regions, where dedicated renewable energy would be fed to each electrolyzer system. Europe has pioneered relevant regulations, and other regions are expected to follow—especially if they plan to export green hydrogen or green ammonia.

Competitive in next few years

Renewable energy is already very inexpensive and will keep getting cheaper; therefore, the industry should focus on reducing the other two cost drivers of LCOH: CapEx costs and utilization. However, scaling up the production of electrolyzers is a challenge, especially for technologies like PEM, which is more expensive due to the need for rare, expensive metals.

Green hydrogen is a promising solution for decarbonizing various industries, but there are still challenges that need to be addressed to make it commercially viable. While there is no clear timeline for when green hydrogen will become competitive with fossil-derived hydrogen, in most regions, it is expected to happen in the next few years if everything falls in place.

The industry should focus on reducing the costs of electrolyzers while increasing their efficiency, and siting projects where renewable clean energy is plentiful and available at low cost.

George Touloupas is senior director, technology and quality at Clean Energy Associates.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Nice article overall.

Not sure about the idea of using hydrogen to replace fossil-fuel powered usage. Hydrogen as a fuel has significant economic and thermodynamic challenges that scale can’t overcome.

“Fossil-derived hydrogen is very low-cost; therefore, lowering the cost of green hydrogen—both via innovation and subsidies—is a top priority. For newer hydrogen applications, the cost pressure is even greater. For green hydrogen to compete with fossil-derived hydrogen and replace fossil-fuel-powered uses, scale is of the essence. Achieving scale in green hydrogen production will require subsidies and policy support, at least in the early years.”